TL;DR

- Enthusiast Gaming Holdings has undergone a restructuring after divesting its direct sales line business for CAD$900,000.

- The overhaul has helped lift the EGLX share price in recent months, although it’s still down 44.44% since the start of 2025.

- Chief executive Alex Macdonald believes the divestment removes a “major drag” on results and gives a clearer view of the company’s core business.

- EGLX stock is traded on the Toronto Stock Exchange. The company was listed on the Nasdaq but chose to voluntarily delist two years ago.

- The company plans to focus on operating and expanding its portfolio, which includes Icy-Veins, Addicting Games and the global B2B event series, PocketGamer Connects.

Enthusiast Gaming Holdings hopes its major restructuring will help it deliver profitability – and give its investors a much-needed boost.

The Canadian digital publisher recently divested its direct sales business, including the Luminosity esports organisation, in a $900,000 deal.

The move has already had a positive impact on the EGLX stock price, which has risen 50% over the past six months after sinking earlier in 2025.

But what happens next? Will this be the start of a prolonged turnaround for the shares, or are there other factors influencing its attractiveness?

In our Enthusiast Gaming Holdings stock forecast 2025-2030, we examine how the company’s changed, analyse its recent performance, and predict what could come next.

Enthusiast Gaming Holdings stock forecast 2025–2026: One-year EGLX stock projection

It’s important to recognise that EGLX, which is only listed on the Toronto Stock Exchange, having voluntarily delisted from the Nasdaq, is a relatively small stock.

As the market closed on October 21, 2025, the EGLX stock price was CAD$0.075, valuing the business at CAD$11.94 million.

The main problem with investing in businesses of this size is that relatively few – if any – stock market analysts follow them closely. This means there’s relatively little independent opinion available from professional investors, making forming an opinion challenging.

According to the algorithmic forecasts of Wallet Investor, the EGLX share price could drop to zero over the coming year.

It stated: “According to our live Forecast System, Enthusiast Gaming Holdings Inc stock is a bad long-term (1-year) investment.”

| One-year Enthusiast Gaming Holdings stock forecast (as of October 21, 2025) | |

|---|---|

| WalletInvestor | CAD$0.000 |

Enthusiast Gaming Holdings stock predictions

How about the longer-term Enthusiast Gaming Holdings stock prediction? What are the EGLX stock predictions of analysts and algorithmic forecasters for the next five years?

As we’ve already discussed, there’s relatively little in the way of analyst predictions, so that makes an accurate EGLX share price forecast virtually impossible.

According to Wallet Investor’s algorithmic forecasts, investors in EGLX stock could be in for a fairly miserable next five years. However, time will tell whether this proves to be accurate.

Enthusiast Gaming Holdings stock forecast 2027–2030: Longer-term prospects

| Long-term EGLX stock forecasts (as of October 21, 2025) | ||

|---|---|---|

| Year | October 2027 | October 2030 |

| WalletInvestor | CAD$0.000 | CAD$0.000 |

EGLX stock YTD, one-year & five-year performance analysis

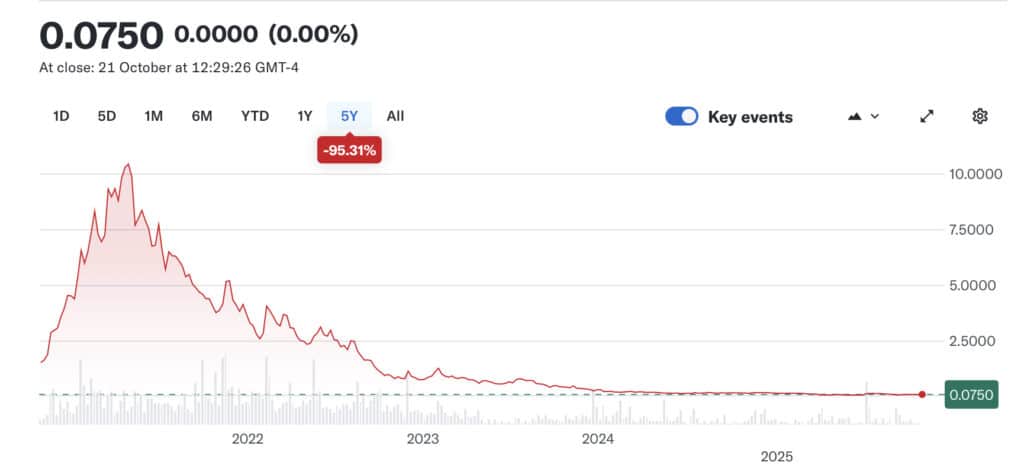

Enthusiast Gaming Holdings stock year-to-date: -44.44%

As the stock market closed on October 21, 2025, the EGLX share price was trading almost 45% lower than at the start of the year.

