TL;DR

- GameSquare Holdings is undertaking a restructuring and has introduced an Ethereum-based treasury strategy.

- The company owns FaZe Clan, which runs prominent teams competing in games such as Fortnite, Rocket League and FIFA.

- GAME stock is rated a ‘moderate buy’, according to the views of four Wall Street analysts, compiled by MarketBeat, as of October 8, 2025.

- The consensus view is that the GAME share price could rise by 270.83% to $3 over the coming year to October 2025.

- GameSquare’s investors are understood to include Jerry Jones, who owns the Dallas Cowboys.

It’s been a busy year for GameSquare Holdings. The owner of the FaZe esports team has been busy turning itself into a digital-led entertainment company.

This has involved a restructuring to streamline costs, the divestment of its remaining stake in FaZe Media, and the formation of a strategic alliance with GGTech Entertainment.

The US-based business has also launched an Ethereum-based treasury strategy, which it hopes will enhance its financial flexibility. The overhaul has helped push the stock price up 15.4% over the past year to $0.81, as of the market close on October 7, 2025.

In our GAME stock forecast for 2025-2030, we examine the company’s strategy, its most recent results, and the predictions of analysts.

GameSquare Holdings stock forecast 2025–2026: One-year GAME stock projection

GAME stock is rated a ‘moderate buy’, according to the views of four Wall Street analysts compiled by MarketBeat. Two have it down as a ‘buy’, one as a ‘strong buy’, and one as a ‘sell’.

The consensus view is that the stock could hit $3 over the next 12 months. This would represent a 270.83% increase over the $0.81 closing price on October 7, 2025.

Elsewhere, the views of two analysts compiled by Tip Ranks give a more modest 12-month forecast of a 116.32% rise to $1.75. It, too, has the stock down as a ‘moderate buy’.

Meanwhile, the algorithmic forecasts of Wallet Investor don’t share the optimistic outlook, predicting the GAME stock price will fall to zero.

It stated: “According to our live Forecast System, GameSquare Holdings Inc. stock is a bad long-term (one-year) investment.”

| One-year GameSquare Holdings stock forecast (as of October 8, 2025) | |

|---|---|

| MarketBeat | $3.00 |

| TipRanks | $1.75 |

| WalletInvestor | $0.00 |

GameSquare Holdings stock predictions

How about the longer-term GAME stock prediction? What are the GameSquare Holdings stock predictions of analysts and algorithmic forecasters for the next five years?

Analysts are generally reluctant to provide long-term share price forecasts because there are so many potential variables when you’re looking several years ahead.

However, Wallet Investor’s GameSquare Holdings share price forecast predicts the stock will remain flat at zero over the next five years.

