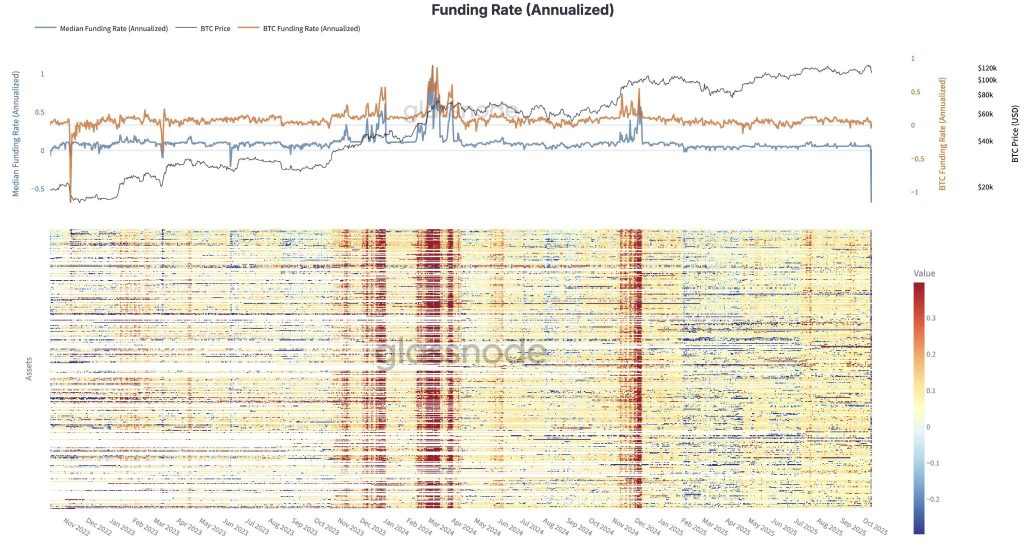

Crypto derivatives funding rates plunged to their lowest levels since the 2022 bear market following the largest liquidation event in history, with Glassnode data showing altcoin funding rates collapsed to a median of -0.4% before resetting above zero within 24 hours.

The swift recovery in funding rates following the purge of over $19.33 billion in leveraged positions suggests the market may have completed one of the most severe deleveraging events in crypto history.

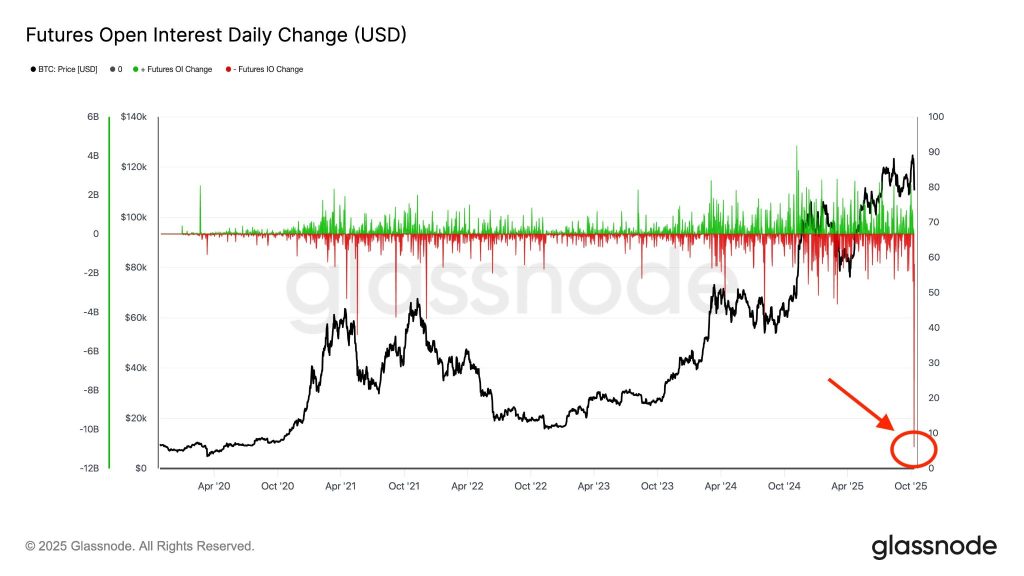

Altcoins Suffer -20% Median Drawdown as $10B BTC Open Interest Vanishes

Glassnode co-founder Rafael analyzed the market carnage, noting that while Bitcoin corrected comparatively mildly, altcoins experienced one of the sharpest daily drawdowns in years, with median returns reaching -20%.

Bitcoin alone saw over $10 billion in open interest erased across all major exchanges, which is the largest open interest wipeout in history.

