TL;DR

- Gamer Pakistan was launched in November 2021 to create college, inter-university, and professional esports events in Pakistan.

- It went public through an IPO that raised $6.8 million in October 2023 and began trading on the Nasdaq under the ticker ‘GPAK’.

- The company announced in August 2024 that it would be delisted from the Nasdaq and would start trading on the Over-the-Counter (OTC) markets.

- A loss of $1.95 million was recorded for the nine months ended September 30, 2024, due largely to a significant increase in expenses.

- It announced that it was ceasing operations in Pakistan due to the “ongoing political and economic uncertainty” in the country and seeking alternative opportunities.

- News flow from the company has been very light over the past year, with no significant announcements being made.

Gamer Pakistan is an interactive esports event promotion and marketing company that launched just under four years ago.

The business, which created professional esports events in Pakistan, was initially traded on the Nasdaq under the GPAK ticker, but was delisted in August 2024. However, it’s now trading on the Over-The-Counter markets and has announced that operations will cease in Pakistan due to “ongoing political and economic uncertainty” in the country.

In our Gamer Pakistan stock forecast, we examine the business, explore the most recently published reports, and offer insight into what analysts expect for the stock.

Gamer Pakistan stock forecast 2025–2026: One-year GPAK stock projection

Unfortunately, there are very few predictions available for the stock due to a significant lack of analysts covering the business. This is likely because GPAK is now listed on the OTC market, and its share price has declined significantly over the past few years.

Data platform Coincodex is the only source offering any insight into how the shares will perform over the coming year.

It stated: “On average, GPAK is expected to change hands at $ 0.013363 during the year (2026). The most bullish month for GPAK could be January, when the currency is anticipated to trade -0.82% lower than today.”

| One-year Gamer Pakistan stock forecast (as of September 16, 2025) | |

|---|---|

| Coincodex | 0.0134 |

Gamer Pakistan stock predictions

How about the longer-term GPAK stock prediction? What are the Gamer Pakistan stock predictions of analysts and algorithmic forecasters for the next five years?

Well, the same issue applies. No analysts have shared their GPAK share price forecast, and there’s very little information from the algorithmic forecasters.

Once again, it’s only Coincodex that gives any indication, and as you can see from the predictions, this hardly represents positive news for the company.

Gamer Pakistan stock forecast 2027–2030: Longer-term prospects

| Long-term GPAK stock forecasts (as of September 16, 2025) | ||

|---|---|---|

| Year | September 2027 | September 2030 |

| Coincodex | $0.0133 | $0.001 |

GPAK stock YTD, one-year & five-year performance analysis

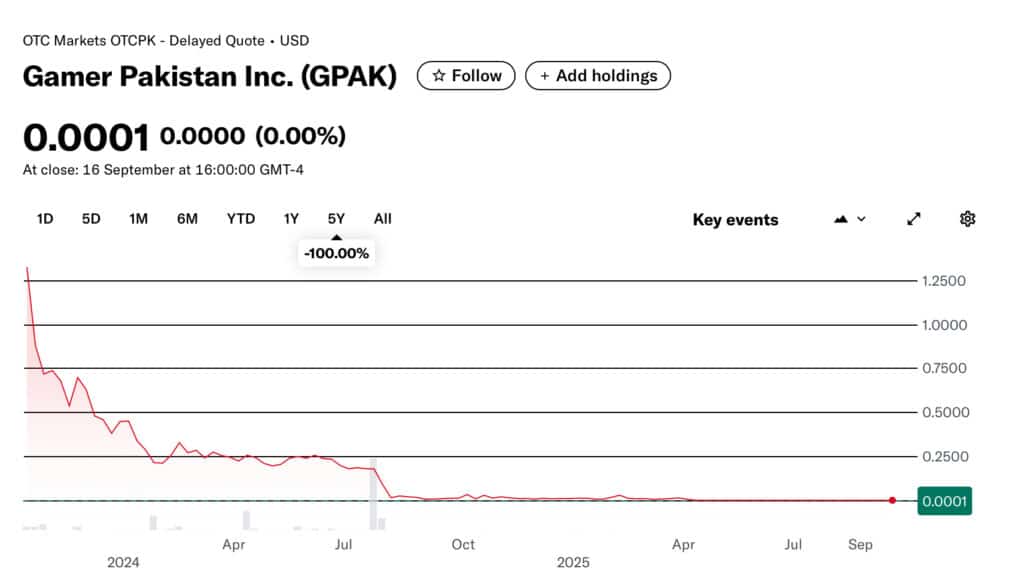

Gamer Pakistan stock year-to-date: -99%

The GPAK share price has lost almost all its value since the start of 2025 and is a far cry from its high of $4 a couple of years ago.

