Bitcoin’s latest market bloodbath has left traders devastated, with over $12 billion in open interest wiped out in just days, one of the sharpest contractions in derivatives positioning in recent history.

On-chain data shows that the decline saw Bitcoin open interest plunge from $47 billion to $35 billion, marking a major reset in market leverage following weeks of overheated speculation.

The sell-off was triggered by a combination of macroeconomic factors and a cascade of forced liquidations, which was worsened by President Trump’s newly announced tariffs on Chinese imports.

The move rattled global risk sentiment and led to over $20 billion in leveraged positions being flushed out.

Yet beneath the short-term volatility, analysts say this event could mark a healthy recalibration rather than a structural breakdown.

Panic from Bitcoin Bloodbath and China Trade War Fades as BTC Price Recovers to $115K

Market indicators now point to broad deleveraging and normalization across the board.

The Estimated Leverage Ratio (ELR) has dropped to levels last seen in 2022, while the Stablecoin Supply Ratio (SSR) has fallen to its lowest point since April, suggesting ample liquidity on the sidelines ready to re-enter.

According to Shawn Young, chief analyst at MEXC Research, Bitcoin’s swift rebound to around $115,000 following the largest liquidation event in crypto history shows the market’s resilience.

“The Great Reset has exposed a more mature market structure, one where leveraged excesses are cleansed, and conviction capital steps back in,” Young told CryptoNews.

Despite the bloodbath, U.S. spot Bitcoin ETFs saw only minimal outflows of about $4 million, while weekly inflows surpassed $2.7 billion.

Bitcoin has now rebounded above $115,000, confirming the broader risk-on positioning across global assets.

Optimism surrounding potential Federal Reserve rate cuts and improving liquidity conditions has also revived bullish sentiment.

Major indices, such as the S&P 500 futures, have surged over 130 points from Friday’s lows, while gold has hit a new record high above $4,100, and oil prices have climbed back to $60.

With funding rates and open interest normalizing, the market now appears more balanced, though short-term charts still show downward momentum.

According to Young, Bitcoin must now reclaim $120,000 to invalidate bearish setups, with a break above $122,000 indicating that “the market has fully absorbed last week’s storm and is ready for new highs.”

On the downside, he warns that renewed trade tensions could push BTC under $100,000 for the first time since May 7th.

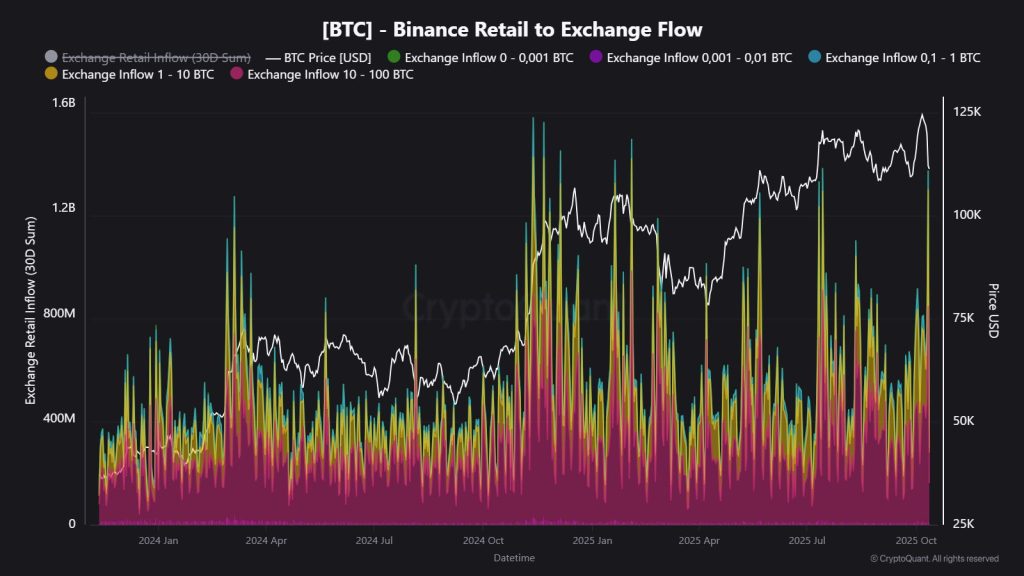

Retail Floods Binance with $1.36B, History Says Next Stop is $130K

From an on-chain perspective, analysts at CryptoQuant observed $1.359 billion in retail deposits to Binance on October 11, one of the largest single-day spikes in a year.

JA Martunn, an analyst at the firm, pointed out that these inflows often coincide with sharp price movements, indicating that retail traders remain reactive rather than proactive.

A similar surge on July 14, 2025, preceded a bullish August that saw Bitcoin climb above $124,000 for the first time.

Meanwhile, investors are responding positively to fresh statements from Washington.

Senior administration officials now describe the U.S.–China relationship as “good,” with the U.S. Treasury Secretary stating that the planned 100% tariffs on Chinese goods “don’t have to happen.”

This rhetoric shift has further fueled optimism that the sell-off was an overreaction.

With Q4 historically being Bitcoin’s strongest quarter, averaging over 70% gains since 2013, analysts say a sustained recovery could provide the momentum needed to test $126,000 and potentially push toward $130,000 in the coming weeks.

Technical Analysis: Bitcoin Needs to Clear $116k CME Gap For a Move Above $126k

Bitcoin’s ability to hold above its 21-week Exponential Moving Average (EMA) has been key in sustaining the bull trend.

The recent flush also allowed Bitcoin to fill the long-standing Weekly CME Gap between $109,700 and $111,310, an important technical target that had remained open since the mid-summer rally.

With that gap now closed, market attention has shifted to a new CME Gap between $115,690 and $116,865, which will likely serve as a short-term pivot zone.

Analysts suggest that reclaiming and holding the $120,000–$122,000 range would invalidate remaining bearish setups and pave the way for a retest of the $126,000 all-time high.

A breakout beyond that level could unlock a measured move toward $130,000

On the downside, Immediate support rests at the $110,000–$111,000 region, which now coincides with the filled CME gap and serves as a key psychological and structural floor.

Failure to defend this level could open the door to a $100,000 handle, particularly if geopolitical tensions or macroeconomic risk events re-emerge.

The post What Comes After the Bitcoin Bloodbath? Open Interest Drops $12B as Leverage Ratio Hits Multi-Year Lows – Next Stop $130K? appeared first on Cryptonews.