TL;DR

- Esports Entertainment Group (EEG) delisted from the Nasdaq in 2024 and now trades on the Over-the-Counter (OTC) Markets.

- EEG deregistered with the US Securities and Exchange Commission last year, relieving it of the obligation to file periodic reports.

- It reported a loss of $2.8 million for the three months ended March 2024, according to the most recent results filed with the SEC.

- EEG operates two complementary business segments: EEG iGaming and EEG Games.

- Alex Igelman, a gaming lawyer, was named chief executive in late 2022 and reviewed the entire organisation.

Esports Entertainment Group has maintained a relatively low profile since leaving the Nasdaq and deregistering with the US Securities and Exchange Commission.

The Malta-based gaming and online gambling company has only issued a few press releases and has been relatively quiet on social media.

But what does this mean for EEG? Should potential investors consider buying into the shares, or is it wiser to sit tight for a while?

In our Esports Entertainment stock forecast, we chart the performance of GMBL stock, examine its most recent financial results, and see what could be in store.

Esports Entertainment Group stock forecast 2025–2026: One-year GMBL stock projection

There is virtually no analyst coverage for this company, which makes it very difficult to compile an accurate GMBL share price forecast.

All we found were predictions from WalletInvestor, an algorithmic forecaster that uses various data-driven models to make projections.

Currently, it has the GMBL share price tumbling to virtually nothing over the next 12 months, classifying it as a “bad long-term (1 year) investment”.

However, these estimates are based on patterns and don’t include any fundamental analysis or insights into the company.

| One-year Esports Entertainment Group stock forecast (as of September 2, 2025) | |

| WalletInvestor | $0.000000000012 |

Esports Entertainment Group stock predictions

How about the longer-term GMBL stock prediction? What are the Esports Entertainment Group stock predictions of analysts and algorithmic forecasters for the next five years?

As already mentioned, it’s almost impossible to predict future movements in the GMBL stock price due to the lack of analyst coverage.

Esports Entertainment Group stock forecast 2027–2030: Longer-term prospects

| Long-term GMBL stock forecasts (as of September 2, 2025) | ||

| Year | September 2027 | September 2030 |

| WalletInvestor | $0.000001 | $0.000001 |

GMBL stock YTD, one-year & five-year performance analysis

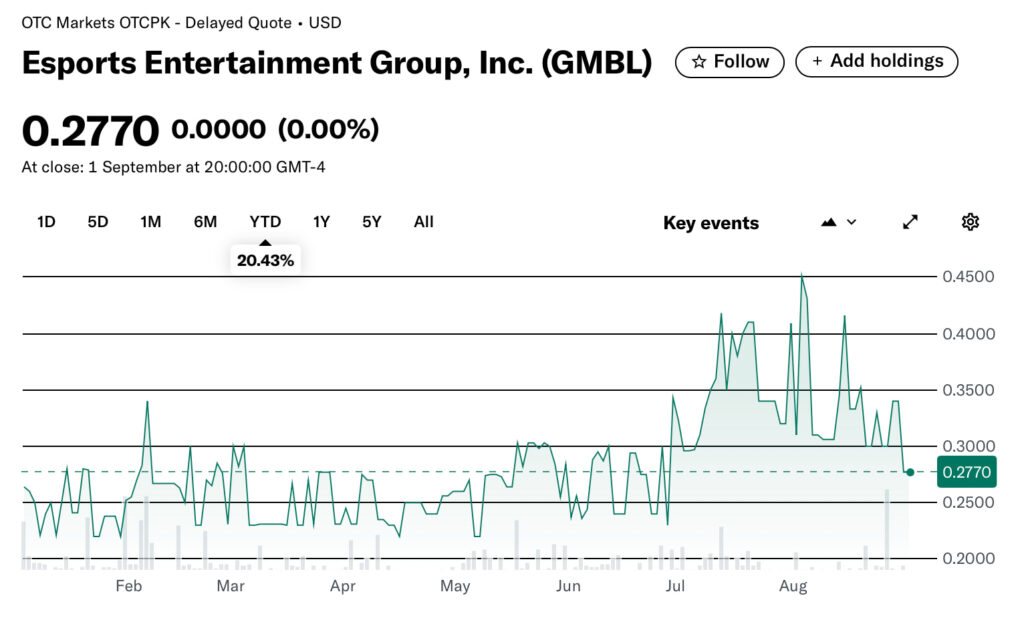

Esports Entertainment Group stock year-to-date: +20.43%

As the market closed on September 1, 2025, the GMBL share price stood at $0.27. This represents a 20.43% increase from the start of this year.

