TL;DR

- The AGAE stock price has risen more than 90% in 2025, but has endured a very volatile journey over recent years.

- Allied has been locked in an ongoing battle with Knighted Pastures, a dissident shareholder, since early 2024.

- First quarter 2025 results saw increased losses due to multi-million dollar legal fees associated with the shareholder dispute.

- Management recently unveiled a strategic plan for growth and long-term value creation that included mergers & acquisitions.

- James Li was appointed chief executive officer of Allied Gaming & Entertainment in late June 2025. He continues to also serve as president and chairman of the board.

Investors in Allied Gaming & Entertainment, the parent company of Allied Esports, have certainly endured a rocky ride over the last few years.

Significant losses, activist shareholder action and compliance issues have proved to be a volatile cocktail for the AGAE stock price.

But what’s next for the New York-based company, whose interests include an esports company, casual mobile gaming, and organising live entertainment events?

Is its recent share price recovery expected to last, or will expensive legal issues continue to be an unwelcome drag on performance?

In our AGAE stock forecast 2025-2030 we’ll look at the main revenue drivers for the business, its latest quarterly results, and what observers expect to happen to the AGAE share price.

Allied Gaming & Entertainment stock forecast 2025–2026: One-year AGAE stock projection

There is a significant challenge when it comes to predicting future movements in the AGAE stock price and it’s that relatively few analysts follow the company.

Shares could be trading at $1.50 in a year’s time, according to the view of one Wall Street analyst, compiled by TipRanks.

This would represent a 3.85% fall over the $1.56 closing price on August 12, 2025. However, it’s important to remember that this is just one opinion.

The algorithmic forecasts of WalletInvestor have a more upbeat prediction, with the stock rising to $2.21 over the next 12 months.

| One-year Allied Gaming & Entertainment stock forecast (as of August 12, 2025) | |

|---|---|

| TipRanks | $1.50 |

| WalletInvestor | $2.15 |

Allied Gaming & Entertainment stock predictions

How about the longer-term AGAE stock prediction? What are the Allied Gaming & Entertainment stock predictions of analysts and algorithmic forecasters for the next five years?

Once again, the AGAE share price forecast of WalletInvestor has the stock climbing to $2.87 by August 2027 and hitting $4.82 three years later.

Allied Gaming & Entertainment stock forecast 2027–2030: Longer-term prospects

| Long-term AGAE stock forecasts (as of August 12, 2025) | ||

|---|---|---|

| Year | August 2027 | August 2030 |

| WalletInvestor | $2.87 | $4.63 |

AGAE stock YTD, one-year & five-year performance analysis

Allied Gaming & Entertainment stock year-to-date: +96.72%

On the face of it, the AGAE share price has performed spectacularly well in 2025. However, it’s important to look at this massive hike in context.

At the back end of 2024, the stock was trading at $0.79. It then rose to around $3.50 by early June 2025, before legal and compliance issues, as well as the financial losses, triggered a fall.

Allied Gaming & Entertainment stock one-year performance: +24.80%

Investors who bought into the stock a year ago will be pretty content with an increase of just over 27% but this headline figure masks the volatility.

The 52-week high stock price is $3.79, according to data compiled by Macrotrends. This is 146% above the $1.54 closing price on August 11, 2025.

Allied Gaming & Entertainment stock five-year performance: -6.02%

There have certainly been plenty of highs and lows since the summer of 2020 but the stock hasn’t reached its all-time high closing price of $10.81, according to Macrotrends.

This came back on June 24, 2019. Since then, the company’s stock price has fluctuated quite wildly at times due to both operational and external factors.

Latest earnings results

In early July 2025, the company announced a rather mixed bag of results for the first quarter of this year, which has only heightened the stock price volatility.

