Bitcoin (BTC/USD) is holding near $114,770, up 0.66% on Tuesday, as institutional investors step back into the market. The world’s largest cryptocurrency is regaining ground after last week’s selloff, lifted by renewed corporate buying and easing geopolitical stress between the U.S. and China.

The headline move came from Strategy, the largest corporate Bitcoin holder globally, which quietly bought 220 BTC for $27 million just before prices dipped to $110,000. Despite volatility, the firm now holds 640,250 BTC, valued at around $73 billion.

This latest purchase, financed through preferred share sales, nudged Strategy’s average purchase price to roughly $74,000. Analysts see it as yet another show of faith. “Large holders like Strategy don’t flinch in market swings; they anchor Bitcoin’s long-term floor,” one market strategist told reporters.

Such steady institutional positioning continues to signal confidence, keeping the broader market structure intact and setting the tone for the next potential rally.

BlackRock’s $94B ETF Strengthens the Case

Adding to the momentum, Larry Fink, CEO of BlackRock, recently likened Bitcoin to gold in a CBS interview, marking a complete reversal from his earlier skepticism. “Crypto has a role, just like gold does,” he said.

BlackRock’s iShares Bitcoin Trust now manages roughly $94 billion, and half its investors are first-time clients. That mix of institutional and retail demand is deepening Bitcoin’s mainstream footprint, reinforcing its identity as “digital gold” amid inflation worries.

- Fink’s endorsement has fueled renewed investor trust.

- Retail interest is surging, widening the crypto market base.

- Bitcoin’s store-of-value narrative continues to mature.

Wall Street’s growing embrace of Bitcoin adds another layer of validation, suggesting that the asset’s next phase of adoption could come from traditional portfolios seeking stability and diversification.

Trump’s BTC Holdings Add Political Weight

In another surprising twist, President Donald Trump has become one of Bitcoin’s biggest individual holders. His company, Trump Media, purchased $2 billion in Bitcoin earlier this year, giving him an indirect stake of roughly $870 million through his 41% ownership.

The move mirrors Michael Saylor’s playbook at MicroStrategy, turning Trump Media into a Bitcoin-treasury-style company. Since the purchase, Bitcoin’s price has risen nearly 6%, reflecting growing optimism around the alignment between political influence and crypto adoption.

Market watchers now view this convergence, between Wall Street, corporate America, and political power, as the strongest signal yet of Bitcoin’s institutional legitimacy.

Bitcoin Technical Setup: Bulls Target $122K

Technically, Bitcoin trades in a tight consolidation channel between $112,700 and $117,600. A breakout above $116,100—the key 50% Fibonacci retracement—could trigger renewed bullish momentum toward $119,800–$122,500.

The RSI at 56 shows improving buying strength, while lower candle wicks highlight consistent dip accumulation. If resistance holds, BTC could retest $111,200, where strong support aligns with the 23.6% Fib retracement.

For short-term traders, a close above $116,000 sets up a possible continuation pattern, while institutions continue to treat every dip as a buying opportunity.

With sentiment improving, ETF inflows steady, and macro tensions easing, Bitcoin’s path toward $122K may only be getting started.

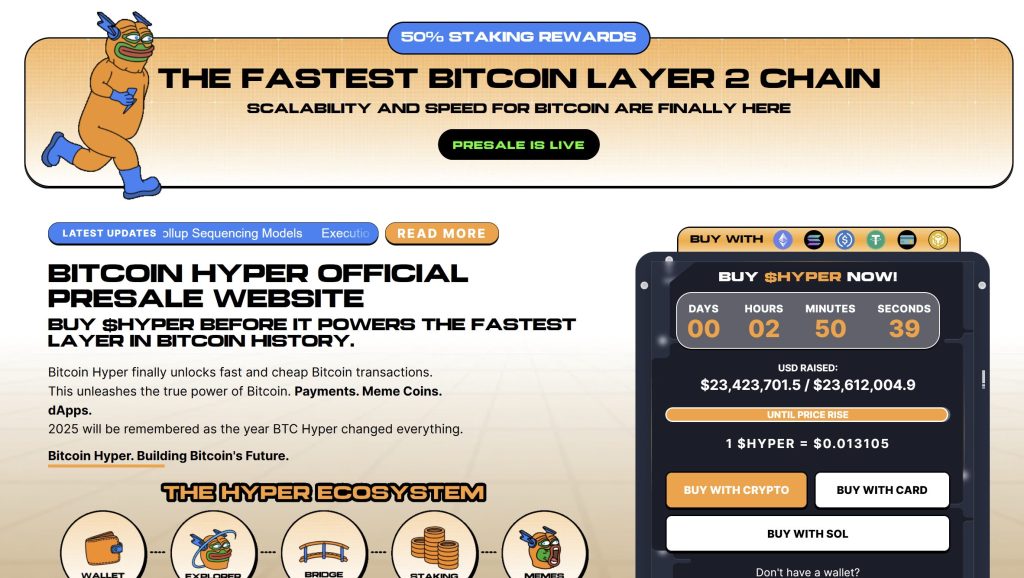

Bitcoin Hyper: The Next Evolution of Bitcoin on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed.

Built as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $23.4 million, with tokens priced at just $0.013105 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems.

If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Trump, BlackRock, and Strategy Fuel Renewed Optimism as Bulls Target $122K appeared first on Cryptonews.

Forbes says President Donald Trump “is now one of the largest

Forbes says President Donald Trump “is now one of the largest