It has suffered from a lack of information from the company, the move from the Nasdaq to the Over-The-Counter markets, and no analyst views being shared.

Gamer Pakistan stock one-year performance: -98.85%

There are no real surprises that the GPAK share price has fallen so significantly, as the company has announced substantial losses, the delisting from the Nasdaq, and ceased operations in Pakistan.

Gamer Pakistan stock five-year performance: -100%

The stock hasn’t been listed for five years. In fact, it only went public in October 2023, so let’s look at the last couple of years.

The all-time high closing price of Gamer Pakistan stock was $4 at the time of the IPO, whereas the average stock price for the past year is just $0.01, according to MacroTrends.

Latest earnings results

Gamer Pakistan’s most recently published results were for the quarter ended September 30, 2024. They covered the three- and six-month periods preceding that date.

It stated: “Due to the ongoing political and economic uncertainty in Pakistan, the company has decided to cease operations in Pakistan and reduce overhead expenses wherever possible while it continues to seek alternative opportunities for the company.”

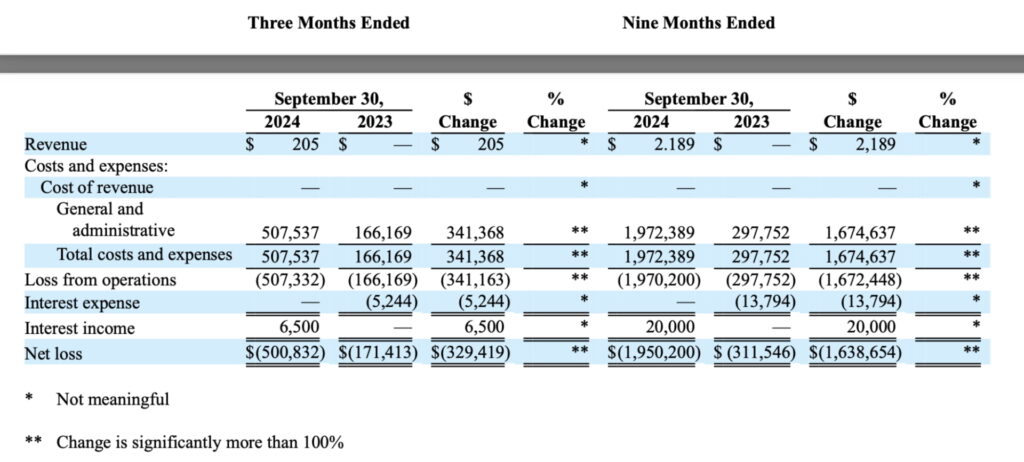

As for the figures, a modest revenue of $2,189 was recorded for the preceding nine months, representing an improvement over the zero income in the corresponding period in 2023.

The company stated: “During the nine months ended September 30, 2024, the Company’s revenue consisted of commissions, registration fees received, and sponsorship fees for K2 Gamer and totalled approximately $2,100.”

It also commented on the quarter in question. “During the three months ended September 30, 2024, the Company’s revenue was immaterial,” it added. “The Company had no revenue for the three and nine months ended September 30, 2023.”

The expenses recorded were considerably higher. For the nine-month period, these stood at $1.97 million, up from $298,000 the previous year.

It stated: “The increase in general and administrative expenses was primarily driven by an increase of approximately $452,000 in consulting fees, $645,000 in professional, accounting, legal and business development fees, $273,000 in payroll, $182,000 in public filing fees, board stipend and insurance fees, and approximately $116,000 of expenses in Pakistan.”

Overall, the financial situation resulted in Gamer Pakistan suffering net losses of $500,332 for the three months ended September 2024. The losses for the nine months were even higher at $1.95 million, compared to the $311,546 corresponding loss for the same period in 2023.

Let’s also consider some other Gamer Pakistan news.

Significant deficit

In its results announcement, the company also acknowledged a deficit of approximately $4.3 million as of September 30, 2024.

“The company had minimal revenue-generating operations from which it generated revenues through September 30, 2024,” it stated. “The company expects that it will operate at a loss for the foreseeable future.”

The statement went on to say it had raised gross proceeds of around $6.8 million during October 2023 through its IPO.

