The proposed merger between Naver and the Upbit crypto exchange operator Dunamu could create a “mega company” with profits totaling $2.1 billion a year, experts claim.

Per reports from the South Korean media outlets Newsis and Wow TV, the Naver-Dunamu merger is “expected to generate KRW 3 trillion in consolidated operating profits.”

However, experts say that “regulatory uncertainties” remain, with others this month speaking about five major legal obstacles standing in the companies’ way.

Naver-Dunamu Crypto Merger: Positivity Surrounding Deal, Says Expert

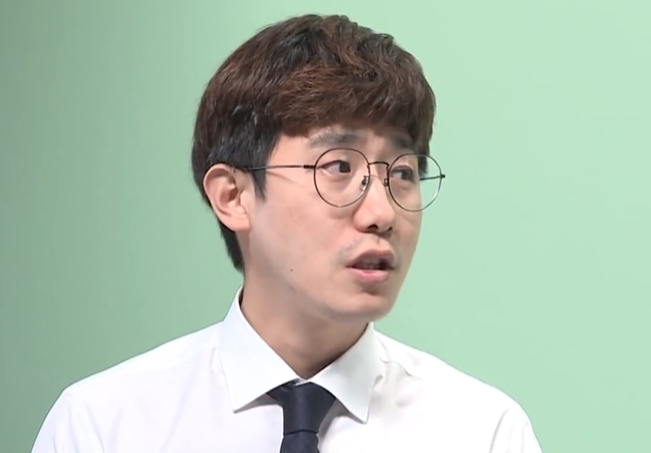

The outlets interviewed Jang Ho-yoon, a researcher at the securities provider Korea Investment & Securities.

The researcher explained that Naver “has always been relatively undervalued” on the South Korean market, despite its rival Kakao “receiving a high valuation through business expansion.” He explained:

“The acquisition of Dunamu will allow Naver to fully enter the crypto industry. Stablecoins, in particular, could generate significant synergy with Naver’s existing advertising, commerce, and fintech businesses.”

Naver is the country’s biggest internet company. Its subsidiary Naver Financial already operates several banking and e-pay platforms.

The firm hopes to merge Naver Financial with Dunamu, the owner of South Korea’s biggest crypto trading platform. The move would create Asia’s biggest fintech company. Jung explained:

“The industry expects the new firm to create a stablecoin ecosystem centered on Dunamu’s exchange business and its GIWA protocol [Upbit’s Layer-2 Ethereum-based chain]. Combing this with Naver’s existing services will let it secure an advantageous position over competitors in both the crypto and general payment spheres.”

Trading Boom Incoming?

The researcher also predicted a coming boom in crypto trading activity. He said that as the United States enters “a rate-cut cycle,” crypto trading volumes are likely to increase. Jung explained:

“As advanced blockchain-powered businesses, such as stablecoins and tokenized securities, become popular in Korea, diverse business opportunities will open up for Naver.”

Jung opined that the merger would “open up various possibilities for Naver,” which has seen its valuation decline due to “a lack of new growth engines.”

And while some continue to claim that regulatory approval for the merger is still up in the air, the researcher said there was a “relatively positive atmosphere” around the deal.

While regulations still prevent banks from engaging in crypto-related business, some say that these rules do not apply to e-pay providers like Naver.

Jung said that there is uncertainty over the question of whether fintech companies such as Naver Financial should be considered traditional financial companies. He said:

“The levels of uncertainty surrounding the merger are not very high.”

The researcher concluded that the proposed merger meant Naver would be “the most notable internet large-cap stock to watch next year.”

Naver Financial last month announced a plan to effectively take over Dunamu in a proposed comprehensive stock swap deal.

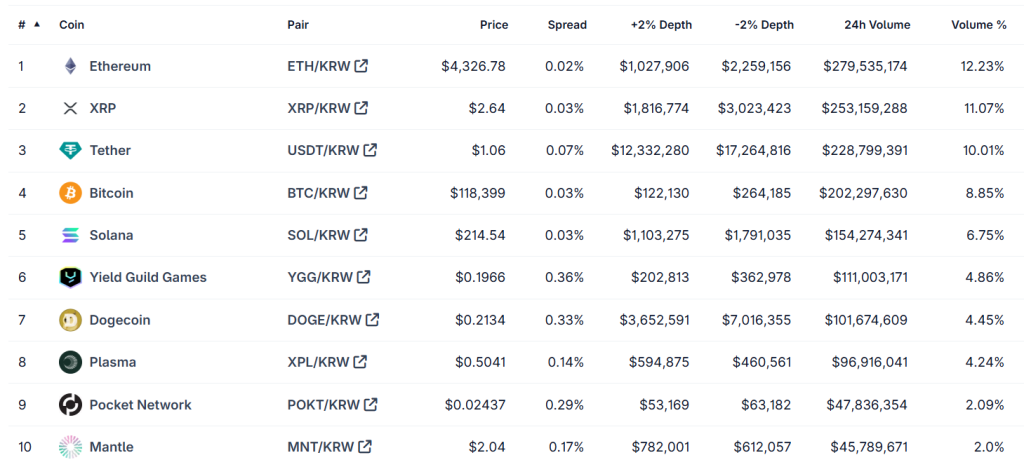

Upbit has cornered over 70% of the South Korean market share, per recent estimations. The merger talk has stoked speculation that Naver Financial-Dunamu could look to go public on the NASDAQ exchange.

The post Naver-Dunamu Crypto ‘Mega-Company’ Could Be Worth $2.1B a Year – Experts appeared first on Cryptonews.