Although there hasn’t been much news flow this year, it’s essential to note that shares traded on the OTC Markets can experience more volatile price movements. This can be due to factors such as lower liquidity, less regulation and speculative trading behaviour.

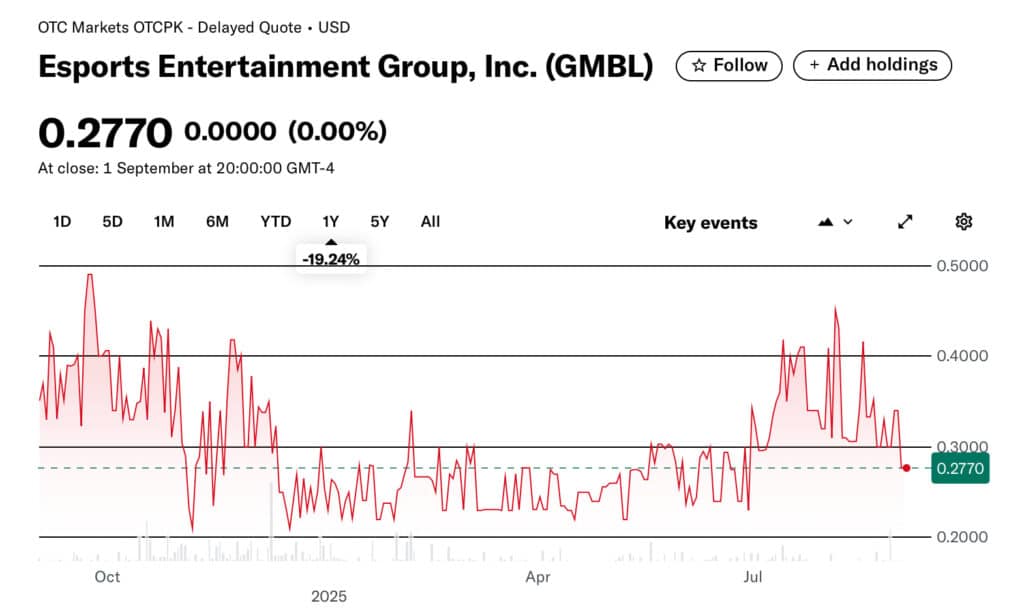

Esports Entertainment stock one-year performance: -19.24%

Over the past 12 months, the GMBL stock has declined 19.24% and closed at $0.27 on September 1, 2025. Last September, it was trading around $0.50.

It’s likely that the changes implemented by the company prior to this period, including the reverse stock splits, have contributed to this outcome. However, as we have already highlighted, shares traded on OTC Markets can experience higher volatility than on exchanges like the Nasdaq.

