The October trend Bitcoin could soon reignite as traders bet on a Federal Reserve rate cut, with CME data showing a 96.7% chance of easing later this month. Historically, October has been one of BTC’s strongest months, averaging 20% gains since 2019.

With institutions now holding over $117 billion in BTC, optimism is building for a potential late-month breakout above $110,000.

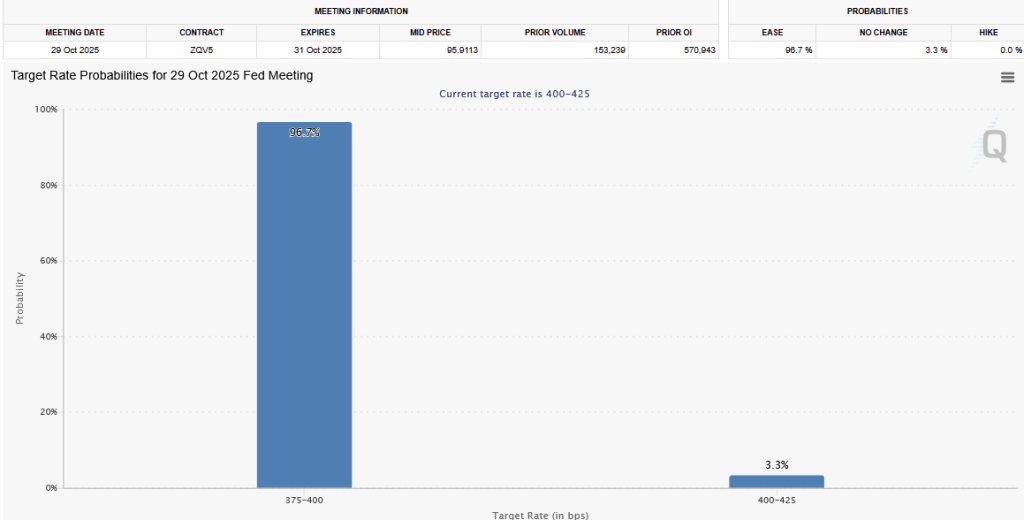

Fed Rate Cut Bets Rise to 96.7% Ahead of October Meeting

Bitcoin’s historical October strength may be gearing up for another test as traders brace for a potential Federal Reserve rate cut later this month.

According to the latest CME FedWatch data, markets are pricing in a 96.7% probability of a 25-basis-point reduction in the federal funds rate, from 4.00–4.25% to the 3.75–4.00% range. Only 3.3% of traders expect no change.

A cut would mark the Fed’s first easing move in over a year, signaling that policymakers may be shifting toward stimulating growth amid softening economic indicators. Lower borrowing costs often lead to greater liquidity and a stronger risk-on appetite, favoring assets like BTC.

Since 2019, October has historically delivered a 20% average gain and 15% median return for BTC, setting the stage for what could be a late-month rebound.

Corporate Bitcoin Holdings Surge Past $117B

Institutional sentiment is also turning more constructive. According to Bitwise’s Q3 2025 Corporate Bitcoin Adoption Report, total BTC held by public companies reached 1.02 million BTC, valued at $117 billion, a 28% quarterly increase.

Nearly 48 new firms added Bitcoin to their balance sheets in Q3, bringing the total number of corporate holders to 172, up 38.7% from the previous quarter.

Leading the charge, Strategy now holds 640,031 BTC, followed by MARA Holdings (52,850 BTC), XXI (43,514 BTC), Metaplanet (30,823 BTC), and Bitcoin Standard Treasury Company (30,021 BTC). The largest single purchase came from Strategy, which added 40,000 BTC in Q3 alone.

This wave of accumulation underscores that corporations are increasingly treating Bitcoin as a strategic reserve asset, not just a speculative play. The ongoing Fed pivot narrative, combined with expanding institutional adoption, could amplify Bitcoin’s recovery momentum into November.

If policy easing materializes as expected, Bitcoin may find its footing above $110,000, with a potential breakout toward $120,000 in Q4 as liquidity returns and corporate demand accelerates.

Bitcoin Builds Momentum Above Key $109K Support

Bitcoin (BTC/USD) is steady near $111,300, rebounding from the $109,600 triple-bottom zone, a key support that’s repeatedly attracted buyers since early October. The structure suggests a potential reversal, with higher lows forming a short-term base for recovery.

On the 1-hour chart, BTC remains capped by a descending trendline from $122,000, with resistance near $112,700–$113,000, where the 20-EMA is attempting to cross above the 50-EMA. A confirmed breakout could drive price toward $114,600, $116,100, and possibly $117,600, aligning with key Fibonacci levels.

The RSI near 48 signals early bullish divergence, hinting that downside pressure may be fading.

Candlestick patterns, particularly recent Doji formations, show market hesitation before potential reversal. A sustained move above $112,700 would confirm bullish momentum, while a break below $109,600 may expose $107,300 as the next support.

If this reversal holds, Bitcoin could re-enter a broader bullish channel, paving the way for a push toward $117,600 and renewed confidence ahead of the next market uptrend.

Bitcoin Hyper: The Next Evolution of Bitcoin on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed.

Built as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $23.7 million, with tokens priced at just $0.013115 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems.

If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: October Is Still Bullish – Fed Rate Cut Could Trigger a Surprise BTC Comeback appeared first on Cryptonews.