GameSquare Holdings stock forecast 2027–2030: Longer-term prospects

| Long-term GameSquare Holdings stock forecasts (as of October 8, 2025) | ||

|---|---|---|

| Year | October 2027 | September 2030 |

| WalletInvestor | $0.0000 | $0.0000 |

GAME stock YTD, one-year & five-year performance analysis

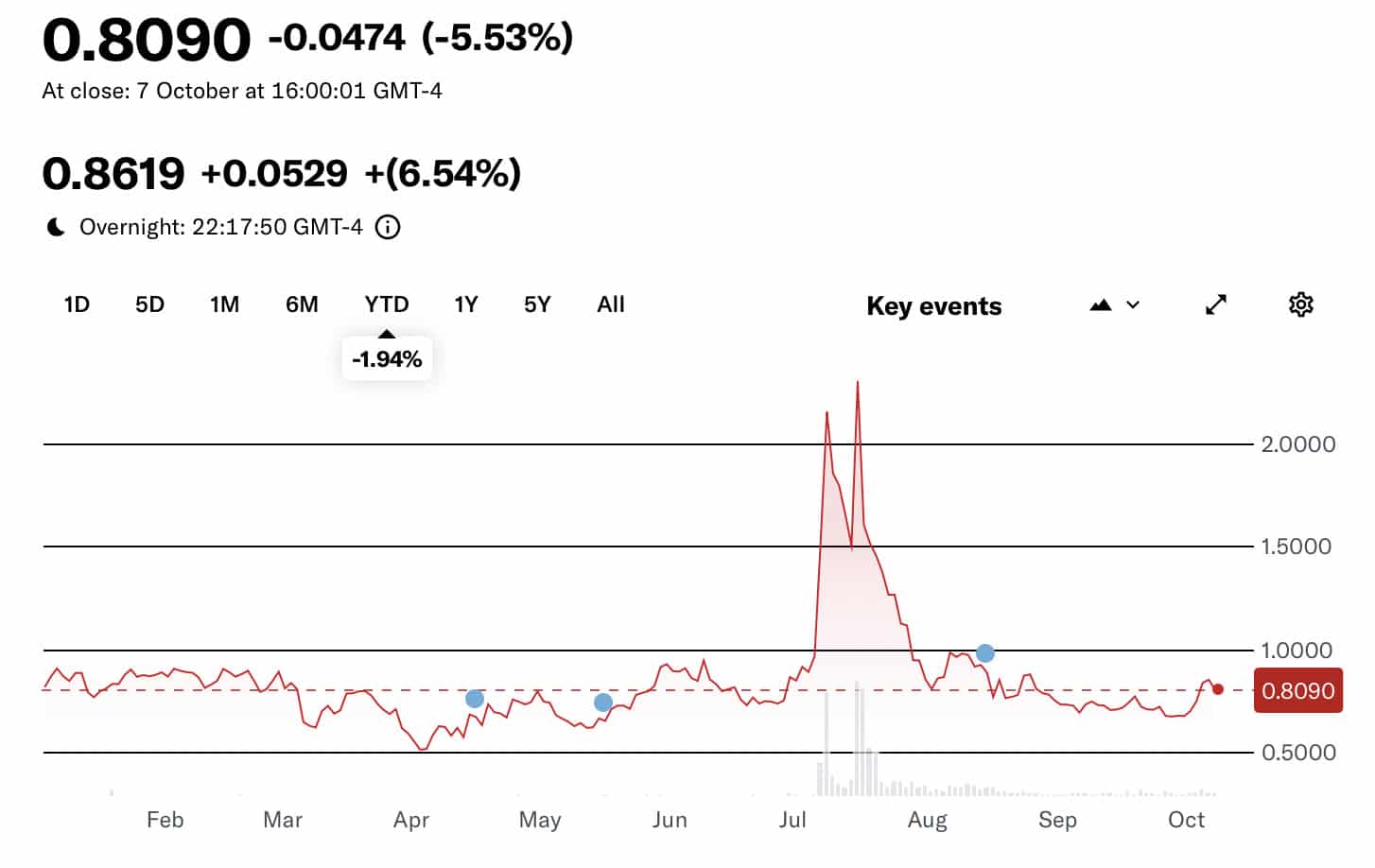

GAME stock year-to-date: -1.94%

The GAME share price has endured a fairly volatile ride this year.

There was a particularly sharp increase in July, when its Ethereum treasury strategy was revealed, before the stock returned to trading around its more usual level.

