TL;DR

- Shares in the Danish digital sports media company have fallen 40% over the past year and stood at 140 SEK as the stock market closed on July 30, 2025.

- A disappointing trading update, weakness in the US market, and Brazil’s new regulatory backdrop have caused problems.

- The BETCO stock price could rise 17% to 163.46 SEK over the coming year, according to the consensus BETCO share price forecast of analysts, compiled by MarketScreener.

- It announced in May that first-quarter revenue was down 13%, although this was in line with management’s expectations.

- Better Collective is undergoing a corporate restructuring and recently announced a share buyback.

It’s been a very tough period for investors in Better Collective. Shares in the Danish digital sports media company have plummeted more than 40% over the past year.

A disappointing trading update, weakness in the US market, and the new regulations in Brazil have combined to depress the BETCO stock price. The challenging backdrop saw a corporate restructuring announced in late 2024 to streamline the business, cut costs, and reduce the headcount by 300 people.

This has helped the share price recover some lost ground, although concerns remain after the Copenhagen-based company announced a 13% drop in first-quarter revenue.

The question is: what does this all mean for investors? In our BETCO stock forecast 2025-2030, we examine whether now is the time to become a shareholder.

Better Collective stock forecast 2025–2026: One-year BETCO projection

Is the BETCO stock price now trading at an attractive level, or is there a realistic chance of further falls?

Let’s start by taking a look at the current position. As the stock market closed on July 30, 2025, shares stood at 139.70 SEK. This makes it the world’s fifth-largest esports company.

The stock is classed as ‘outperform’, according to the BETCO share price forecast of three analysts compiled by MarketScreener. Their consensus view is that the BETCO share price could hit 163.46 SEK over the coming year. This would be a 17% increase over the 139.60 SEK closing price on July 30, 2025.

One of the analysts has the stock down as a ‘buy’, while the other two see it as a ‘hold’, suggesting that a degree of anxiety remains.

| One-year Better Collective stock forecast (as of July 30, 2025) | |

|---|---|

| MarketScreener | 163.46 SEK |

| WalletInvestor | 84.94 SEK |

Better Collective stock predictions

One of the issues for the company is that its stock price is still substantially lower than where it was before the share price plunged late last year.

This is certainly a significant hurdle for the management team, according to Danni Hewson, head of financial analysis at AJ Bell. She told Esports Insider: “Better Collective has a tough hill to climb to get investors back on side. Its share price has failed to recover from last year’s slump, and a superior earnings outlook only goes so far.”

However, Hewson acknowledged there were opportunities for the business, even considering the potential problems it faces. “It’s got fingers in a lot of tasty pies and that diversification does have merit, but there are also considerable headwinds to consider,” she added.

How about the longer-term BETCO stock prediction? What are the Better Collective stock predictions of analysts and algorithmic forecasters for the next five years?

Better Collective stock forecast 2027–2030: Longer-term prospects

| Long-term BETCO stock forecasts (as of July 30, 2025) | ||

|---|---|---|

| Year | July 2027 | July 2030 |

| WalletInvestor | 19.84 SEK | 0.00 SEK |

The forecasts certainly don’t look very encouraging, although it’s important to remember this is only based on algorithmic views.

Very few analysts are prepared to make forecasts too far into the future because of the number of variables that can influence price movements.

You will need to carry out your own research on the stock to decide whether the longer-term potential positives outweigh the negatives.

BETCO stock YTD, one-year & five-year performance analysis

Better Collective stock year-to-date: +25.31%

It’s fair to say that 2025 has been pretty kind to Better Collective investors, with the BETCO share price having risen 25.31% to 139.60 SEK as the stock market closed on July 30, 2025.

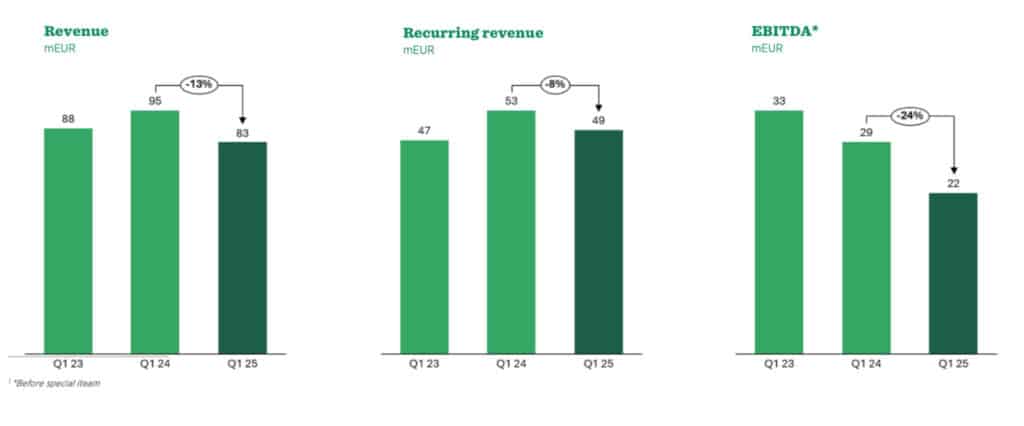

Despite announcing a 13% revenue decline in the first quarter, analysts were buoyed by its cost efficiencies and share buyback program.

Better Collective stock One-year performance: -42.43%

The stock price wasn’t helped by a trading update in October 2024 in which the company downgraded its financial guidance for the full year 2024. It also highlighted lower activity than expected from its US partners and a continued slowdown in the Brazilian market ahead of regulation being introduced.