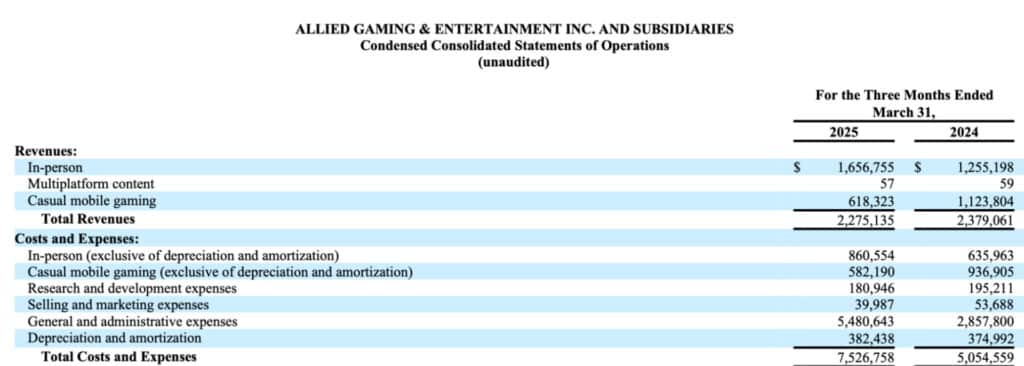

A gloomy combination of falling total revenues and rising costs resulted in a net loss of $4.8 million for the three months ended March 31, 2025.

This was substantially higher than the $1.8 million loss recorded in the corresponding period in 2024, according to the company’s results.

Varying revenues

Allied revealed that in-person experience revenues came in at almost $1.7 million for the three months ended March 31, 2025. This was 32% higher than the same period last year and was due to higher revenue generated from arena events.

However, casual mobile gaming revenue slumped 45% to $618,000 from $1.1 million in the three months to the end of 2024. The fall was primarily due to “contraction of the online card game market” as well as increasing competition from new mobile game developers.

Higher costs

Total costs and expenses for the period came in at $7.5 million, which was almost $2.5 million higher than the $5.1 million figure for the first quarter of 2024.

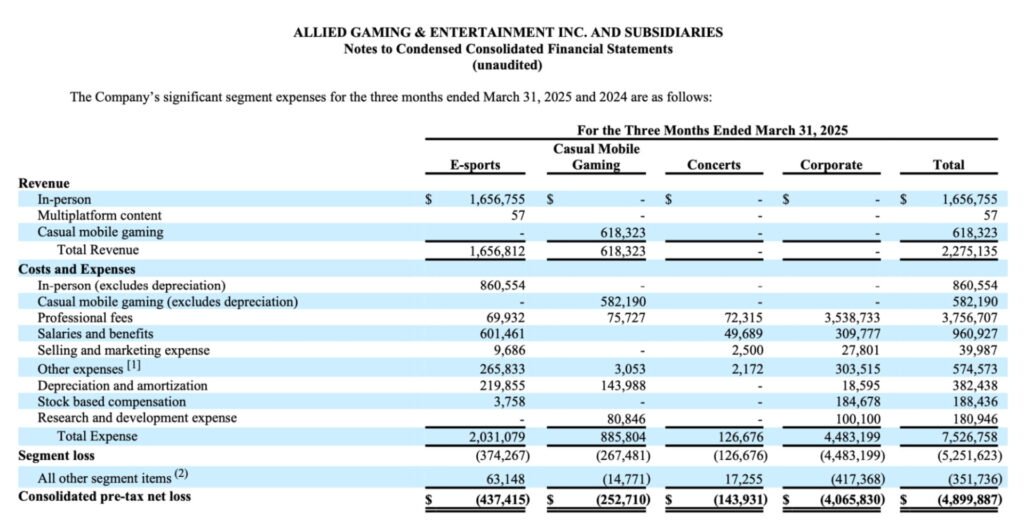

When you analyse the results on a segmented basis, esports lost around $437,000, casual mobile gaming was down $252,000 and concerts was in the red to the tune of almost $144,000.

The corporate losses of just over $4 million consisted largely of legal fees associated with Allied’s ongoing battle with shareholder Knighted Pastures.

There was also a $0.1 million increase in salaries, due to the hiring of the company’s new President in April 2024.

Elsewhere, there was a drop in selling and marketing costs, research and development, and casual mobile gaming. The latter is due to lower user incentive fees and acquisition costs.

Activist shareholder dispute

The most recent Allied Gaming & Entertainment news has concerned the company’s long-running battle with Knighted Pastures and its managing member, Roy Choi.

