Crypto exchange Gemini has recently upgraded its crypto credit card, boosting its rewards rate to 4% back on eligible purchases. While traditional rewards credit cards offer prizes in the form of points or cash, the Gemini Credit Card lets you earn crypto rewards in coins like BTC, XRP, and ETH.

To unlock rewards, competitor cards charge either an annual fee or require you to hold a certain amount of their token. With the Gemini Credit Card, that’s not the case. This crypto card comes with no annual fees, making it affordable for every user in the US.

Breaking Down the Reward Tiers

The Gemini Credit Card offers boosted rewards on select categories and a flat reward rate on all other purchases. Here’s how much you can earn on your spending:

- 4% back on EV charging, gas, and transportation, including transit, taxi, and rideshare, up to $300 per month. After reaching the cap, the rate drops to 1% until the start of the next month, when it resets back to 4%

- 3% back on dining

- 2% back on groceries

- 1% back on all other purchases

Users can choose to receive their rewards in more than 50 supported cryptocurrencies, which are instantly credited to their balance.

Key Features of Gemini Card Explained

While earning rewards on every purchase you make with your card is enticing, there’s more to the Gemini Credit Card. Here’s what else you get:

- No annual or foreign transaction fees. There’s no annual cost to own the card, making it affordable for everyone. Additionally, using the card abroad won’t incur any foreign transaction fees, while still earning you rewards.

- Welcome bonus. Earn $200 in crypto after you spend $3,000 in the first 90 days when you get the card.

- Choose your reward currency. With over 50 supported cryptocurrencies, you choose which coin you earn as a reward for your spending.

- Integration with Gemini’s platform. Gemini is one of the leading crypto exchanges with a robust trading platform and tools. Within a single account, you can manage your rewards, either to trade them or safely store them as an investment.

At its core, the Gemini Credit Card is a Mastercard World Elite, which comes with additional benefits tied to the Mastercard brand. Users get Priority Pass, which provides access to 1,700 airport lounges worldwide, they can enjoy special offers and discounts in airport terminals on dining, retail, and spa services, and get access to a 24/7 concierge agent.

The card also comes with native theft protection and zero liability protection against unauthorized transactions, making it one of the most secure card payment options available.

From Swiping Your Card to Rewards in Your Wallet

Your crypto rewards are credited instantly, with some exceptions that may take up to 72 hours to post. This can happen at online merchants where they make a pre-authorization charge that is often different from the actual purchase price. These transactions are typically cleared within three days, and once the transaction completes, your rewards will be credited.

Once your rewards land in your account, you can seamlessly manage them either on Gemini’s desktop platform or the Gemini mobile app. There are no strings attached, meaning you can instantly sell your coins, use them for trading, or simply hold them for potential price appreciation.

Note: Not all transactions are eligible for rewards. Exclusions include gift cards, traveler’s checks, precious metals, casino chips, crypto purchases, lottery tickets, and cash equivalents. These items and assets won’t earn rewards under the Gemini Rewards Program Terms.

Benefits for Everyday Users

Spending on gas, groceries, coffee, and hundreds of other everyday items rewards you with real crypto. This can be an excellent way to passively grow your portfolio without making direct crypto purchases.

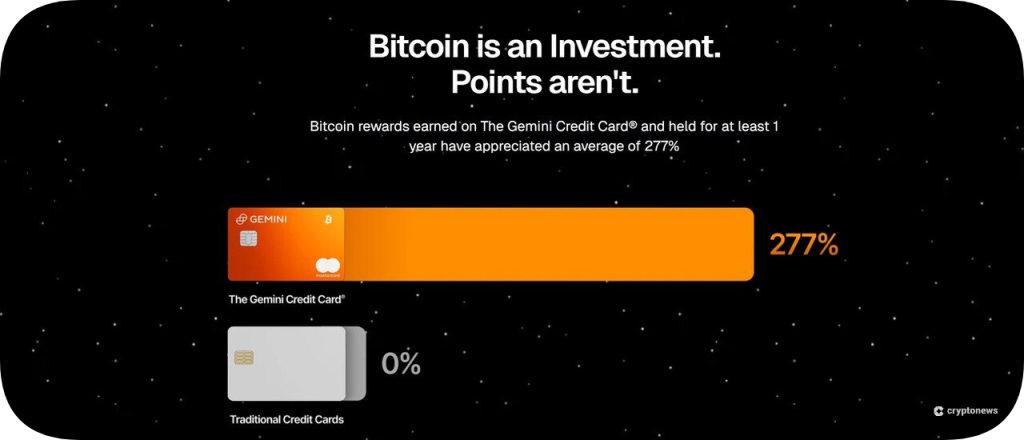

Gemini Credit Card users who choose Bitcoin as their reward and hold their coins for at least one year have seen their BTC appreciate an average of 277%. There’s no way to get the same returns with a traditional cashback or a rewards card.

What Makes the Gemini Credit Card Unique

One of the Gemini Credit Card’s standout features is its no-annual-fee policy, meaning everyone can afford the card. Competitor cards like the Nexo Credit Card or the Crypto.com Visa Card charge an annual fee or require that you buy and hold a certain amount of the platform’s native tokens to unlock the card’s rewards.

Additionally, some of the competitor cards offer rewards in their own native token. With Gemini, you can choose from 50 cryptocurrencies, including Bitcoin, the go-to crypto for its unrivaled staying power. These two features alone make the Gemini Credit Card superior.

Regarding the safety of your funds, Gemini, one of the oldest cryptocurrency exchanges, has not suffered a breach or lost user funds since its inception in 2014. On top of that, the Mastercard World Elite comes with its own set of protections, giving users peace of mind that their funds enjoy the highest level of security.

What to Consider Before You Apply

Traditional cashback or rewards cards offer rewards in USD or points. With USD rewards, you know exactly how much you earn on your spending. With points, the logic is similar, as each point carries a certain USD value.

On the other hand, the Gemini Credit Card rewards you in crypto. As a result, the actual reward you get from your purchases can vary. Let’s take BTC rewards, for example. If you choose to receive your rewards in Bitcoin and the price of Bitcoin goes up 100% since you received your coins, your actual rewards will be doubled.

The opposite is also true. Holding BTC while its price drops means your actual rewards are lower than the maximum 4%, in which case a traditional rewards card could offer steadier returns.

Another aspect to consider is the $300 cap on the 4% rewards on gas, EV charging, and transit purchases. This means you earn 4% rewards until you hit the cap. After that, a 1% rewards rate applies until the next month begins.

Conclusion

The Gemini Credit Card is a standout option for anyone looking to move away from traditional banking and earn crypto rewards on their purchases. In addition to rewards, the card offers Mastercard World Elite benefits, which are among the best for travel, as well as no annual fees for cardholders.

For crypto-savvy users, the Gemini Credit Card could be an excellent addition to their wallets, enabling them to increase their crypto holdings by making everyday purchases.

The post Earn Up to 4% Back in Crypto with the Gemini Crypto Credit Card for US Users appeared first on Cryptonews.