Coinbase has acquired Echo, an on-chain capital-raising platform founded by crypto veteran Cobie, in a $375 million deal that could reshape how projects raise funds and potentially reignite interest in public token sales, a format once synonymous with the initial coin offering (ICO) boom of 2017.

In a statement published on its blog, Coinbase described Echo as a leading platform that makes community-based fundraising more accessible and transparent.

The acquisition, led by Coinbase executives Shan Aggarwal and Aklil Ibssa, seeks to simplify how projects raise funds directly from their supporters while opening early investment opportunities to retail users.

Coinbase said Echo’s tools would help “create more accessible, efficient, and transparent capital markets” by connecting projects directly with their communities.

The move comes as public token sales, once thought to be obsolete, are quietly making a comeback through new, regulated platforms designed to avoid the pitfalls of the past.

Coinbase Expands Full-Stack Crypto Infrastructure With Echo Buyout

In the announcement, Coinbase said integrating Echo’s tools will allow companies to raise capital entirely on-chain, joining projects with investors in a seamless ecosystem.

The company plans to expand support beyond crypto tokens to tokenized securities and real-world assets, leveraging Echo’s existing infrastructure.

Since its launch in 2024, Echo has helped projects raise over $200 million across more than 300 deals. Its Sonar product has already powered several high-profile token sales, including Plasma’s XPL token, which drew strong market attention.

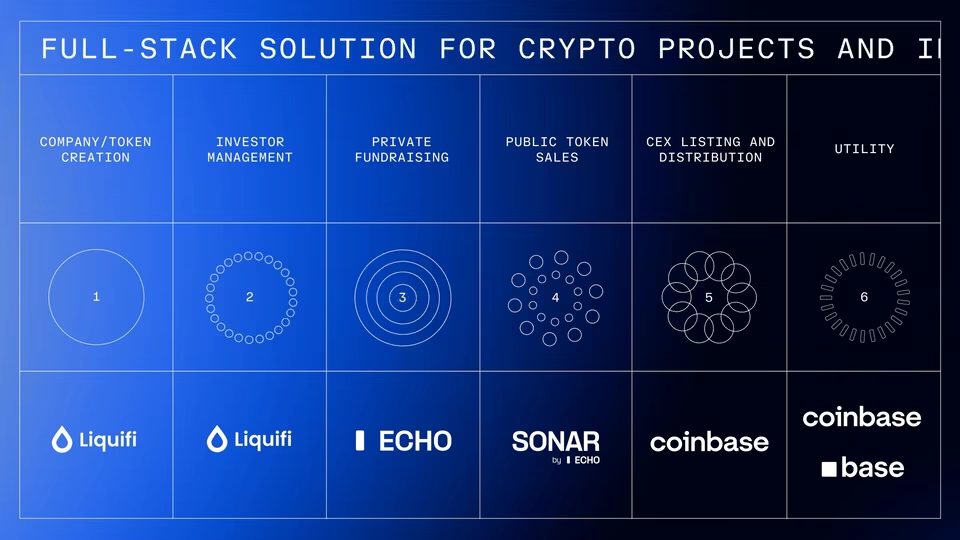

Coinbase executives said the acquisition extends the company’s reach across the entire lifecycle of crypto ventures, from token creation and cap table management, supported by its earlier acquisition of Liquifi, to fundraising and secondary market trading.

“We’re building a full-stack solution for crypto projects and investors,” the blog post stated.

Cobie, Echo’s founder, confirmed the acquisition on X, saying he “certainly didn’t think Echo would be sold to Coinbase, but here we are.”

He added that Echo would “remain a standalone platform under its current brand for now,” while Sonar would be integrated into Coinbase’s ecosystem to create new pathways for founders and investors.

When Echo launched in beta in April 2024, Cobie described it as a 95% long shot but a “noble failure worth attempting.”

Instead, the platform became one of the most talked-about new ventures in on-chain fundraising, driven by its mission to let communities invest together in early-stage crypto projects.

The acquisition adds to a string of Coinbase expansions this October, reflecting the exchange’s broader effort to become a full-stack crypto infrastructure provider.

Within the last two weeks, the company has launched decentralized exchange (DEX) trading in its mobile app, reintroduced staking services in New York, and filed for a U.S. National Trust Charter.

It also unveiled new payment tools under its Coinbase Business suite and made a new investment in India’s CoinDCX exchange, strengthening its global reach.

