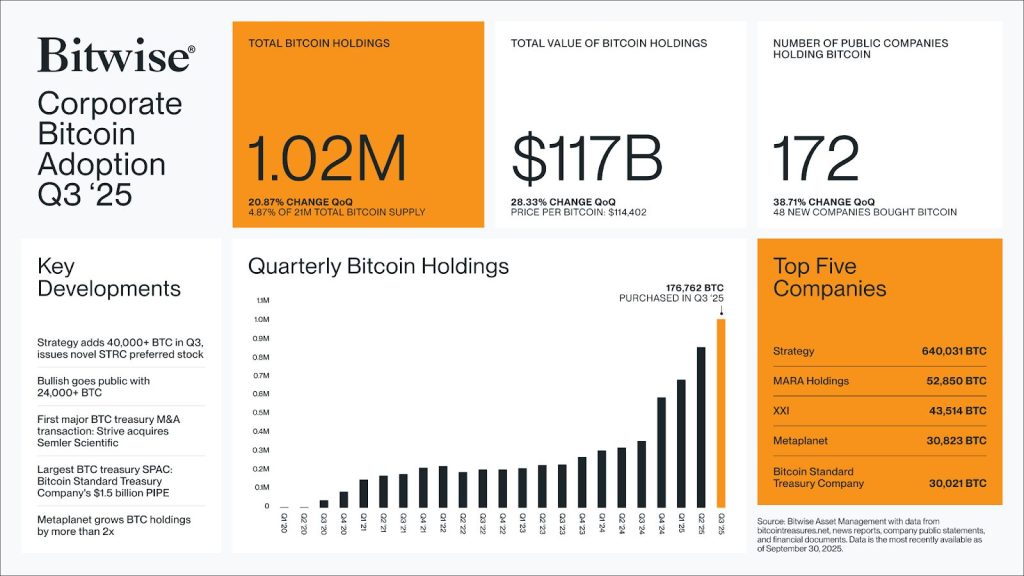

The number of public companies holding Bitcoin has surged 38% in just three months, marking one of the fastest waves of corporate adoption in the asset’s history.

According to Bitwise Asset Management’s Q3 Corporate Bitcoin Adoption report, 172 publicly traded firms now hold Bitcoin, with 48 new entrants joining between July and September.

Bitwise CEO Hunter Horsley described the data as “absolutely remarkable,” noting in a post on X that both individuals and corporations “want to own Bitcoin.”

The report, which draws from BitcoinTreasuries.NET, found that corporate Bitcoin holdings now exceed 1.02 million BTC, representing roughly 4.87% of the total supply.

The combined value of these holdings has climbed to $117 billion, a 28% increase from the previous quarter, driven by both price appreciation and aggressive accumulation.

The Next Chapter of Corporate Bitcoin: Smaller Firms, Bigger Conviction

Bitwise’s data revealed that public companies purchased an additional 176,762 BTC in the third quarter alone, equivalent to about 17% of all corporate holdings.

The report suggests that the adoption wave is broadening beyond early adopters, with more firms adding smaller allocations rather than a few large players dominating purchases.

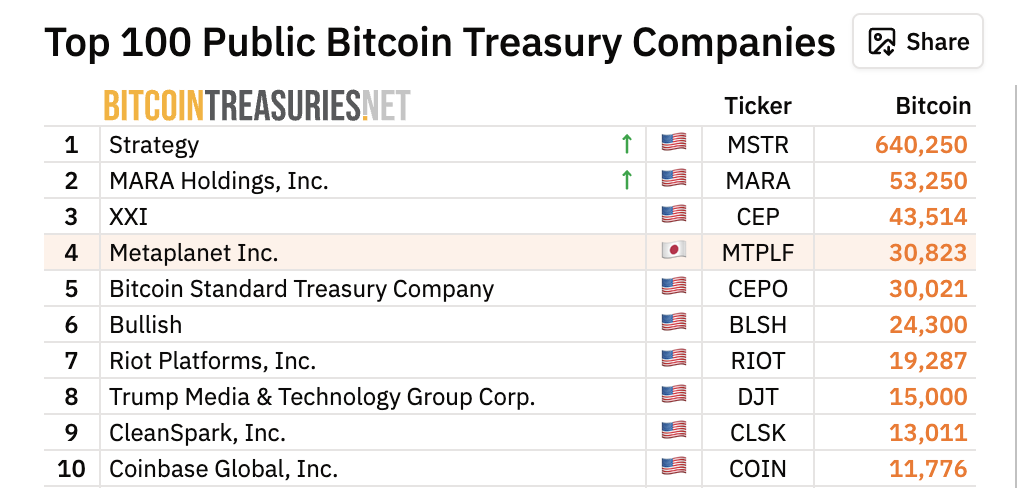

The concentration, however, remains significant. Strategy, formerly MicroStrategy, holds 640,250 BTC, more than 62% of all corporate-held Bitcoin, according to BitcoinTreasuries.

Other major holders include MARA Holdings with 52,850 BTC, XXI with 43,514 BTC, Metaplanet with 30,823 BTC, and Bitcoin Standard Treasury Company with 30,021 BTC.

Bitwise’s report notes that corporate adoption is shifting from early pioneers to a broader base of firms making smaller allocations.

Many of these companies are integrating Bitcoin through capital raises, public listings, and even mergers and acquisitions.

