TL;DR

- ESE Entertainment’s stock price has more than doubled this year, largely due to the success of its US subsidiary.

- It acquired Bombee Global Entertainment, the North American arm of Bombee Event Production, in October 2024.

- Bombee enjoyed a “record financial performance” in the three months ended July 31, 2025, with revenue of CAD$3.8 million, 109% higher than the previous quarter.

- ESE has discontinued some of its businesses over the past couple of years, including World Performance Group Ltd and Auto Simulation Ltd.

- Bombee has recently signed a couple of exclusive partnership deals, and these have helped lift the ESE stock price.

ESE Entertainment’s stock price has soared after its US subsidiary delivered record-breaking results and made a string of positive announcements.

The Canadian entertainment company, which is focused on gaming and esports, purchased Bombee Global Entertainment Ltd in October 2024

And the success of this new addition has helped push the ESE share price up 116% from CAD$0.06 at the start of this year to CAD$0.13 at the market close on October 28, 2025.

But is the current ESE stock price sustainable? Is now an attractive entry point for would-be investors, or is it sensible to hold fire for a few months?

In our ESE Entertainment stock forecast 2025-2030, we examine the impact made by Bombee, scrutinise ESE’s latest results, and predict what could happen over the coming year.

ESE Entertainment stock forecast 2025–2026: One-year ESE stock projection

As ESE is a relatively small company, this poses problems for would-be investors who find it hard to source independent opinions and insights. This is because relatively few, if any, stock market analysts follow businesses at the lower end of the market capitalisation scale.

Therefore, potential investors must rely on their own research and the expectations of algorithmic forecasters if they’re looking for predictions.

According to Wallet Investor, for example, the ESE stock price will lose all the gains made in 2025 over the coming year.

| One-year ESE Entertainment stock forecast (as of October 28, 2025) | |

|---|---|

| WalletInvestor | CAD 0.06 |

ESE Entertainment stock predictions

How about the longer-term ESE stock prediction? What are the ESE Entertainment stock predictions of analysts and algorithmic forecasters for the next five years?

As we have already highlighted, the ESE share price forecast is difficult as so few analysts make public declarations.

Wallet Investor, however, has the stock continuing to fall to zero over the next two and five-year periods. That obviously makes for pretty grim reading.

ESE Entertainment stock forecast 2027–2030: Longer-term prospects

| Long-term ESE stock forecasts (as of October 28, 2025) | ||

|---|---|---|

| Year | October 2027 | October 2030 |

| WalletInvestor | CAD 0.00 | CAD 0.00 |

ESE stock YTD, one-year & five-year performance analysis

ESE Entertainment stock year-to-date: +116.67%

The ESE share price has soared this year, largely due to the continued success of Bombee, its wholly owned US subsidiary that joined the ESE family in October 2024.

A significant spike in the stock price has occurred in recent weeks, following some positive announcements concerning Bombee.

ESE Entertainment stock one-year performance: +52.94%

The acquisition of Bombee has certainly been positive for ESE, with increased revenue, lower expenses, and a stronger stock price.

This has been the major factor behind the ESE share price hike, with the recent partnership announcements particularly welcome.

ESE Entertainment stock five-year performance: -38.10%

ESE Entertainment went public on the TSX Venture Exchange in August 2020, but the ESE stock price has fallen significantly over the past five years.

Unfortunately, net losses have been a negative for the shares, meaning investors who have been in since October 2020 have been adversely affected.

