Bitcoin’s current price of $97,700 may just be the beginning of a larger narrative, according to analysts projecting a meteoric rise to $2 million by 2027.

Driving these bold predictions are events ranging from regulatory shifts to growing institutional adoption.

The crypto’s modest 0.42% increase over the last 24 hours, alongside its massive $88.96 billion trading volume, highlights its dominance in the market. Bitcoin’s market cap stands at $1.93 trillion, reinforcing its position as the leading cryptocurrency.

PlanB, the creator of the Stock-to-Flow model, suggests a trajectory where Bitcoin could benefit from major macroeconomic events, such as regulatory clarity, ETF inflows, and global adoption.

This hypothetical scenario sees Bitcoin reaching milestones like $100,000 following the 2024 U.S. presidential election and $1 million by late 2025 as FOMO (fear of missing out) grips the market.

The prediction culminates in a peak of $2 million by 2027, supported by strategic government and institutional accumulation.

Bitcoin Price Analysis: Technical Levels Signal Consolidation Before Next Move

Bitcoin’s immediate price action reveals key resistance at $99,500, acting as a psychological barrier. The cryptocurrency has entered the overbought zone, with the RSI sitting at 73.

This suggests potential bearish consolidation in the near term. Fibonacci retracement levels indicate a completed 23.6% pullback near $97,600, with the next target at the 38.2% retracement level of $96,400.

Despite the overbought conditions, Bitcoin’s bullish trend remains intact as long as the $95,000 support level holds.

This level aligns with the 50-day EMA at $92,435, a dynamic support zone critical for sustaining upward momentum. Should Bitcoin break above $99,500, it could set its sights on resistance levels at $101,728 and $102,877.

However, a breach below $95,000 could trigger deeper corrections, potentially testing $94,516 or even $92,435.

What’s Fueling Long-Term Optimism?

Bitcoin’s long-term outlook is buoyed by market optimism around spot Bitcoin ETFs, growing institutional adoption, and geopolitical events. Predictions by analysts like PlanB include nations such as Bhutan and Argentina adopting Bitcoin as legal tender and AI integrating Bitcoin into decentralized trading by 2025.

While speculative, these trends highlight how macroeconomic factors and regulatory clarity could drive Bitcoin toward unprecedented highs.

Key Insights in Bullet Points

- Immediate Resistance: $99,500; a breakout could target $101,728 and $102,877.

- Immediate Support: $95,000; a breach could test $94,516 or $92,435.

- RSI at 73.67: Overbought conditions suggest near-term consolidation.

- Long-Term Outlook: Institutional adoption and global policy shifts could drive Bitcoin toward $2 million by 2027.

–

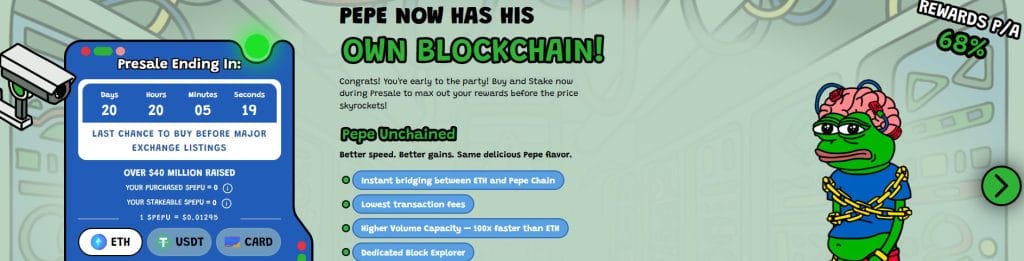

Portfolio Boost: Last Chance to Buy $PEPU Before Listing!

As meme coins surge, Pepe Unchained ($PEPU) stands out with its impressive presale performance and lucrative features.

Key Highlights

- Presale Ending Soon: With over $40 million raised, $PEPU is in its final phase at $0.01295 per token. Prices are expected to rise after tier-1 exchange listings.

- High APY Staking: Offering a massive 499% APY, over 321 million $PEPU tokens have been staked, showing strong investor trust.

- Smart Contract Security: Audited by Coinsult and SolidProof, ensuring a secure platform for investors.

Act Fast on the Presale

Only 20 days remain to secure $PEPU at presale prices before its listing on tier-1 exchanges. Don’t miss this opportunity!

The post Analysts Outline A $2 Million Bitcoin ATH by 2027 – Here’s How appeared first on Cryptonews.