Coinbase CEO Brian Armstrong has also reconnected with Cobie on a cultural level. Earlier this week, Coinbase purchased the UpOnly NFT from Cobie for $25 million, reviving the popular “UpOnly” podcast that paused during the FTX collapse.

Is This How ICOs Make a Comeback—Transparent, Regulated, and On-chain?

The relevance of Coinbase’s acquisition extends beyond corporate expansion. It indicates a growing trend of regulated, community-driven token sales, a shift that could define the next phase of crypto fundraising.

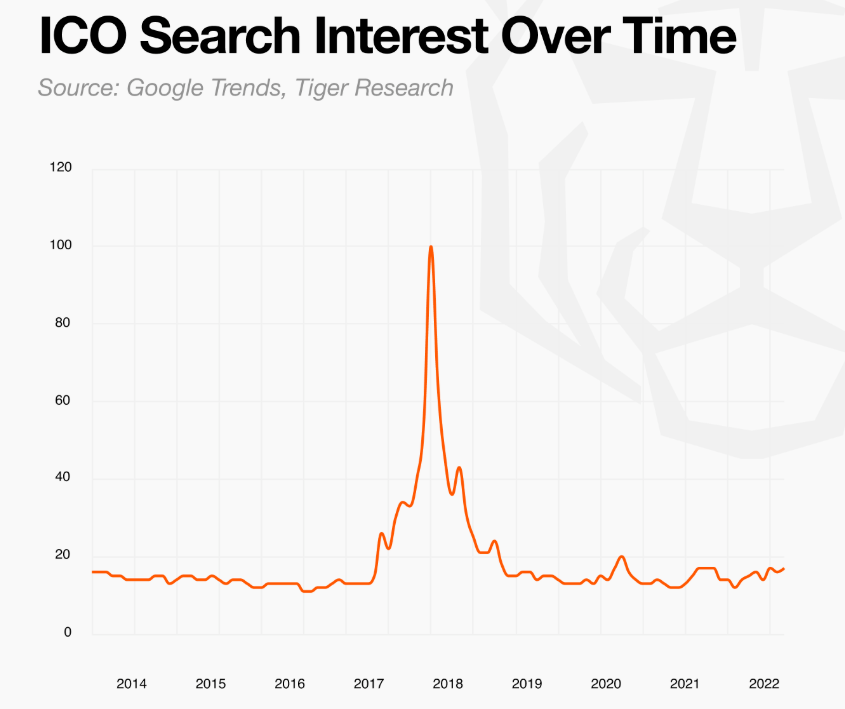

The move also arrives as market analysts report a renewed appetite for public sales, once the hallmark of ICOs.

According to Tiger Research, platforms such as Sonar, Buidlpad, Legion, and Kaito are leading a new wave of compliant launchpads that combine accessibility with investor protection through KYC and transparency measures.

Back then, ICOs allowed thousands of blockchain projects to raise billions of dollars directly from investors by selling tokens before launching. Ethereum, EOS, Chainlink, Filecoin, and Tezos were among the projects that began through ICOs.

However, the boom ended in controversy as scams, poor oversight, and a lack of regulatory clarity triggered legal crackdowns.

The U.S. Securities and Exchange Commission (SEC) later classified many ICOs as unregistered securities offerings, forcing several projects to return investor funds or pay fines.

What makes this new wave different is its structure. Modern token sales are self-hosted, transparent, and often governed by compliance frameworks such as Europe’s MiCA law, which provides clear guidelines for token issuance.

These guardrails make the environment far safer than during the ICO frenzy, where investors often faced opaque terms and rug pulls.

Echo’s Sonar product fits neatly into this evolution. It allows founders to host their own public token sales directly on blockchains like Base, Solana, Cardano, and Hyperliquid.

For Coinbase, integrating Sonar could transform its exchange from a trading hub into a global fundraising gateway, giving verified users access to early-stage investment opportunities previously reserved for venture capital firms.

The post Coinbase Acquires Echo for $375M – And It Could Spark the Return of ICOs appeared first on Cryptonews.

Coinbase purchased UpOnly NFT from well-known crypto trader Cobie for $25 million, resurrecting the podcast show “UpOnly” after three years halt.

Coinbase purchased UpOnly NFT from well-known crypto trader Cobie for $25 million, resurrecting the podcast show “UpOnly” after three years halt.