However, this doesn’t accurately illustrate the fall in the wake of the first quarter’s results and the uptick due to the summer’s business restructuring.

Enthusiast Gaming Holdings stock one-year performance: -46.43%

Declining revenues in certain parts of the business have been a drain on performance and affected the stock price over the past year.

Enthusiast Gaming Holdings stock five-year performance: -95.31%

EGLX investors have had a pretty miserable five years, according to the company’s woeful share price performance.

The Enthusiast Gaming Holdings stock price has lost 95% of its value over this period due to factors such as declining revenues.

Latest earnings results

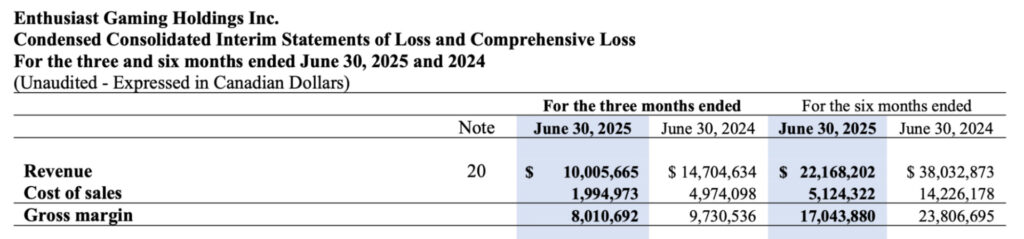

The company achieved revenue of CAD$10 million in the second quarter of 2025, according to its latest results, lower than the CAD$14.7 million recorded for the same period in 2024.

It attributed the “majority of the decline” to a decrease in both direct sales and the Omnia video platform. Gross profit, meanwhile, fell CAD$1.7 million to CAD$8 million due to less revenue.

Operating expenses fell by CAD$1 million to CAD$10.6 million, and the adjusted EBITDA loss rose CAD$1 million to CAD$1.4 million.

Business restructuring

As far as Enthusiast Gaming Holdings news is concerned, it’s been a hectic few months with senior management changes, debt financing, and the sale of certain divisions.

New chief executive

It was announced in July that Alex Macdonald, a founding executive of the business and its chief financial officer, would be taking over as chief executive.

The company noted that he’d played a key role in taking Enthusiast public as well as directly overseeing flagship properties such as The Sims Resource and U.GG.

The statement also revealed it had entered into an agreement to sell the direct sales business, including Omnia Media and Luminosity Gaming.

Separately, Enthusiast announced in late July that a debt financing transaction had been completed, resulting in it receiving a non-revolving loan of $2 million.

Sale completed

Enthusiast announced the completion of its direct sales business divestment to Vertiqal Studios for CAD$900,000 in early September 2025.

It said the transaction was expected to result in approximately CAD$10 million of annual cost savings, as well as $4.5 million of balance sheet improvement and working capital benefits.

Alex Macdonald said: “This transaction is a significant step forward and marks the beginning of a new era for Enthusiast Gaming.”

In a statement, US-based Vertiqal said its digital communities were scaling across every major social and streaming platform.

“Omnia’s YouTube network and Luminosity’s premier Twitch presence, combined with our scale across TikTok, Instagram, and Snapchat, position us to deliver fully integrated campaigns for brand partners and expand our premium programmatic guaranteed offerings,” it added.

What is the outlook?

A key conclusion of our EGLX stock analysis is that much will depend on how the refocused business model performs over the coming months.

Of course, that’s more difficult at this stage because the divestment was only finalised in September 2025, and everything is still settling down.

So, what does this mean for the remaining Enthusiast Gaming Holdings business, and how will the divestment affect its financial state?