The investment entity, which owns approximately 27.2% of Allied’s shares, published an open letter in early June calling for its own nominees to have seats on the Board. The move had followed a lawsuit from Knighted Pastures alleging breach of fiduciary duty in connection with Allied’s recent strategic investment with Yellow River.

Allied then published a response to the action in which it claimed the lawsuit was motivated by a desire to gain control of the company at a discounted price. The United States District Court for the Central District of California issued an order in early August 2025 stating that Allied’s annual meeting must go ahead as planned.

However, the ruling also stated no vote would be taken on any of the company’s or Knighted’s director nominees.

Other Allied Gaming & Entertainment news

The company has seen a number of business developments over the past year that are likely to have a significant bearing on the company.

As far as revenue is concerned, the first-ever World Mahjong Tour tournament was held at the HyperX Arena in Las Vegas in early February 2025.

The event attracted more than 150 competitors, with the company stating that it marked “a significant milestone” in its mission to bring mahjong to the global stage.

Allied also co-launched RythmX x Strawberry Music Festival in Macau’s first 50,000 capacity outdoor venue.

Additionally, the company made a strategic investment in the production of The Angry Birds Movie 3 via Flywheel Media.

Last October, Allied announced a $6.6 million strategic investment from Yellow River Global Capital, the private equity manager.

Management changes

In late June 2025, Allied announced some changes within its senior management team to “further strengthen” the execution of its growth strategy.

It announced Mr James Li would take over as chief executive officer of Allied Gaming & Entertainment, while retaining his position as president and chairman of the board.

Ms Yinghua Chen, who previously held the role, is retaining the CEO title at the helm of Allied Esports International, its wholly owned subsidiary.

What is the outlook?

A key part of any AGAE stock analysis is looking to the future, and Allied recently laid out a strategy for growth and long-term value creation.

There are four key elements:

- Rapid revenue growth through organic investments, joint ventures and acquisitions

- Investing in opportunities that accelerate growth within existing businesses

- Strategic partnerships that are not capital-intensive

- Acquisitions in gaming, proprietary content IP, and live & experiential entertainment.

The company also noted that stock buybacks would be done opportunistically, when they are “an efficient use of capital” and support long-term shareholder value.

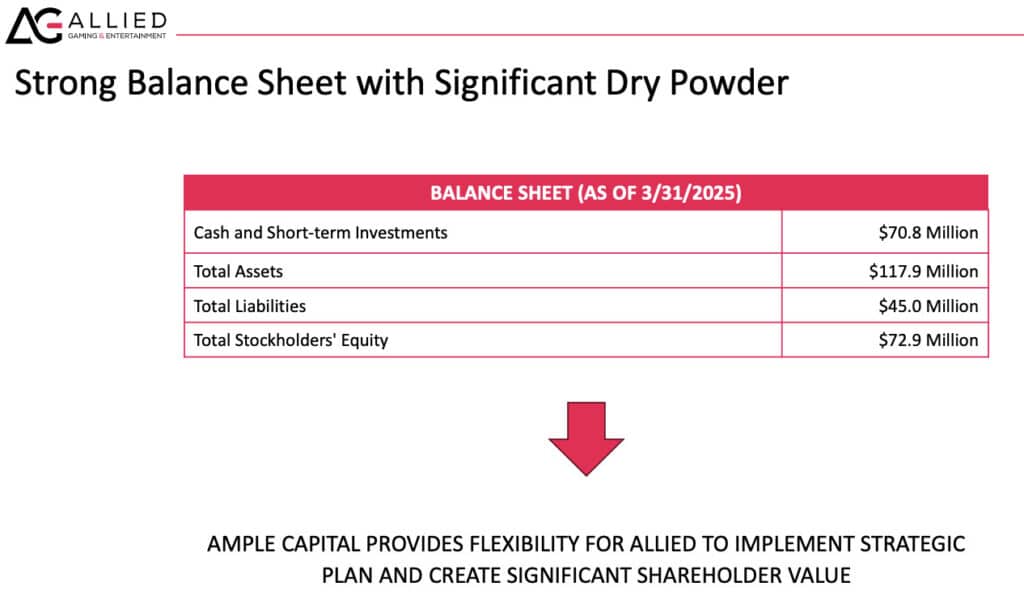

It also emphasised its strong balance sheet and insisted this provided the flexibility required for Allied to implement the strategic plan.