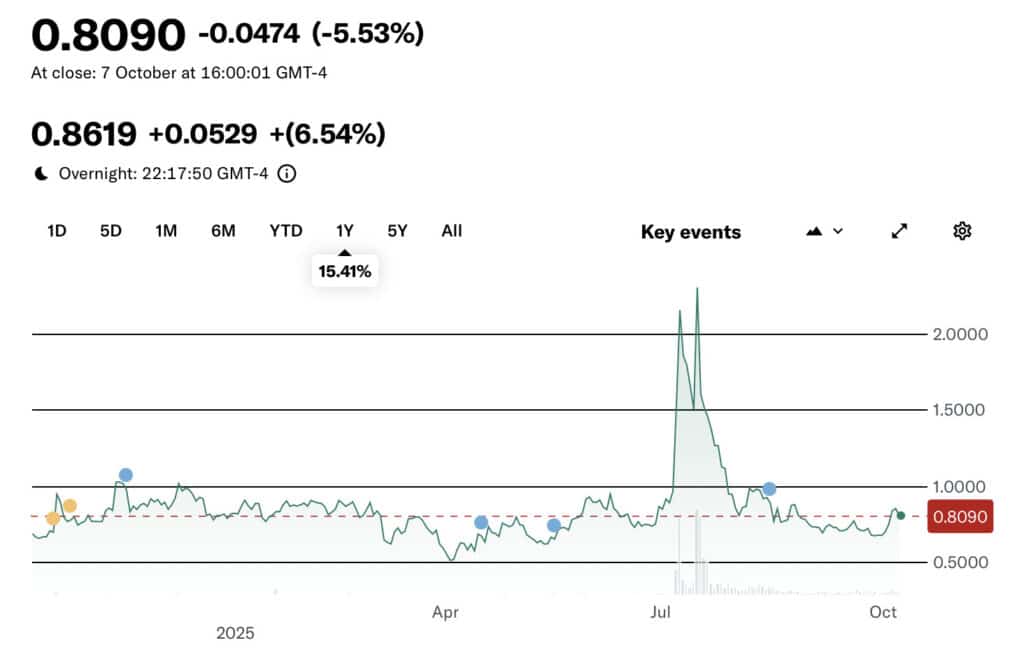

GAME stock one-year performance: +15.41%

A significant restructuring, quarterly losses and swings in sentiment have all influenced the GAME share price over the past 12 months.

This has resulted in the stock price having increased 15.41% to $0.81 as the stock market closed on October 7, 2025.

