The crypto market is down today, with the cryptocurrency market capitalization decreasing by 4.9%, falling to $3.67 trillion. Of the top 100 coins, 97 have dropped over the past 24 hours. At the same time, the total crypto trading volume is at $234 billion.

Crypto Winners & Losers

At the time of writing, all top 10 coins per market capitalization have seen their prices decrease over the past 24 hours.

Bitcoin (BTC) decreased by 4.5% since this time yesterday, currently trading at $105,732.

Ethereum (ETH) is down by 6%, now changing hands at $3,764.

The highest drop in the category is 10% by Binance Coin (BNB), now trading at $1,064.

It’s followed by Dogecoin (DOGE)’s 9.3% to the price of $0.179.

The smallest drop is 4.3% by Tron (TRX), now standing at $0.3079.

Looking at the top 100 coins, 97 are down. Among these, more than 30 recorded double-digit falls.

ChainOpera AI (COAI) fell the most: 22.8% to $17.71.

It’s followed by Zcash (ZEC), which decreased by 19.9% to $193.

The green coins are PAX Gold (PAXG), Tether Gold (XAUT), and Figure Heloc (FIGR_HELOC). These are down 2.8%, 2.3%, and 1.9%, respectively.

The recent major downturn was caused by a wave of massive liquidations exceeding $19 billion, boosted by the US–China trade tension and related threats coming from the US. Following this drop, the market is having a hard time re-establishing a basis for another leg up.

We Could See a ‘Much Deeper Correction’

Analysts at Glassnode found that BTC stands between key support levels. However, they wrote, a break below $99,900 could lead to “a much deeper correction.”

Meanwhile, Dom Harz, Co-Founder of BOB, commented that despite the liquidations and price fluctuations we’ve seen this week, Bitcoin DeFi’s TVL has remained relatively steady.

“This highlights that there is a strong conviction in Bitcoin as a utility asset, not just a store of value. It’s important not to let these short-term movements distract from Bitcoin’s, and indeed Bitcoin DeFi’s, true trajectory,” he argues.

Moreover, “with growing mainstream and institutional adoption, Bitcoin’s maturation is clear. We are likely to see Bitcoin move more in tandem with other financial markets as it moves closer to becoming a core component of the global financial system.”

Consequently, this momentum will also drive technological developments in Bitcoin DeFi. The institutions holding BTC “will want to unlock Bitcoin’s utility and put their assets to work by securely deploying BTC natively into DeFi protocols.”

Levels & Events to Watch Next

At the time of writing on Friday morning, BTC trades at $105,732. The coin recorded a sharp drop from the intraday high of $111,758 to the low of $105,149.

Overall, BTC has declined 13.3% in a week and 10.5% in a month.

The price is still trending lower at the moment and is about to step into the $104,900 zone. After that, it may proceed to $103,500 and below $100,000.

Ethereum is currently changing hands at $3,764. It started the day at $4,068 but then plunged to $3,744.

ETH is down 13.7% in a week and 17.8% in a month. It’s now 24.1% from its all-time high.

Like BTC, ETH is still declining at the time of writing. It is moving towards $3,500 and possibly lower. If the tides turn, we may see it climb back above $4,000.