What is Allied Esports?

It’s the esports unit of Allied Gaming & Entertainment and puts on competitive community and professional gaming events.

The business also owns and operates the HyperX Esports Arena in Las Vegas, as well as Allied Esports Trucks, the 18-wheel mobile gaming arenas.

There’s also AE Studios, which is Allied’s original content development and production services division. It has bases in both Las Vegas and Hamburg, Germany.

The company originally started trading on Nasdaq in August 2019, when it was known as Allied Esports Entertainment. However, it subsequently changed to Allied Gaming & Entertainment (under the ticker AGAE) following a strategic review.

Conclusion: Should I buy Allied Gaming & Entertainment stock?

Shares may have risen more than 90% over the past year but this company should only be considered by those who aren’t put off by volatility.

As our AGAE stock analysis shows, shares in the esports company have been extremely volatile and this is likely to be a deciding factor for would-be investors.

On the positive side, the company is generating decent revenues from the different areas of its business and is hopeful that they will continue to grow.

However, it’s still involved in an ongoing battle with shareholder Knighted Pastures, and this needs to be resolved to give investors some much-needed clarity.

Looking ahead, a lot will depend on the performance of James Li, the newly appointed chief executive, and whether he can implement the company’s strategic plan.

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

You will need to answer this question based on the opinions of stock market analysts and your own opinions. Remember that even professional investors can make mistakes.

Your AGAE share price forecast should consider recent newsflow, comments from the company and views of the wider market.

It’s not clear where the AGAE share price will end up this year, as we’ve already seen it below $1 and spiking up to $3.50 over the course of a turbulent past six months.

A lot will depend on whether the company’s plans are successful and whether it will continue experiencing high legal costs.

This depends on which data you consult. The stock price could fall 3.85% to $1.50 over the coming year, but that’s only the view of one analyst compiled by TipRanks.

Elsewhere, the Allied Gaming & Entertainment stock forecast of WalletInvestor suggests that shares could continue climbing over the next five years.

It’s the business esports unit of Allied Gaming & Entertainment and is known for putting on competitive community and professional gaming events.

The division’s interests include the HyperX Esports Arena in Las Vegas, as well as Allied Esports Trucks, the 18-wheel mobile gaming arenas.

References

- Allied Gaming & Entertainment (AGAE) Stock Forecast, Price Targets and Analysts Predictions (TipRanks)

- Allied Gaming & Entertainment Stock Forecast, “AGAE” Share Price Prediction Charts (WalletInvestor)

- Allied Gaming & Entertainment – 8 Year Stock Price History (Macrotrends)

- Allied Gaming & Entertainment Inc. (AlliedGaming)

- Quarterly Reports (AlliedGaming)

- Knighted Pastures Nominates Highly Qualified Director Candidates for Election to Allied Gaming’s Board at Upcoming Annual Meeting (GlobeNewswire)

- Allied Gaming & Entertainment Files Lawsuit Against Knighted Pastures and Roy Choi et al. Alleging Violations of Federal Securities Laws (BusinessWire)

- Allied Gaming & Entertainment Responds to Lawsuit from Dissident Stockholder (AlliedGaming)

- Federal District Court Issues Order Regarding Allied Gaming & Entertainment Combined 2024/2025 Annual Meeting of Stockholders to Take Place As Planned on August 4th, 2025 (AlliedGaming)

- Allied Gaming & Entertainment Celebrates the Successful Debut of the Inaugural World Mahjong Tour Tournament at HyperX Arena (AlliedGaming)

- AGAE to Co-Launch RythmX x Strawberry Music Festival in Macau’s First 50,000-Capacity Outdoor Venue (BusinessWire)

- Allied Gaming & Entertainment Announces CEO Transition to Accelerate Strategic Growth and Innovation (AlliedGaming)

- AGAE Investor Presentation (cloudfront)

- HyperX Arena Las Vegas at the Luxor (HyperX Arena Las Vegas)

The post Allied Gaming & Entertainment stock forecast 2025-2030: What should we expect next from the volatile AGAE stock price? appeared first on Esports Insider.