A Beijing court has sentenced five individuals to prison terms ranging from two to four years for operating an illegal foreign exchange operation that moved over $166 million through crypto channels

As regulators described, this marks one of China’s most significant prosecutions of crypto-enabled financial crime, as authorities intensify their crackdown on digital asset activity.

The case, unveiled at the 2025 Financial Street Forum Annual Meeting on October 28, particularly shows Beijing’s growing sophistication in tracking and prosecuting cross-border crypto transactions amid broader warnings from Chinese officials about stablecoins threatening global financial stability.

Between January and August 2023, the group orchestrated a complex operation converting client funds into USDT stablecoins to facilitate illegal cross-border transfers, processing 1.182 billion yuan ($166 million) through multiple accounts.

The Beijing Municipal People’s Procuratorate detailed how the scheme used virtual currency as a “bridge” for disguised foreign exchange trading, with individual members handling amounts ranging from 149 million to 469 million yuan.

Advanced Forensics Crack Crypto Money Trail

Lin Jia led the operation under instructions from unnamed parties, collaborating with Lin Yi, Xia, Bao, and Chen to funnel client funds through multiple bank accounts registered in their names.

The group converted incoming yuan payments into USDT through various Tether trading platform accounts under their control, then completed cross-border transfers through platform transactions while profiting from each exchange.

The prosecution deployed specialized technical methods to overcome the inherent challenges of crypto investigation, combining financial data analysis with blockchain transaction tracing.

Investigators compared temporal correlations between traditional bank accounts and virtual currency trading accounts, identifying suspicious patterns in fund flows that contradicted defendants’ claims of legitimate “crypto speculation.”

The procuratorate remotely examined data from overseas platforms to verify evidence-collection procedures, ensuring legal compliance while building their case.

This “full coverage” approach solved what prosecutors called the “evidence collection dilemma” in cross-border economic crimes involving both capital and personnel across multiple jurisdictions.

The Haidian District People’s Court delivered its first-instance judgment on March 21, 2025, with all five defendants accepting their sentences without appeal.

The case provided authorities with what they described as “key judicial practice references” for handling similar crypto-related financial crimes in an increasingly digital world.

Beijing Escalates Stablecoin Warnings

Pan Gongsheng, governor of the People’s Bank of China, issued stark warnings at the same Financial Street forum, calling stablecoins a threat to global financial stability and monetary sovereignty.

“Stablecoins, as a form of financial activity, still cannot meet the basic requirements of financial supervision,” Pan stated, citing failures in customer identification and anti-money laundering compliance.

The central bank chief emphasized that stablecoins “have amplified weaknesses in the global financial system” and expose vulnerabilities for terrorist financing and money laundering.

Pan confirmed that the PBoC would maintain its zero-tolerance policy toward private digital currencies while closely monitoring developments in the overseas stablecoin market.

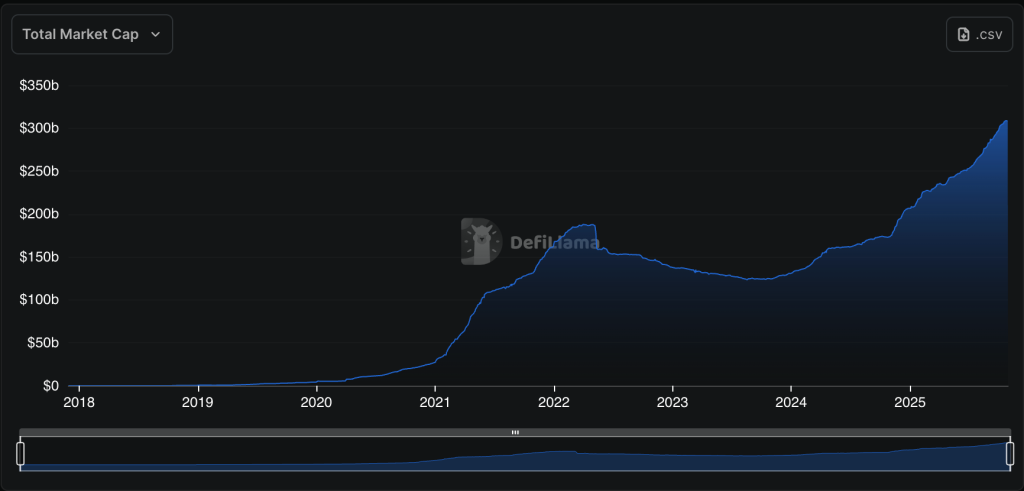

These warnings come as stablecoin markets reached around $310 billion in capitalization, with Tether and USD Coin accounting for about 84% of the combined supply (59% and 25%, respectively) and processing over $46 trillion in settlements annually.

Tech Giants Forced to Abandon Hong Kong Stablecoin Plans

Ant Group and JD.com halted their stablecoin issuance plans in Hong Kong following direct instructions from the PBoC and Cyberspace Administration of China in mid-October.

Officials told both companies that the right to issue currency must remain exclusively with the state, not private enterprises.

The intervention reversed earlier momentum, as Ant had announced in June plans to pursue stablecoin licenses in Hong Kong, Singapore, and Luxembourg.

Despite the setback, Ant filed trademarks in Hong Kong for virtual assets and blockchain technology, including “ANTCOIN,” while its Whale blockchain platform processed one-third of global payment transactions valued at over $1 trillion last year.

In August, Chinese regulators ordered brokerages and research institutions to stop publishing reports or hosting seminars promoting stablecoins, citing fraud and speculative risks.

Meanwhile, the Chinese government appears to be the limiting factor to adoption.

Last month, Hong Kong’s stablecoin licensing regime attracted 77 expressions of interest from banks, technology firms, and Web3 startups, with the Hong Kong Monetary Authority conducting preliminary meetings while cautioning that only limited licenses would be approved initially.

The post China Jails Five for $166M Crypto Money Laundering Scheme appeared first on Cryptonews.

China’s central bank has called stablecoins a “threat”. At the

China’s central bank has called stablecoins a “threat”. At the  Ant Group files crypto trademarks in Hong Kong as Beijing blocks its stablecoin plans over concerns about private firms issuing currency-like tokens.

Ant Group files crypto trademarks in Hong Kong as Beijing blocks its stablecoin plans over concerns about private firms issuing currency-like tokens.