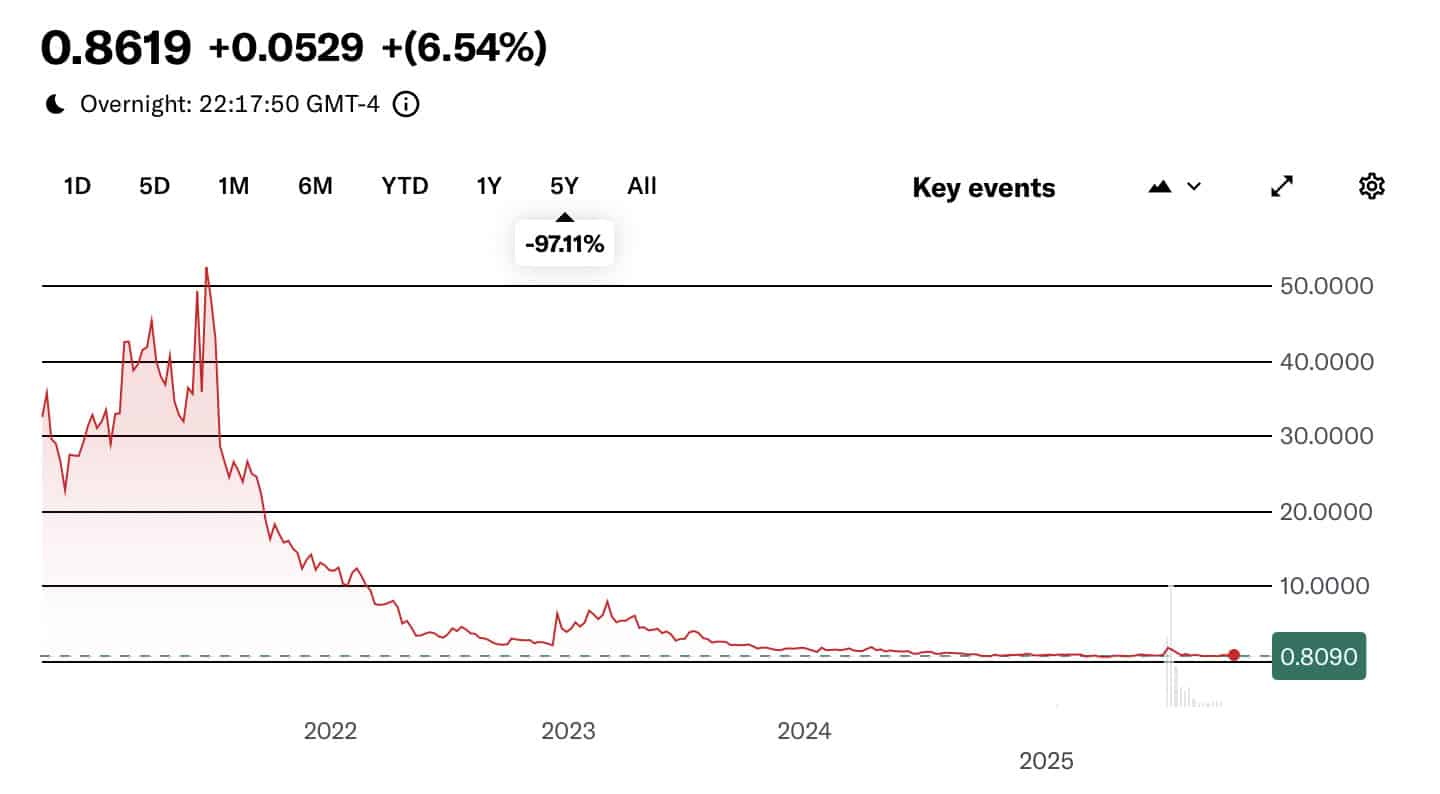

GAME stock five-year performance: -97.11%

The stock price fall looks dramatic but it’s misleading to consider the five-year performance of the GAME ticker, as the business has undergone mergers and acquisitions.

For example, in early April 2023, the company (then known as Engine Gaming and Media) completed a plan of arrangement that saw it acquire the issued shares of GameSquare Esports.

Latest earnings results

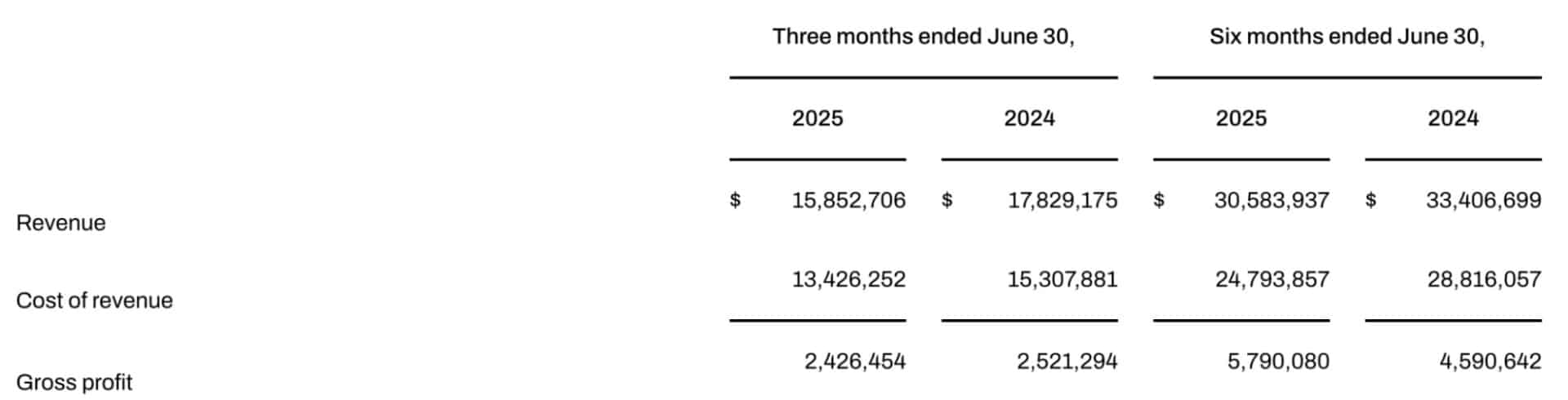

GameSquare revealed second-quarter revenue of $15.8 million, representing a substantial fall from $17.8 million in the corresponding period last year.