Latest earnings results

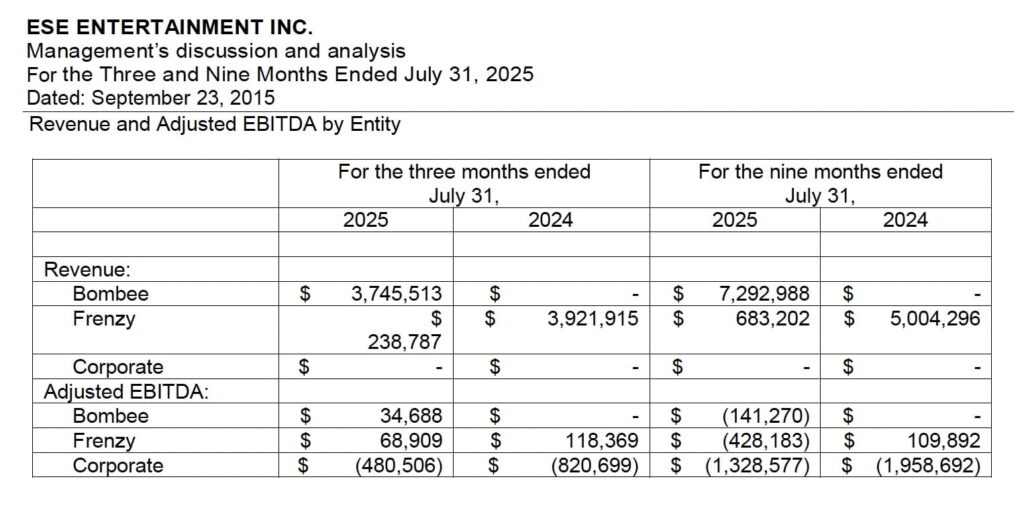

ESE recorded a net loss from continuing operations of CAD$2.72 million for the nine months ended July 31, 2025. This is according to the financial records the company posted, which were available on SEDAR+.

However, this was better than the $3.2 million loss suffered during the corresponding period in 2024, which is obviously a positive.

It stated: “This change during this quarter is mainly attributed to the overall cost efficiencies and the acquisition of Bombee in October 2024.”

The purchase also helped lift the company’s revenue from CAD$5 million to almost CAD$8 million over the same nine-month period.

Bombee financial success

In late September 2025, ESE announced that Bombee had delivered a “record financial performance” in the three months ended July 31, 2025.

Revenue came in at CAD$3.8 million, 109% higher than the CAD$1.8 million in the previous quarter. Gross profit, meanwhile, had improved from CAD$207,181 to CAD$527,541.

This all resulted in adjusted EBITDA of CAD$34,688 for the period ended July 31, 2025, compared to a loss of CAD$184,998 for the three months ended April 30, 2025.

Konrad Wasiela, chief executive of ESE Entertainment, said the ability to execute at the highest level for major clients and international events was translating into strong financial performance.

“These results validate Bombee’s role as a cornerstone of our strategy and a significant contributor to shareholder value,” he added.

Discontinued businesses

ESE Entertainment has discontinued the operations of several of its interests over the past couple of years.

In April 2024, it discontinued World Performance Group Ltd, a Canadian- and Europe-based infrastructure business for managing fan engagement in OTT and esports.

In the previous October, it discontinued the business of Auto Simulation Limited, which operated under the name Digital Motorsports, a simulation racing solutions provider.

Bombee purchase

ESE announced in October 2024 that it was acquiring Bombee Global Entertainment Ltd, the North American arm of Bombee Event Production.

This will be the first of many strategic acquisitions to strengthen its market position, ESE chief executive Konrad Wasiela commented at the time.

He said: “The convergence of gaming, music, and sports is opening incredible new opportunities, and this acquisition positions us to lead in delivering unique, immersive experiences across this fast-growing industry.”

The longer-term goal, he added, was to build a “global powerhouse” in live event production and innovation.

“The surge in demand for live, in-person events post-COVID presents an extraordinary moment for growth, and we’re excited to deliver standout experiences with this acquisition,” he added.

Bombee’s founders had been involved in the management and growth of festivals, including DreamHack.

Other ESE Entertainment news

Bombee has made a string of positive announcements in 2025 that have helped lift the ESE stock price to the delight of investors.

Signs CAD$1.74 million production agreement

In late October 2025, it signed an agreement to provide white-label production and technical services for several large events, generating CAD$1.74 million in revenue.

Bombee’s solutions include stage design and rendering, technical documentation, lighting, video, audio, rigging, power distribution, special effects, and project management.