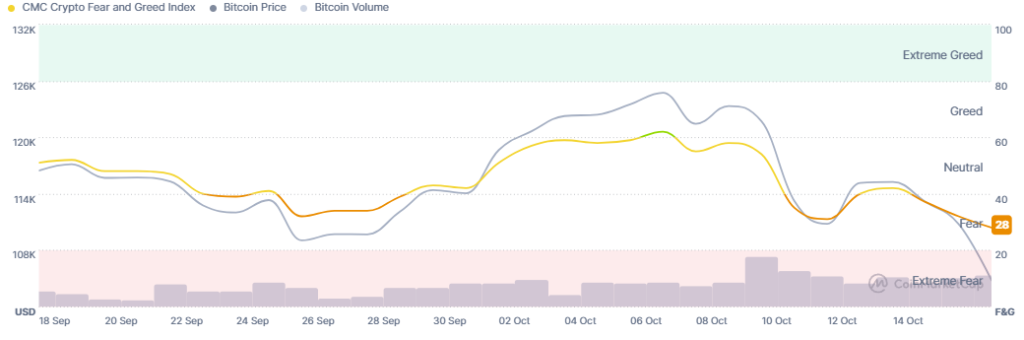

Meanwhile, the crypto market sentiment has plunged even lower within the fear zone, reaching another lowest point since April this year. The crypto fear and greed index fell from 32 yesterday to 28 today. For comparison, it stood at 62 (the greed zone) just seven days ago. It is now approaching ‘extreme fear’.

This indicates a growing fear and heightened apprehension among traders and investors, which can lead to panic selling and amplified volatility. On the other hand, for long-term investors, it opens a door to add to their holdings at lower prices.

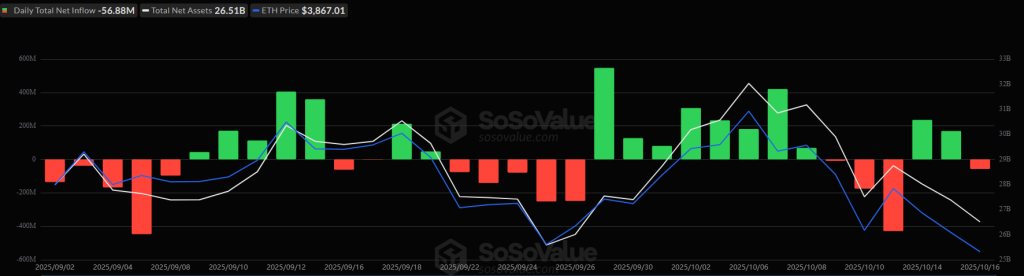

ETFs Go Back Into Red

The US BTC spot exchange-traded funds (ETFs) saw notable negative flows on Thursday, with $536.44 million leaving the funds.

Of the 12 ETFs, eight recorded outflows. There were no inflows. At the top of this list is Ark&21Shares with $275.25 million, followed by Fidelity with $132 million.

Furthermore, the US ETH ETFs recorded $56.99 million in outflows on 16 October, breaking a very break inflow streak.

One of the nine finds saw positive flows, and five saw negative flows. BlackRock took in $46.9 million, while Grayscale saw $69.03 million leave.

Meanwhile, the US lawmakers in Florida have introduced a bill that would authorize this state to invest specific public funds in BTC.

More precisely, the House Bill 183 authorizes Florida’s chief financial officer to allocate 10% of the General Revenue Fund and the Budget Stabilization Fund into Bitcoin and ETFs.

Quick FAQ

- Why did crypto move with stocks today?

The crypto market has decreased over the past day, and the stock market saw a drop during work hours on Thursday. By the closing time on 16 October, the S&P 500 was down by 0.63%, the Nasdaq-100 decreased by 0.36%, and the Dow Jones Industrial Average fell by 0.65%. This comes as bond yields fell to their lowest level since April, gold set its latest ATH, and regional bank shares came under pressure.

- Is this drop sustainable?

The decrease will likely continue, at least for today. The prices are still trending downwards, and geopolitical and economic pressures are strong. A shift upwards is, nonetheless, possible in the near term.

The post Why Is Crypto Down Today? – October 17, 2025 appeared first on Cryptonews.

Bitcoin has declined to ~$111K, dropping 11.8% since its $125.8K all-time high 9 days ago. With Trump’s temporary tariff threats acting as a catalyst, gold has thrived, while equities chop. It can be argued

Bitcoin has declined to ~$111K, dropping 11.8% since its $125.8K all-time high 9 days ago. With Trump’s temporary tariff threats acting as a catalyst, gold has thrived, while equities chop. It can be argued  NEW: Florida files first Strategic Bitcoin Reserve bill of the 2026 legislative session.

NEW: Florida files first Strategic Bitcoin Reserve bill of the 2026 legislative session.