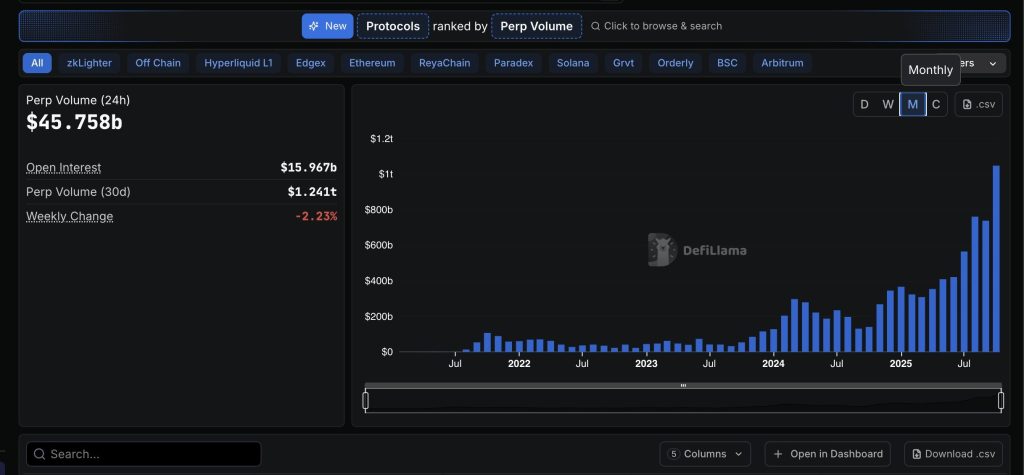

Decentralized perpetual trading has hit a new milestone, surpassing $1 trillion in monthly volume for the first time ever, with a week still left in October.

Key Takeaways:

- Decentralized perpetual trading volume surpassed $1 trillion in October, setting a new monthly record.

- Hyperliquid led the surge with over $317 billion in trades, contributing to a $78 billion single-day volume peak.

- The gap between DEXs and CEXs is narrowing as decentralized platforms improve speed, liquidity, and accessibility.

The surge reflects growing appetite for leveraged crypto trading and a shift toward on-chain derivatives platforms.

According to DeFiLlama, October’s trading activity has already blown past August’s $762 billion record, marking an explosive 30% month-on-month increase.

Hyperliquid Leads DEX Surge as Daily Perp Volume Hits $78 Billion

Leading the charge is Hyperliquid, which has processed $317.6 billion in trades so far, followed by Lighter ($255.4 billion), Aster ($177.6 billion), and edgeX ($134.7 billion).

Collectively, decentralized exchanges (DEXs) recorded an unprecedented $78 billion in trading volume on Oct. 10 alone.

At the current pace, decentralized perpetual platforms are on track to close the month at around $1.3 trillion, nearly doubling the previous all-time high.

The growing demand for perpetual swaps, derivatives that allow traders to bet on price movements without owning the underlying asset, is being fueled by their flexibility: 24/7 trading, high leverage, and no expiration dates.

Despite the surge, DEXs still trail far behind centralized exchanges (CEXs) such as Binance and Bybit, which saw $69.3 billion and $26 billion in daily volume, respectively, according to CoinGecko.

However, analysts note that the gap is narrowing as decentralized platforms improve user interfaces, execution speed, and liquidity access.

Industry figures credit Hyperliquid with bringing decentralized perps into the mainstream. “It was the first to really get it right and scale successfully,” Infinex founder Kain Warwick said earlier this month.

The platform’s momentum was further boosted after MetaMask integrated Hyperliquid on Oct. 8, allowing users to trade perpetual swaps directly from their wallets.

The record-breaking month underscores how decentralized finance continues to mature, with perps trading emerging as one of its fastest-growing frontiers.

Hyperliquid Strategies to Raise $1B to Become Largest HYPE Token Holder

As reported, Hyperliquid Strategies has filed with the US Securities and Exchange Commission (SEC) to raise up to $1 billion, with plans to use the proceeds to expand its crypto holdings and acquire additional HYPE tokens.

The move marks a major step in the firm’s push to strengthen its presence in the decentralized derivatives market.

Chardan Capital Markets is advising on the offering, which includes up to 160 million shares of common stock.

The company will emerge from the merger between Sonnet BioTherapeutics and Rorschach I LLC, a SPAC deal that will form the new Hyperliquid Strategies entity.

Upon completion, David Schamis will serve as CEO and Bob Diamond, former Barclays chief, will take the role of chairman.

News of the filing drove HYPE token prices up 8% to $37.73, even as the wider crypto market declined slightly.

Once the merger closes, Hyperliquid Strategies is expected to hold 12.6 million HYPE tokens worth about $470 million, alongside $305 million in cash set aside for further acquisitions, making it the largest corporate holder of HYPE.

The post Hyperliquid Leads DEX Surge as Perp Trading Volume Tops $1 Trillion in Record-Breaking October appeared first on Cryptonews.