Germany’s debate over Bitcoin is intensifying as lawmakers question whether the country’s strict alignment with European Union (EU) regulations could stifle innovation and financial independence.

The latest motion from the Alternative for Germany (AfD) party urges the government to exempt Bitcoin from heavy regulation and taxation under the EU’s Markets in Crypto-Assets (MiCA) framework, a move that could redefine Berlin’s approach to digital money.

The AfD’s proposal, titled “Recognizing the strategic potential of Bitcoin — preserving freedom through restraint in taxation and regulation,” argues that Bitcoin is a fundamentally distinct asset class, describing it as “decentralized, non-manipulable, and limited.”

The motion insists that Bitcoin should not fall under MiCA’s regulatory scope, warning that excessive oversight could drive capital and companies abroad, weaken Germany’s competitiveness, and threaten its digital sovereignty.

Is Germany Ready to Treat Bitcoin Like Money, Not a Speculative Asset?

According to the motion, Bitcoin’s technological and monetary characteristics set it apart from other cryptocurrencies, making it more comparable to a digital form of gold than to speculative tokens.

The deputies called on the federal government to maintain a 12-month tax-free holding period for Bitcoin and to classify private mining and lightning node operations as non-commercial activities.

They also requested a strategic statement recognizing Bitcoin as “free, digital money in the 21st century,” taking into account its implications for energy policy, digital freedom, and monetary sovereignty.

Germany has been one of Europe’s most crypto-friendly jurisdictions, combining national rules with the new EU-wide MiCA framework.

The country’s financial regulator, the Federal Financial Supervisory Authority (BaFin), oversees all crypto-asset service providers (CASPs) and enforces anti-money laundering (AML) and know-your-customer (KYC) standards.

Since MiCA took effect in December 2024, BaFin has been responsible for licensing crypto custodians, trading platforms, and exchanges under the EU’s harmonized system.

A transition period remains in place until December 30, 2025, giving existing providers time to obtain full authorization.

So far, BaFin has issued nine MiCA licenses, more than any other European regulator, including approvals for Boerse Stuttgart Digital Custody and fintech firm Trade Republic.

The regulator’s leadership has positioned Germany as a key hub for regulated digital asset activity within the European Economic Area.

Germany’s Bitcoin Debate Mirrors France’s Proposal to Reject Digital Euro

AfD’s push comes just as France’s National Assembly recently passed a resolution opposing the European Central Bank’s digital euro while supporting Bitcoin and euro-based stablecoins as alternatives.

French lawmakers warned that a centrally managed digital currency could endanger privacy and financial freedom, calling instead for a national strategy to accumulate Bitcoin reserves.

While Germany proposes to pivot from the European Union’s oversight, the German National Bank, Bundesbank President Joachim Nagel, has defended the digital euro as essential to preserving Europe’s financial sovereignty, warning that without it, the continent could become dependent on foreign-controlled payment systems.

Meanwhile, figures such as Bundestag member Joana Cotar argue that Bitcoin represents “financial sovereignty for individuals,” offering protection against inflation and government overreach.

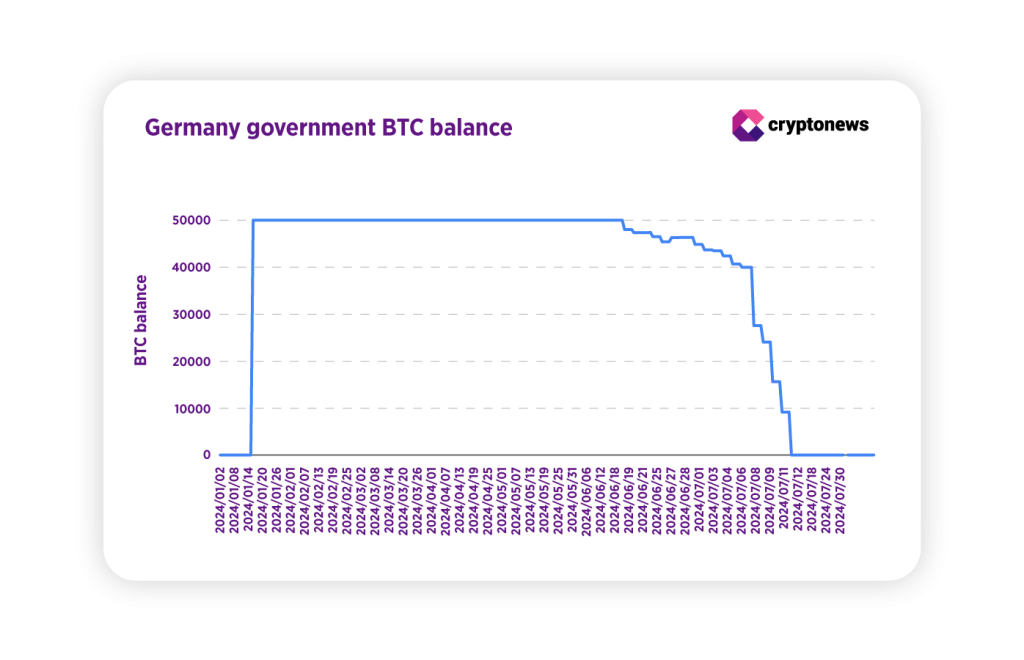

Germany’s mixed record with Bitcoin also fuels the debate. In mid-2024, the government sold nearly 50,000 BTC seized from criminal cases for around $2.9 billion, following legal requirements to liquidate volatile assets.

By August 2025, the price of Bitcoin had more than doubled, meaning the holdings would now be worth over $6 billion, a missed gain of more than $3 billion. Cotar has since urged the government to treat Bitcoin as a strategic reserve asset rather than sell it.

Despite this, Germany’s crypto economy remains strong. Chainalysis data shows the country recorded $219 billion in crypto transaction volume between July 2024 and June 2025, placing it among Europe’s largest markets.

Crypto adoption has expanded rapidly, with an estimated 27 million users projected by the end of 2025, half of whom are Gen Z or millennials. Institutional participation is also rising, with Deutsche Bank preparing to launch a digital asset custody service in 2026.

The post Germany Pushes for Bitcoin — Could Berlin Be the Next to Adopt BTC? appeared first on Cryptonews.

France Adopts Bitcoin: France’s National Assembly has adopted a resolution opposing digital euro and endorsing Bitcoin.

France Adopts Bitcoin: France’s National Assembly has adopted a resolution opposing digital euro and endorsing Bitcoin.