Fundstrat Capital CIO Tom Lee has predicted that Ethereum could rally toward $5,000 if the ETH/BTC pair breaks above the 0.087 resistance level.

According to Lee, a clean breakout above 0.087 would mark a structural shift for Ethereum, similar in scale to the macroeconomic transitions that reshaped Wall Street in the 20th century.

Lee, who serves as chairman of Bitmine Immersion Technologies, revealed that the company has positioned itself as a leading corporate holder of Ethereum.

Bitmine now holds 3.24 million ETH, representing roughly 2.7% of the total supply, with a long-term goal of reaching 5% ownership, what Lee calls the “alchemy of 5%.”

Tom Lee Says Ethereum Would Become Bigger Than Any Bank

At Token2049 Singapore earlier this year, Lee delivered a keynote titled “Wall Street’s Biggest Macro Shift Since the Gold Standard,” arguing that Ethereum is becoming the financial infrastructure for Wall Street’s migration on-chain.

“If half the world’s financial activity goes on-chain, the chain that settles it becomes bigger than any bank or exchange. Today, that chain is Ethereum,” he said.

Lee compared this to the 1971 end of the gold standard, when the U.S. dollar established a financial empire through global adoption despite losing its gold backing.

Similarly, he believes Ethereum will power the next era of global finance through settlement dominance.

Despite recent market volatility, one of crypto’s largest deleveraging events in years, Lee maintains a bullish outlook, calling the current dislocation an attractive accumulation zone for institutional investors.

“Given the expected supercycle for Ethereum, this price dislocation represents an attractive risk/reward,” Lee emphasized.

Currently, the ETH/BTC ratio stands at 0.03654, over 120% away from the 0.087 resistance.

A breakout from this descending trendline would push Ethereum into price discovery above $5,000.

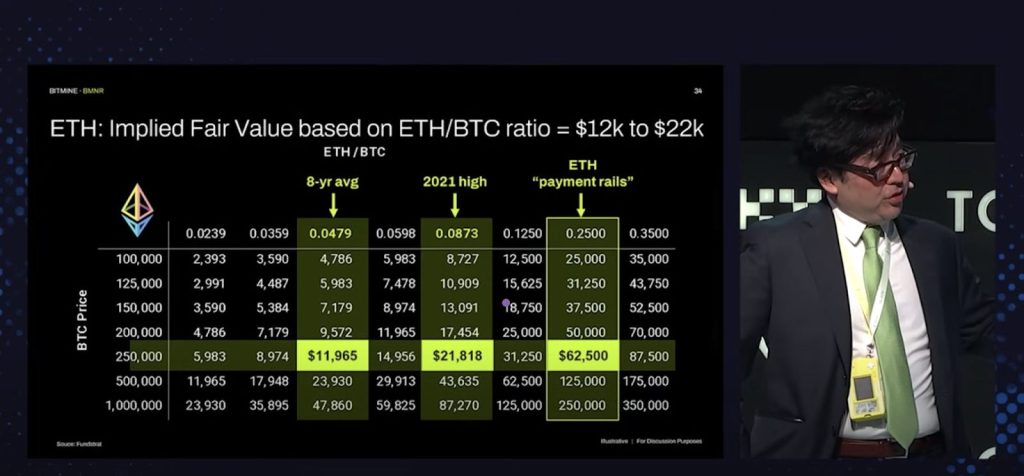

Lee’s valuation model, based on historical ETH/BTC ratios, suggests Ethereum’s fair-value corridor sits between $12,000 and $22,000.

At Bitcoin $250,000, Ethereum’s implied value ranges from $11,965 (at the 8-year average ratio of 0.0479) to $21,818 (at the 2021 high of 0.0873).

Even with Bitcoin at $150,000, ETH would theoretically trade between $7,179 and $13,091, suggesting strong relative upside.

Bollinger and Youssef See $5,000 ETH Rally Coming This Week

Similarly, John Bollinger, legendary analyst and creator of the popular Bollinger Bands indicator, says the ETHUSD chart is forming a “W” double-bottom in volatility terms that could push Ethereum to $5,000 before the end of this week.

Ray Youssef, CEO of NoOnes, also shared with CryptoNews his view on Ethereum’s current market setup as it enters a key inflection point between structural strength and near-term uncertainty.

Youssef notes that “while Ethereum remains fundamentally strong, the market is showing signs of short-term fragility.”

Ethereum’s validator exit queue has now surpassed 2.3 million ETH worth over $9 billion, with unstaking wait time exceeding 40 days.

Ether ETFs have also seen inconsistent inflows recently, recording outflows of over $310 million last week.

However, Youssef views Ether’s current $3,700-$4,000 range as a “cooldown phase” after a strong Q3 performance, where the market is digesting liquidity and removing excess speculative bets.

According to him, the maturing DeFi environment hints that Ethereum is resetting and preparing for its next big price discovery movement.

“A move towards $4,500 in the next weeks, which could quickly propel ETH to $5,000, seems to be brewing if market conditions improve and macro headwinds don’t weigh on risk sentiment,” Youssef said.

A retest of $3,500 support remains possible given geopolitical and macro uncertainty, though Youssef expects strong dip-buying demand at that level.

The post Tom Lee Predicts $5,000 ETH If ETH/BTC Pair Breaks 0.087 Resistance appeared first on Cryptonews.

Record $10B in Ethereum Awaits Exit as Validators Queue to Cash Out – ETH Price Crash Coming?

Record $10B in Ethereum Awaits Exit as Validators Queue to Cash Out – ETH Price Crash Coming?