Better Collective stock Five-year performance: +13.50%

The past five years have certainly been a mixed bag for investors. Revenue growth and acquisitions helped push the stock price up to 322 SEK by early February 2024. The lowering of full-year guidance and headwinds in key markets subsequently sent the stock price tumbling. However, it’s still trading more than 13% higher than it was in 2000.

Latest earnings results

Better Collective announced a 13% decline in revenue to €83 million for the first quarter of 2025, with organic growth down 18%.

The major problem was Brazil’s transition to a regulated market, which had a €7 million impact on revenue and EBITDA (earnings before interest, tax, depreciation, and amortisation).

The decrease in activity from the company’s US partners also had an impact of approximately €5 million, although growth in other areas had a positive effect.

According to Jesper Søgaard, co-founder & co-CEO, the first quarter’s results were in line with the company’s expectations. “As we are now building the ‘New BC’, we are setting the stage for future growth by focusing on global scalability and streamlining our House of Brands,” he said. “This marks the beginning of an exciting new chapter for Better Collective.”

Corporate restructuring

In a statement as part of its first quarter results, the company noted that it had “embarked on a transformative journey” to align its structure with its long-term objectives.

It stated: “Recognising the need for enhanced scalability, focus, and global integration, we have transitioned to a model that better supports our growth ambitions.”

A core part of this is introducing a co-CEO leadership structure with Christian Kirk Rasmussen joining Jesper Søgaard at the helm. Rasmussen will focus on innovation, business development, and operational execution, while Søgaard spearheads external strategic initiatives and engagement with external stakeholders.

The overhaul establishes three global business units: publishing, paid media, and esports. This is a strategic shift away from its former geography-based structure.

“This new setup is designed to reduce complexity, eliminate duplication, and allow us to scale best practices more efficiently across all markets,” it added.

Share buyback

The most recent Better Collective news came in late May 2025, when it initiated a share buyback program for up to €10 million, to be executed by August 26, 2025.

The plan, which had been authorised by shareholders at the annual meeting in April, was to acquire up to 6,195,887 shares.

It stated that the purpose was partly to “optimise and improve” the capital structure of the company and cover future obligations relating to acquisitions.

Other Better Collective news

The company also announced that its esports operations would be reported as a standalone financial segment from the second quarter of 2025.

“With its own leadership and dedicated business structure, this change reflects our ambition to further sharpen focus and enhance transparency in one of our most exciting and high-potential growth areas,” it explained.

Separately, its digital sports audience has also grown by more than 10% from 400 to 450 million monthly visits globally.

What is the outlook?

A key part of any BETCO stock analysis is what investors can expect over the coming year, and the company’s financial guidance remains unchanged. It’s expecting revenue to come in between €320 million and €350 million, along with EBITDA before special items of €100-€120 million. Free cash flow should be €55-€75 million.

The company expects revenue growth to be impacted by the Brazilian market regulation, resulting in a 50-70% decline in revenue share income over the short term.

On the plus side, Better Collective expects absolute growth in its European, esports, South American (excluding Brazil), and Canadian businesses.

Looking further ahead, the management team is predicting positive organic growth from 2026 and continued strong cash conversion.

What is Better Collective?

It’s a Danish digital sports media company set up in 2024 by Jesper Søgaard and Christian Kirk Rasmussen. The Copenhagen-based company has been focused on growth for a number of years and made 35 acquisitions as it built the business.

Today, it has a broad portfolio of interests covering news, betting predictions, and analysis for sports such as football, basketball, hockey, and mixed martial arts.

Its brands include HLTV, FUTBIN, Betarades, Soccernews, Tipsbladet, SvenskaFans, Action Network, Playmaker HQ, VegasInsider, Bolavip, and Redgol.

Conclusion: Should I buy Better Collective stock?

The 21-year–old Danish firm has a diversified spread of interests but is clearly still susceptible to problems in key markets. However, as our BETCO stock analysis shows, it responded to these issues with a corporate overhaul and a share buyback that appears to have calmed the market.

The aim of this cost efficiency drive, which has seen the headcount reduced by 300 people, is to help streamline the overall business in the wake of 35 acquisitions.

It will be down to the management of this leaner operation to return to growth over the next few years and, hopefully, be rewarded by further increases in the stock price.

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

That is something for you to decide, based on a combination of your views about the company and the opinions of stock market analysts. Your BETCO share price forecast must take into consideration its financial performance and plans, as well as any headwinds.

The BETCO share price could hit 163.46 SEK over the coming year, according to the views of three analysts compiled by MarketScreener. This would be a 17% increase over the 139.60 SEK closing price on July 30, 2025.

Not according to the consensus Better Collective stock forecast of three analysts, compiled by MarketScreener. They believe the price could rise 13% over the coming year.

It’s a Danish digital sports media company set up in 2024 by Jesper Søgaard and Christian Kirk Rasmussen. It has a broad portfolio of interests covering news, betting predictions and analysis for various sports.

References

- https://bettercollective.com/press-releases/?slug=better-collective-reports-q3 (Better Collective)

- https://companiesmarketcap.com/esports/largest-companies-by-market-cap/ (Companies Market Cap)

- https://www.marketscreener.com/quote/stock/BETTER-COLLECTIVE-A-S-44196264/consensus/ (MarketScreener)

- https://bettercollective.com/press-releases/?slug=better-collective-reports-q1-2025 (Better Collective)

- https://storage.mfn.se/3a1857cd-4d2b-4ac8-a0af-63258f4d39f0/better-collective-share-buyback-program.pdf (Storage MFN)

- https://storage.mfn.se/1345bb6c-fbce-4d70-81b1-ebdc93eeb4e5/250521-q1-2025-better-collective.pdf (Storage MFN)

The post Better Collective stock forecast 2025-2030: Will the share price continue rising over the coming year? appeared first on Esports Insider.