Well, the new-look company will focus on operating and expanding its portfolio of digital assets as well as its global B2B event series, PocketGamer Connects.

Its gaming properties include U.GG, Icy-Veins, Addicting Games, Fantasy Football Scout, LiveFPL, GameKnot, ProBuildStats and The Countdown.

Commenting as Enthusiast published second-quarter results in mid-August 2025, Alex Macdonald said the company’s products made playing games more meaningful.

The remaining properties in the portfolio, he pointed out, were “profitable, valuable, trusted by audiences, and positioned for continued growth”.

“Direct sales and creative production, including Omnia, Luminosity, and related assets, have been important parts of our history, but they are not part of our future,” he said.

He explained how exiting these areas will allow the company to direct its “energy, talent and reinvestment” toward building and improving owned and operated platforms.

“In Q2, these non-core segments were the primary source of losses and the driver of year-over-year declines,” he added. “Their departure will remove a major drag on our results and give a clearer view of the strength, value, and profitability of our core business.”

What is Enthusiast Gaming Holdings?

Enthusiast Gaming Holdings is a Canada-based digital publisher that owns a portfolio of websites used by competitive gamers.

Its brands include U.GG, a data-driven platform providing real-time stats, and Icy Veins, which offers strategies for games such as World of Warcraft.

There’s also The Sims Resource, which enables players to download custom content such as clothing, and Fantasy Football Scout, which helps inspire better decision-making.

Reasons for delisting

Enthusiast Gaming Holdings voluntarily delisted from the Nasdaq Stock Market in late 2023 as it felt the dual listing (on the TSX as well) was a greater administrative burden.

In a statement, the costs of higher annual insurance, listing, reporting, legal and compliance were more than CAD$2 million.

“We intend to redeploy these expenditures to invest in growth areas of the business, which management believes will be more beneficial to creating shareholder value,” it added.

Conclusion: Should I buy EGLX stock?

The final decision is down to you. Whether or not it’s an attractive stock will depend on your opinion of its prospects and your attitude to risk.

A lot has happened to the company over the last six months, and it will be interesting to see how it develops without the direct sales business.

Realistically, we won’t get a clear picture of how the post-divestment version of Enthusiast Gaming is performing until the fourth quarter results are published in early 2026.

The question will be: should you buy into the stock now, hoping to ride a positive wave, or sit tight and see how it looks to be shaping up?

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

Is EGLX stock a good buy?

You will need to answer this question based on the opinions of stock market analysts and your own opinions. Remember that even professional investors can make mistakes. Your Enthusiast Gaming Holdings share price forecast should consider recent newsflow, comments from the company and views of the wider market.

What is the price prediction for Enthusiast Gaming Holdings in 2025?

According to Walletinvestor’s algorithmic forecast, the EGLX share price could fall to zero over the next 12 months. However, this prediction is not guaranteed.

Is EGLX stock overvalued?

You’ll need to decide. The stock has fallen by almost 45% in 2025, although it has recovered some ground since the divestment. The Enthusiast Gaming Holdings stock forecast of WalletInvestor suggests it could fall even further.

What is Enthusiast Gaming Holdings?

It’s a Canada-based digital publisher that owns a portfolio of websites used by competitive gamers, including The Sims Resource and Fantasy Football Scout.

REFERENCES

- Enthusiast Gaming Holdings Inc. (EGLX.TO) (yahoo!finance)

- MongoDB Exception (#13053) (Wallet Investor)

- Enthusiast Gaming Reports Q2 2025 Financial Results (Enthusiast Gaming)

- Enthusiast Gaming Announces CEO Transition and Strategic Divestment of Direct Sales Business (Enthusiast Gaming)

- Enthusiast Gaming Announces Closing of Debt Financing (Enthusiast Gaming)

- Enthusiast Gaming Completes Direct Sales Business Divestment (Enthusiast Gaming)

- Vertiqal Studios Finalizes Acquisition of Omnia Media and Luminosity from Enthusiast Gaming (News File Corp)

- Nasdaq Voluntary Delisting and Deregistration FAQs (Enthusiast Gaming)

The post Enthusiast Gaming Holdings stock forecast 2025-2030: Will the EGLX share price rise over the coming years? appeared first on Esports Insider.