Once underwriting discounts and commissions were taken into account, the net proceeds were approximately $5.84 million.

It added: “Management believes the net proceeds from the IPO will be sufficient to meet its cash, operational and liquidity requirements for at least 12 months after the date of this annual report. However, the Company anticipates that it will be required to raise additional funds through public or private equity financings in the future to expand its business.”

Loan repayment

Gamer Pakistan also stated it had loaned WestPark Capital Group, an investment banking and securities brokerage firm, $300,000 in September 2024.

It stated: “WestPark will repay the Company monthly payments of $12,500 plus interest on the unpaid balance beginning on December 1, 2024 and will continue over the next 23 months until the loan is paid in full. The interest rate on the loan is eight per cent (8%).”

Delisting

In August 2024, the company announced its request to continue being listed on Nasdaq had been denied and that shares were being suspended.

It stated: “The delisting is a result of failure to satisfy the $1.00 minimum bid price listing required in Nasdaq Listing Rule 5550(a)(2) and the obligation to file periodic filings with the Securities and Exchange Commission as required under Nasdaq Listing Rule 5250(d)(1).”

James Knopf, Gamer Pakistan’s chief executive, stated: “While we are disappointed in the Nasdaq delisting, this does not deter us from our long-term strategy of executing our business plan and creating stockholder value.”

What is the outlook?

The purpose of our GPAK stock analysis is to assess the company’s outlook and what we can expect from it over the next few years.

However, the lack of recent updates makes this difficult. Until further data is released, this is unlikely to change.

What is Gamer Pakistan?

Gamer Pakistan is an esports event development company launched in November 2021 to create college, inter-university, and professional esports events in Pakistan.

According to the company, operations are conducted through K2 Gamer, a 90% owned subsidiary.

In October 2023, it was announced that Gamer Pakistan had completed a $6.8 million IPO and started trading on the Nasdaq.

However, in August 2024, the company revealed it would be delisted from the Nasdaq and would begin trading on the Over-the-Counter (OTC) markets.

It subsequently announced was ceasing operations in Pakistan due to the “ongoing political and economic uncertainty” in the country and seeking alternative opportunities.

Conclusion: Should I buy Gamer Pakistan stock?

You will need to draw your own conclusion regarding whether or not GPAK stock is an attractive investment prospect.

However, it’s essential to note that the company hasn’t released much information about either its financial results or future plans.

It’s understood that the last publicly available results are for the quarter ended September 2024, which were published at the back end of last year. GPAK stock is also now listed on the OTC markets, where there is a less stringent regulatory backdrop than on the Nasdaq.

As always, it’s crucial that would-be investors conduct their own research into potential holdings and not rely solely on the views of observers and analysts.

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

Is GPAK stock a good buy?

You will need to answer this question based on the opinions of stock market analysts and your own opinions. Remember that even professional investors can make mistakes. Any GPAK share price forecast should consider recent news flow, comments from the company, and views of the wider market.

What is the price prediction for Gamer Pakistan in 2025?

Gamer Pakistan doesn’t appear to be followed by any stock market analysts, so there isn’t much in the way of projections. However, the GPAK share price is expected to drop by -0.38% and reach $ 0.013449 per share by October 16, according to Coincodex.

Is GPAK stock overvalued?

That is something you will need to decide. According to the Gamer Pakistan stock forecast of Coincodex, the stock is expected to fall.

What is Gamer Pakistan?

Gamer Pakistan is an esports event development company launched in November 2021 to create college, inter-university, and professional esports events in Pakistan.

References

- Understanding Over-the-Counter (OTC) Markets: Benefits and Risks (Investopedia)

- Gamer Pakistan Inc. Common Stock (GPAK) Stock Forecast & Price Prediction 2025–2030 (CoinCodex)

- Gamer Pakistan Inc. (GPAK) stock price, news, quote and history (Yahoo Finance)

- Gamer Pakistan – 2 Year Stock Price History (MacroTrends)

- GAMER PAKISTAN INC. (Quotemedia)

- GAMER PAKISTAN INC. (U.S. Securities and Exchange Commission)

- Gamer Pakistan Announces Delisting from Nasdaq (PR.com)

- GAMER PAKISTAN TAKES THE WORLD OF ESPORTS BY STORM (Gamer Pakistan)

- Gamer Pakistan Inc. has completed an IPO in the amount of $6.8 million (MarketScreener)

The post Gamer Pakistan stock forecast 2025-2030: What is likely to happen to the GPAK share price? appeared first on Esports Insider.