In an earnings call, chief financial officer Michael Munoz said: “The 11% year-over-year decline in revenue was primarily due to a reduction in programmatic advertising revenue, partially offset by growth across our other business segments.”

The company also reported an adjusted quarterly EBITDA (earnings before interest, tax, depreciation and amortisation) loss of $3.5 million.

However, this was an improvement over the $4.2 million loss for the same period last year, which could be partly attributed to cost savings.

GameSquare restructuring

According to Justin Kenna, GameSquare’s chief executive, 2025 is on track to be a “transformative year” for the company as it builds a digital-first platform.

In a statement, he highlighted the restructuring to streamline costs, the divestment of its stake in FaZe Media, and the strategic alliance with GGTech Entertainment.

He said: “In the second half of the year, we are focused on achieving profitability, benefiting from core revenue growth, improved gross margin, lower operating expenses, and the impact of our restructuring initiatives.”

He also pointed out that the company had doubled down on high-growth areas across its Experiences, Managed Services, and Technology business units.

Ethereum-based treasury strategy

In July 2025, GameSquare launched “one of the most sophisticated” Ethereum-based treasury strategies on the market, following months of planning.

It stated that the arrangement was backed by crypto industry pioneers, including Ryan Zurrer of Dialectic, Robert Leshner of Superstate, and Rhydon Lee of Goff Capital.

According to Justin Kenna, GameSquare is in the “strongest financial position” in its history, with the flexibility to invest in growth, generate yield from our crypto assets, and repurchase its stock.

“We believe the combination of our innovative onchain strategy and the improving performance of our operating businesses positions GameSquare as a powerful platform for long-term value creation,” he added.

GameSquare’s business areas

The company operates across four areas:

- SaaS and managed services

- Agency and media

- Owned and operated IP

- FaZe Clan Esports.

GameSquare’s esports operations

GameSquare became one of the largest gaming and esports organisations, based on audience reach, after completing its merger with FaZe in March 2024.

FaZe Clan was founded in 2010 by a group of gaming enthusiasts who turned their passion into a successful career path.

Its esports division includes nine competitive teams in Fortnite, FIFA, PUBG, PUBG Mobile, Rainbow Six, Call of Duty League (Atlanta FaZe), Rocket League, VALORANT and CS:GO.

During the second quarter of this year, GameSquare sold the remaining 25.5% of its stake in FaZe Media back to its founders. It retains control of the FaZe Clan.

GameSquare Holdings News

FaZe Clan sponsorship

In late September 2025, GameSquare announced the expansion of its multi-million-dollar esports sponsorship deal with Rollbit, an online gaming company.

The expanded terms of the agreement will see Rollbit increase its backing of FaZe Clan’s Counter-Strike team from $1.75 million to $3.25 million in annual revenue.

The team’s jerseys will also feature the Rollbit logo in the centre patch position in what the company believes is one of the most prominent brand placements in global esports.

Sam Norman, Head of Partnerships at Rollbit, said: “Since our initial deal in 2024, FaZe Clan has consistently delivered unmatched reach and engagement, helping Rollbit connect with one of the most dynamic audiences in digital entertainment.”

What is the outlook?

A key conclusion from our GAME stock analysis is to examine what the future holds for the company over the next few years.

GameSquare’s management team believes that the restructuring to streamline operations will accelerate the path to profitability and plans to reintroduce full-year guidance in the third quarter.

