The crypto industry has found religion. After years of “number go up” culture, projects are falling over themselves to prove they deliver “real utility.” Every pitch deck now opens with earnest talk of daily active users, transaction volumes, and genuine adoption. The speculation era, we’re told, is over.

But here’s the inconvenient truth: the industry hasn’t abandoned its old playbook. It has simply developed more sophisticated ways to fake the numbers.

The Great Metric Migration

Walk into any Web3 funding conversation today and you’ll hear founders rattling off impressive statistics. “We’re doing 4 million daily transactions.” “Our DAU just hit 1.2 million.” The language has shifted from speculative promises to data-driven proof points. It sounds like maturity. It looks like legitimacy.

The problem? Most of these numbers are as hollow as the market cap metrics they were meant to replace.

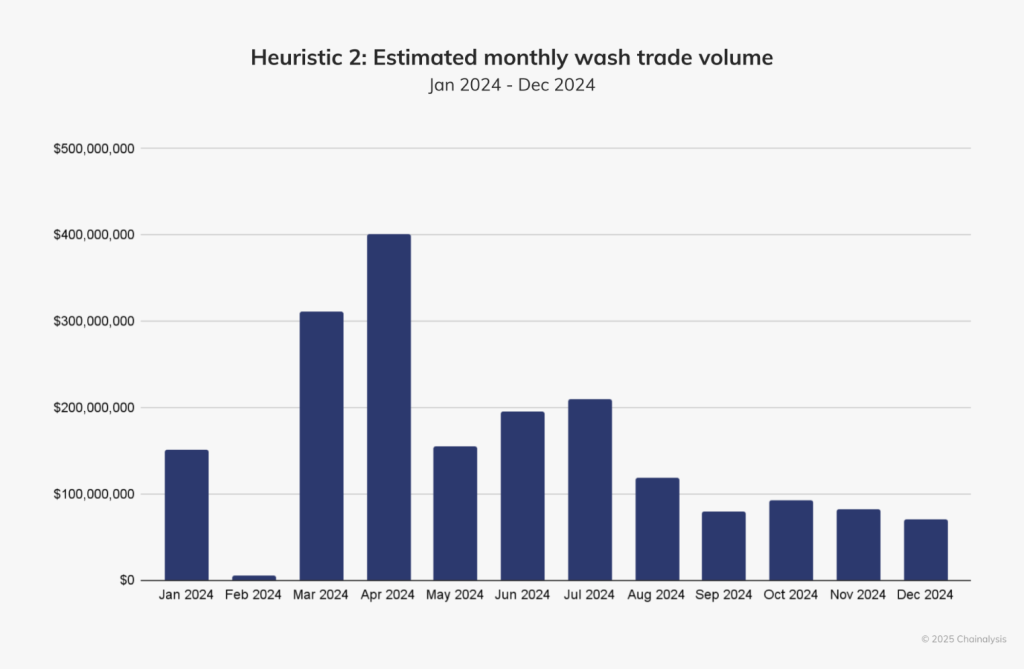

Recent data from Chainalysis reveals the scale of this deception. In 2024 alone, researchers identified approximately $2.57 billion in suspected wash trading activity across major decentralised exchanges. One address initiated over 54,000 buy-and-sell transactions of nearly identical amounts – not to generate profit, but to manufacture the appearance of activity.

Furthermore, researchers found that on average, a single master wallet controlled about 183 other wallets, and in some cases operators managed tens of thousands. These networks of interconnected wallets can make one actor appear like an entire community of users. When a handful of individuals can generate the illusion of widespread adoption, it raises an uncomfortable question: what does “adoption” really mean?

Airdrop Economics and the Mirage of Engagement

The airdrop farming phenomenon has turbocharged this problem. Projects tout massive user numbers without acknowledging that most of their “community” consists of mercenaries hunting free tokens across dozens of protocols simultaneously.

Consider the math: according to industry data, over 52.7% of all cryptocurrencies ever listed on major tracking platforms have already failed, with the bulk of these collapses occurring in 2024 and early 2025. In fact, more than 1.8 million tokens vanished in the first quarter of 2025 alone, underscoring how many projects disappear shortly after launch once initial hype and airdrops subside.

This isn’t adoption. It’s a digital ghost town, animated by bots.

Projects celebrate millions of transactions without asking the uncomfortable question: how many of these interactions would happen if we removed the token incentive? The answer, in most cases, is close to zero. Yet these vanity metrics get packaged into pitch decks and used to justify nine-figure valuations.

The Red Flags No One Wants to See

The warning signs of utility theater are consistent:

- Suspicious transaction patterns. When 90% of your volume comes from accounts that interact with your protocol for exactly the minimum required to qualify for rewards, you don’t have users – you have a gamified points system.

- Bot-driven metrics. Services openly sell fake trading volume, with bots generating tens of thousands of dollars in artificial activity within 24 hours. In one documented case, purchased bots created $39,723 in fake volume for a token, accounting for 43% of its total Uniswap trading activity over several days.

- Token-gated everything. If your “utility” requires users to hold, stake, or spend your token for basic functionality, you’re not solving a problem — you’re creating artificial demand.

- Metrics that vanish post-airdrop. The Chainalysis study found that suspected pump-and-dump schemes typically abandon tokens within six days on average, with 94% of these schemes executed by the same addresses that deployed the liquidity pools.

What Real Utility Actually Looks Like

Genuine utility in crypto doesn’t require an elaborate token mechanism to function. It solves a concrete problem that users will pay to address, token or not. The value proposition stands independent of speculative appreciation.

Real utility generates revenue from actual service delivery, not from selling tokens to the next buyer. It attracts users who stick around after the incentives dry up. It creates measurable value that can be verified without relying on easily-manipulated on-chain metrics.

The infrastructure layer hasn’t solved this problem, it’s become part of it. Tools built to measure “real-world value” often just create new opportunities to game the system. When the measurement itself becomes tokenised and incentivised, we’ve just added another layer to the shell game.

The Reckoning No One’s Prepared For

Let’s be honest: the industry’s rush to rebrand as “utility-driven” has less to do with building useful products and more to do with attracting a new wave of investors, who’ve grown tired of empty promises.

After multiple boom-and-bust cycles and intensified regulatory scrutiny, founders realized they needed better stories. So they borrowed the language of traditional tech, like Daily Active Users (DAU), retention, engagement and applied it to an ecosystem still fundamentally built on speculation.

The tragedy is that this pivot could have represented real progress. Blockchain technology does enable genuinely novel applications. But by dressing up the same speculative dynamics in the clothes of utility metrics, the industry has squandered an opportunity to build something legitimate.

When the music stops, and it always stops — projects will be judged not by their transaction counts or their DAU numbers, but by a simple question: Would anyone use this if the token went to zero?

For the vast majority of today’s “utility-driven” projects, the answer is no. And everyone building in this space knows it.

The emperor’s new clothes are made of smart contracts this time. But he’s still somewhat naked.

Disclaimer: The opinions in this article are the writer’s own and do not necessarily represent the views of Cryptonews.com. This article is meant to provide a broad perspective on its topic and should not be taken as professional advice.

The post The Utility Mirage: How Crypto’s New Metrics Are Just Old Tricks in Disguise appeared first on Cryptonews.