According to Tamir Kastiel, CEO of Bombee Americas, the business has become the “de facto in-house team” for some of the world’s biggest event providers.

“Our knowledge and experience in operating worldwide and utilising our network of local providers, allows them to scale and provide the consistency fans have grown to expect across the US and globally,” he said.

Other Bombee deals

In other ESE Entertainment news, Bombee was selected as the exclusive production partner for FC Supra, a Montreal soccer team.

Rocco Placentino, FC Supra’s president, said: “Partnering with Bombee allowed us to enjoy the launch of our team and know that the production was taken care of by a world-class team.”

Separately, Bombee became the exclusive partner for New Era Productions, which is one of the fastest-growing boxing and live entertainment promotion companies in North America.

The agreement began with the production of the World Boxing Council Interim World Title bout between champion Jean Pascal and contender Michal Cieslak on June 28, 2025.

What is the outlook?

No one has a crystal ball, but the Bombee acquisition certainly seems to be putting ESE on the right path to making progress.

If it can continue securing exclusive partnerships that boost ESE’s revenue while enabling its costs to fall, then this will be great for the company.

However, a lot will depend on what happens over the coming months. This will determine whether the recent share price increase is sustainable or a short-term anomaly.

What is ESE Entertainment?

ESE Entertainment is a Canadian entertainment business focused on gaming and esports that went public in August 2020.

The company provides services to leading video game developers, publishers, and brands. It’s also involved in events, with infrastructure and fan engagement solutions.

Its wholly owned subsidiaries include Frenzy, a Europe-based media and product infrastructure company, and Bombee Global Entertainment Ltd, the North American arm of Bombee Event Production.

Conclusion: Should I buy ESE Entertainment stock?

What is the conclusion of our ESE stock analysis? Is this a stock that you need to buy, or are there still lingering concerns?

The reality is that this is a decision that you’ll need to make, based on your research and belief in the company’s future prospects.

Although ESE has sustained consistent net losses, the acquisition of Bombee could be a game-changer.

The combination of increased revenue and lower costs has already had a positive effect on the ESE share price, which has risen 116% this year.

Trading carries financial risk and can lead to losses. Always conduct your own analysis and never invest more than you can afford to lose.

FAQs

Is ESE stock a good buy?

You will need to answer this question based on the opinions of stock market analysts and your own opinions. Remember that even professional investors can make mistakes. Your ESE share price forecast should consider recent newsflow, the company’s comments, and views from the wider market.

What is the price prediction for ESE Entertainment in 2025?

According to WalletInvestor’s algorithmic forecast, the ESE share price could fall to CAD$0.04 over the coming year before falling to zero over the longer term.

Is ESE stock overvalued?

This is something you’ll need to decide. The stock has risen 116% between the start of 2025 and the market close on October 28, 2025. However, WalletInvestor’s ESE Entertainment stock forecast suggests a decline is on the cards.

What is ESE Entertainment?

ESE Entertainment is a Canadian entertainment business focused on gaming and esports that went public in August 2020.

The company provides services to leading video game developers, publishers, and brands. It’s also involved in events, with infrastructure and fan engagement solutions.

REFERENCES

- ESE Entertainment Stock Forecast, “ESE” Share Price Prediction Charts (Wallet Investor)

- ESE Entertainment Inc. (ESE.V) stock price, news, quote and history (yahoo! finance)

- Home (Sedar Plus)

- ESE Entertainment Asset Bombee Achieves Record Revenues (ESE Gaming)

- ESE Entertainment Completes 100% Acquisition of Gaming Production Company, Bombee Americas (Globe Newswire)

- ESE Entertainment Asset Bombee Selected As Exclusive Production Partner for FC Supra, Montreal Soccer Team (ESE Gaming)

- ESE Entertainment Asset Bombee Signed as Exclusive Productions Partner with New Era Productions (ESE Gaming)

The post ESE Entertainment stock forecast 2025-2030: Will the ESE share price continue rising or has it reached a ceiling? appeared first on Esports Insider.