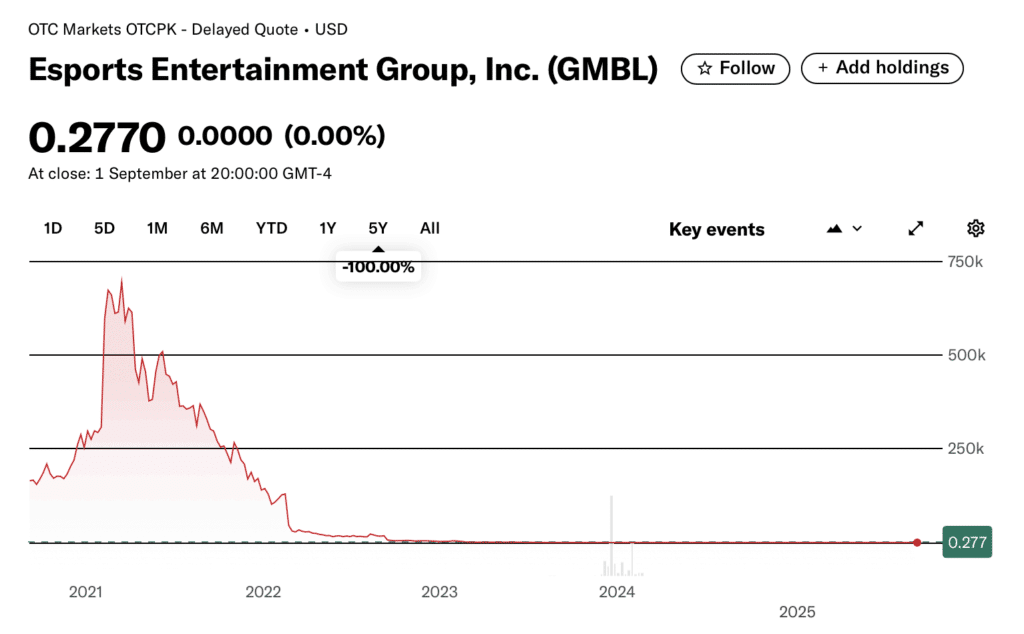

Esports Entertainment stock five-year performance: -100%

The GMBL stock price is significantly lower than in the past. This isn’t surprising, considering what has happened. During this period, we have witnessed delisting from the Nasdaq, deregistration with the SEC, quarterly losses, and reverse stock splits.

Latest earnings results

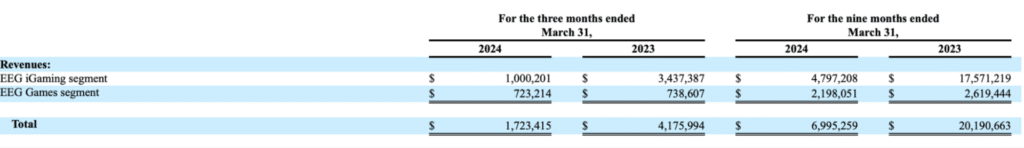

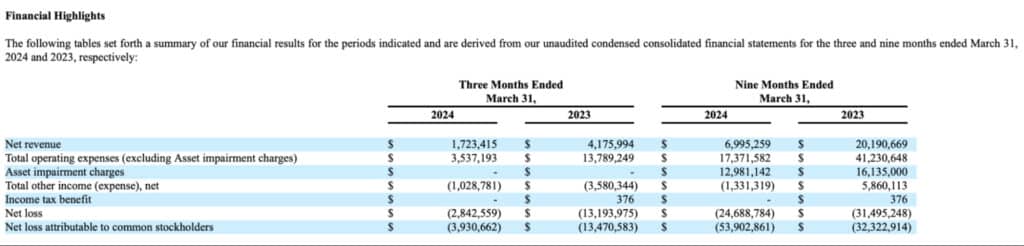

The most recently published financial results were filed with the SEC for the three- and nine-month periods ended March 31, 2024.

They revealed that net revenue for the quarter totalled $1.7 million. This was 60% lower than the $4.2 million achieved for the corresponding period in 2023.

The company noted: “The decrease is primarily attributable to the sale of the Bethard Business on February 24, 2023 and the wind down and eventual liquidation of the Argyll entities where revenue producing operations were ceased on December 8, 2022.”

There was a $2.5 million fall in the iGaming segment’s revenue, from $3.5 million to $1.0 million. Meanwhile, revenue in the EEG Games segment remained flat at around $700,000.

EEG noted the iGaming operations of Lucky Dino, Bethard and Argyll were impacted by “worsening investment and market conditions” and regulatory changes in Finland and the UK.

The nine-month comparisons revealed a similar drop in revenue, with a 65% decline from $20.2 million to $7 million.

“The decrease is primarily attributable to the sale of the Bethard Business on February 24, 2023 and the wind down and eventual liquidation of the Argyll entities, where revenue producing operations were ceased on December 8, 2022,” it added.

EEG made a loss of $2.8 million for the three months ended March 2025. Over the course of nine months, it lost almost $25 million.

Liquidity situation

The company’s results also showed that EEG considered it had an accumulated deficit of $206,114,689 as of March 31, 2024.

EEG also acknowledged a “history of recurring losses” from operations and “recurring negative cash flows” from operations as it has prepared to grow its esports business through acquisition and new venture opportunities.

It added: “At March 31, 2024, the company had $957,112 of available cash on hand and net current liabilities of $7,821,552. Net cash used in operating activities for the nine months ended March 31, 2024, was $5,550,732, which includes a net loss of $24,688,784.”

Additionally, the amount of available cash on hand as of May 21, 2024, one business day before the filing, was approximately $600,000.

Fresh direction for Esports Entertainment Group

Alex Igelman was appointed chief executive of EEG in late December 2022, following the departure of Grant Johnson.

Mr Igelman, a gaming lawyer with more than 30 years of industry experience, outlined his vision in a letter to shareholders about three months after taking over.

He told them that he’d undertaken a “top-to-bottom review” of the organisation, based on where he believed the industry was going.

“Esports Entertainment has extremely valuable and differentiated assets, which we believe will be key to the future of this industry,” he insisted.