It believes results in the second half of 2025 will be driven by:

- Unrealised Ethereum gains

- Core revenue to be generated

- Growth supported by new wins and expansion

- Impact of restructuring

Unrealised Ethereum gains

As of August 13, 2025, the company stated that it had approximately $19.3 million in unrealised gains on its Ethereum holdings.

Core revenue to be generated

Approximately 60% of core revenue is expected to be generated in the second half of the year, in line with typical season trends.

Growth supported by new wins and expansion

GameSquare expects meaningful sequential growth, with third-quarter revenue higher than the second and fourth building further, supported by new wins and expansion with existing partners.

Impact of restructuring

Ongoing initiatives are expected to lower operating expenses. The company has also identified an additional $5 million in annualised savings.

Unfortunately, no one has a crystal ball, so any predictions made by stock market analysts need to be regarded as information-based opinions.

The consensus view from analysts is that the stock could rise substantially over the coming year as the business continues to restructure and reduce costs.

However, it’s worth pointing out that such percentage increases are amplified by the fact that each share trades at less than $1.

What is GameSquare Holdings?

It’s a US-based digital media and technology company that helps brands and game publishers connect with hard-to-reach Gen Z, Gen Alpha and Millennial audiences.

GameSquare’s platform provides marketing and creative services to its brand partners, as well as data and analytical solutions.

FaZe Clan Esports, for example, is one of the “most prominent and influential” gaming organisations in the world, according to the company.

GameSquare is traded on the Nasdaq under the ticker: GAME. Its largest investors are understood to include Jerry Jones, who owns the Dallas Cowboys.

Conclusion: Should I buy GameSquare Holdings stock?

Whether or not you should buy into GameSquare Holdings will depend on your view of the stock and the opinions of analysts.

The GAME share price has risen over the past year due to a combination of its restructuring programme and cost reductions.

The consensus view among Wall Street analysts is that further increases may be seen over the next 12 months, although there’s no guarantee they’re correct.

The conclusion of our GameSquare Holdings stock forecast is that a lot depends on the success of the company’s strategy.

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

Is GameSquare Holdings stock a good buy?

You will need to answer this question based on the opinions of stock market analysts and your own opinions. Remember that even professional investors can make mistakes. Your GAME share price forecast should consider recent news flow, comments from the company and views of the wider market.

What is the price prediction for GameSquare Holdings in 2025?

Opinions are divided. According to WalletInvestor’s algorithmic forecast, the GAME share price is expected to fall to zero over the next 12 months. However, the consensus view of four analysts compiled by MarketBeat is for shares to be trading at $3 in a year’s time.

Is GameSquare Holdings stock overvalued?

This is something you’ll need to decide. The stock has risen by 15.41% in 2025, but the consensus view of four analysts compiled by MarketBeat is for shares to be trading at $3 in a year’s time. This would represent an increase of around 270%.

What is GameSquare Holdings?

It’s a US-based digital media and technology company that helps brands and game publishers connect with hard-to-reach Gen Z, Gen Alpha and Millennial audiences.

REFERENCES

- GameSquare (GAME) Stock Forecast and Price Target 2025 (MarketBeat)

- GameSquare Holdings (GAME) Price & Analysis (TipRanks)

- GameSquare Holdings Stock Forecast, “GAME” Share Price Prediction Chart (Wallet Investor)

- GameSquare Holdings, Inc. (GAME) (yahoo! finance)

- GameSquare Announces Completion of Arrangement (GameSquare)

- GameSquare Holdings Inc. Second Quarter 2025 Results Conference Call Transcript (S28.q4cdn)

- GameSquare Holdings Reports 2025 Second Quarter Results (GameSquare)

- GameSquare Announces Completion of Faze Clan Acquisition (GameSquare)

- GameSquare Announces that Rollbit Expands Record FaZe Clan Esports Sponsorship with Multi-Million Dollar Agreement (GameSquare)

The post GameSquare Holdings stock forecast 2025-2030: Will the GAME share price increase over the coming year? appeared first on Esports Insider.