Bullish, for example, went public this year with more than 24,000 BTC on its balance sheet, while Strive completed one of the first-ever acquisitions of a Bitcoin treasury firm, Semler Scientific.

This growing structural demand, according to Bitwise, is removing coins from circulation and reducing sell-side liquidity, amplifying Bitcoin’s price sensitivity during demand spikes.

Mete Al, founder of ICB Labs, told CryptoNews that this quiet accumulation reflects deepening conviction rather than speculation. “Many of these firms aren’t chasing short-term price swings — they’re positioning for a structural shift in how value is stored and transferred globally,” he said.

According to him, Bitcoin on corporate balance sheets is becoming more than an investment — it’s a gateway into the broader digital-asset economy. “It’s less about quarterly gains and more about readiness for a new monetary paradigm,” he added.

Corporate Bitcoin Boom Shows Cracks as One in Four Firms Trade Below Asset Value

However, cracks are beginning to appear beneath the surface of this growing corporate enthusiasm.

Despite record holdings, one in four public Bitcoin treasury firms now trades below the value of their crypto assets, a condition known as trading under net asset value (NAV).

Data from K33 Research shows that 26 of the 168 tracked Bitcoin-holding firms have an mNAV below 1.0, meaning their market capitalizations are worth less than the Bitcoin on their balance sheets.

Metaplanet Inc. is among the most visible examples of this reversal. The Tokyo-listed company, which holds 30,823 BTC worth around $3.4 billion, now trades at an mNAV of 0.99, below its asset value. Its shares have fallen roughly 70% since June highs.

Analysts say the pullback reflects a cooling of the earlier “Bitcoin stockpiling euphoria.” Other companies, including NAKA, Twenty One, Semler Scientific, and The Smarter Web Company, have also dropped below their NAVs.

While smaller firms struggle to maintain premiums, the largest players like Strategy continue to anchor the space.

Strategy’s mNAV has declined from 3.89x in late 2024 to about 1.26x, limiting its ability to issue new shares for further Bitcoin purchases.

Its acquisition pace has slowed, but the firm still holds over $24 billion in unrealized gains at a cost basis of $74,000 per coin.

Overall, corporate accumulation of Bitcoin has slowed by 95% since July, according to CryptoQuant data.

Only one company adopted Bitcoin in September, compared to 21 in July. Rising interest rates, tighter capital conditions, and shrinking valuation premiums have forced many firms to scale back or seek alternative financing.

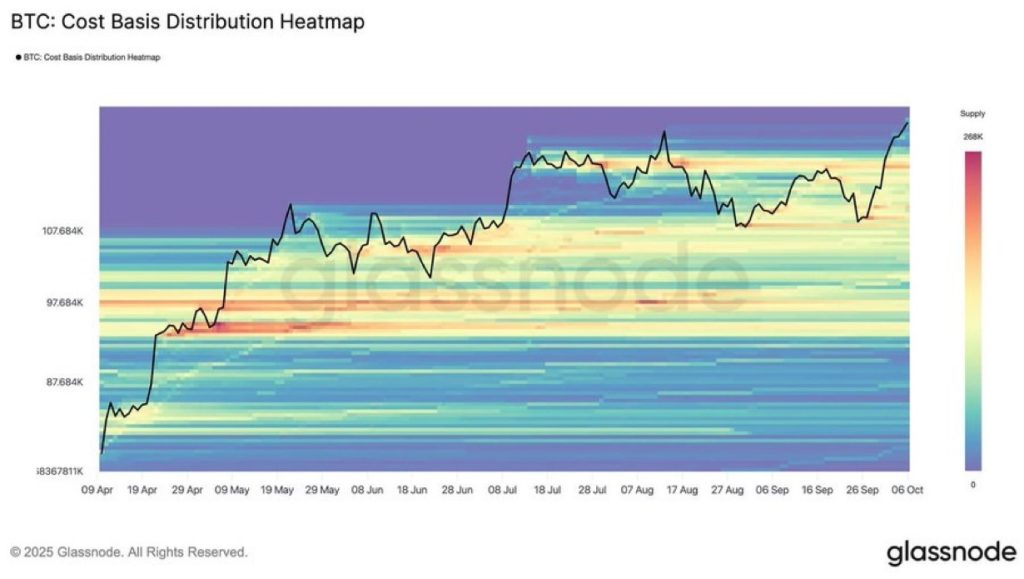

Despite the slowdown, analysts believe corporate Bitcoin holdings now represent a structural component of the market. Nearly 97% of Bitcoin’s circulating supply is in profit, according to Glassnode, which also reported strong institutional inflows.

Over $2.2 billion entered U.S. spot Bitcoin ETFs in a single week in October, one of the strongest waves of buying since April.

The analytics firm said the latest rally to above $120,000 was driven by ETF demand and consistent accumulation from smaller holders, rather than pure speculation.

The post Big Companies Are Quietly Loading Up on Bitcoin — 48 New Treasuries in 3 Months: What Do They Know? appeared first on Cryptonews.

A quarter of all public companies holding Bitcoin now trade at market values below the worth of their BTC holdings.

A quarter of all public companies holding Bitcoin now trade at market values below the worth of their BTC holdings. Metaplanet’s mNAV hits 0.99, trading below $3.4B Bitcoin reserves as one in four treasury firms are trading at discount, with corporate buying down 95% since July.

Metaplanet’s mNAV hits 0.99, trading below $3.4B Bitcoin reserves as one in four treasury firms are trading at discount, with corporate buying down 95% since July.