Mr Igelman also pointed out that the company now comprised seasoned gambling executives, former regulators, and video game industry professionals.

“We are also diversifying our sources of revenue to create a more resilient and sustainable business model,” he added. “With the right leadership, direction and financial discipline, I am extremely confident we can establish Esports Entertainment as a leader in this rapidly emerging market, while unlocking value for shareholders.”

Other Esports Entertainment Group news

Deregistering from the SEC

One of the reasons less information is available about EEG is that it filed a Form 15 with the US Securities and Exchange Commission in July 2024. This document effectively releases the company from the obligation to file periodic reports.

Delisting from the Nasdaq

The company announced back in February 2024 that it was voluntarily delisting from the Nasdaq Stock Market. The move was expected to reduce costs.

Chief executive Alex Igelman explained that expenses related to maintaining the Nasdaq listing were significant.

In a statement at the time, he said: “At the moment, we are 100% focused on driving growth and profitability and believe that this move to the OTC Markets will allow us to regroup as we execute on the aforementioned initiatives.”

Reverse stock split

In late December 2023, EEG announced that its Board of Directors had approved a 1-for-400 reverse split of the company’s common stock.

The move saw every 400 shares of common stock issued and outstanding automatically combined into one share of common stock.

Factors such as the trading price of the common stock and efforts to regain compliance with Nasdaq listing rules were the primary reasons behind the decision.

What is the outlook?

A crucial part of our GMBL stock analysis is gauging what the future looks like for the Esports Entertainment Group.

However, the news flow has been extremely limited over the past 18 months, making it very difficult to make any accurate predictions.

We’ll need to wait and see if the company publishes any updates over the coming months, as the most recent press release on their website dates back to February 2024.

What is the Esports Entertainment Group?

It’s a diversified business that operates two complementary business segments: EEG iGaming and EEG Games.

EEG iGaming encompasses its iGaming casino, with the company stating in its latest financial results that its goal is to be a leader in the rapidly growing sector of esports real-money wagering.

Meanwhile, EEG Games focuses on providing esports entertainment experiences to gamers in various ways. This business is understood to operate in the US and Europe.

EEG, formed in Nevada, US, in July 2008, was initially known as Virtual Closet. It then changed its name to DK Sinopharma, then VGambling and, finally, Esports Entertainment Group.

In early 2019, it announced the opening of its new global headquarters in Malta, due to the country’s “strategic location” within the European Union. It also highlighted the benefit of access to a “highly educated and multi-lingual workforce”, particularly within the field of online gambling.

Conclusion: Should I buy Esports Entertainment Group stock?

It is a time of transition for the Esports Entertainment Group, so a wise move is probably to sit tight and see how everything unfolds over the coming months.

As our Esports Entertainment Group stock forecast shows, it’s virtually impossible to draw meaningful conclusions as there have been very few public announcements. Would-be investors also need to accept that its shares will likely be more volatile because it trades on the OTC Markets.

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

Is GMBL stock a good buy?

You will need to answer this question based on your own analysis. Remember that even professional investors can make mistakes. Your GMBL share price forecast should consider recent news flow, comments from the company, and views of the broader market.

What is the price prediction for Esports Entertainment Group in 2025?

The GMBL share price is expected to fall to virtually zero over the coming year, according to the algorithmic forecasts of Wallet Investor.

Is GMBL stock overvalued?

You will need to draw your own conclusion based on the current GMBL share price and the company’s outlook.

What is the Esports Entertainment Group?

It’s a diversified competitive gaming and online gaming company that’s based in Malta and traded on the OTC Markets.

References

- EEG Stock Forecast, “GMBL” Share Price Prediction Charts (WalletInvestor)

- EEG, Inc. (GMBL) stock price, news, quote and history (Yahoo Finance)

- UNITED STATES SECURITIES AND EXCHANGE COMMISSION (SEC)

- EEG Announces Alex Igelman as Chief Executive Officer (Esports Entertainment Group)

- EEG CEO Provides Letter to Shareholders (Esports Entertainment Group)

- EEG Announces Voluntary Delisting from the Nasdaq and Transfer to the OTCQB® Venture Market (Esports Entertainment Group)

- EEG Announces Reverse Stock Split (Esports Entertainment Group)

- EEG Opens New Global Headquarters In Malta, Hires Two Key Executives (GlobeNewswire)

The post Esports Entertainment Group stock forecast 2025-2030: What should we expect next from the GMBL stock price? appeared first on Esports Insider.