According to Rafael, Hyperliquid’s liquidation heatmap was “virtually wiped clean” with levels both above and below spot triggered, likely driven by the rapid buildup of liquidation clusters in cross-margined accounts.

Notably, the collapse occurred as a Satoshi-era whale opened over $1.1 billion in short positions against BTC and ETH just before President Trump’s tariff announcement, ultimately generating an estimated $190 million to $200 million in realized profits.

The same trader has since returned with a new $163 million short position on Bitcoin with 10x leverage, already up $3.5 million in unrealized profit, though facing liquidation if BTC climbs to $125,500.

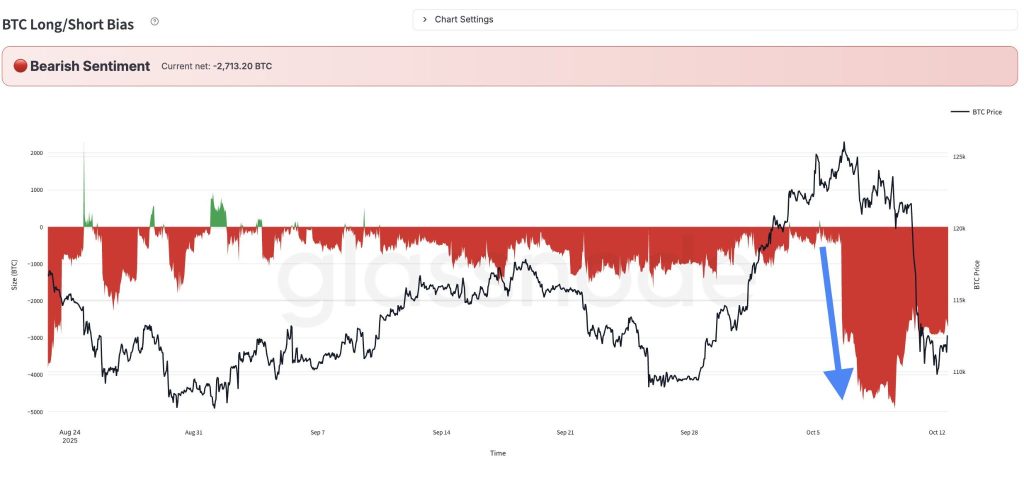

Glassnode’s Bitcoin Long/Short Bias chart, which tracks the aggregate net positions of the largest traders on Hyperliquid, showed a steep rise in net shorts starting on October 6, well before Friday’s crash.

While levels have since recovered, they remain profoundly negative, prompting Rafael to urge traders to “stay cautious.”

ETF Inflows Continue Despite Government Shutdown Delays

From October 6 to October 10, spot Bitcoin ETFs recorded net weekly inflows of $2.71 billion, with BlackRock’s IBIT leading at $2.63 billion.

Spot Ethereum ETFs saw net weekly inflows of $488 million, led by BlackRock’s ETHA with $638 million.

The strong institutional demand comes as at least 16 exchange-traded funds await SEC approval, with decisions delayed by the government shutdown now entering its third week.

Nate Geraci of ETF Store noted that “once government shutdown ends, spot crypto ETF floodgates open,” calling it “ironic that growing fiscal debt and usual political theater” are holding up approvals for crypto products designed to address those exact issues.

The crypto industry was set for a flood of ETF approvals in October, with the SEC scheduled to make final decisions on at least 16 applications, plus another 21 filed in the first eight days of the month.

Polymarket bettors now show a 98% prediction that the government shutdown will continue past October 15, up from 43% on October 2.

The shutdown began after Republicans and Democrats failed to reach a funding agreement by October 1, leaving the SEC operating with only essential staff.

Republicans demand rolling back spending to reduce the national debt, now exceeding $37.8 trillion, approximately $111,000 per person, while increasing funding for border enforcement.

Democrats oppose healthcare cuts and seek extension of expiring tax credits.

The Senate isn’t scheduled to hold votes until Tuesday, leaving no immediate avenue to end the stalemate.

Whale Returns With New $163M Short as Market Digests Crash

The controversial whale’s new bearish position comes just days after accusations of insider trading for timing the previous short 30 minutes before Trump’s tariff announcement.

Crypto analyst MLM suggested that the trader “played a huge role in what happened” and may have contributed to the weekend’s liquidation cascade.

On-chain trackers revealed over 250 wallets lost millionaire status on Hyperliquid following the selloff.

The sharp volatility has reignited debates about the integrity of the crypto market, with SWP Berlin researcher Janis Kluge noting that “crypto people are realizing today what it means to have unregulated markets — insider trading, corruption, crime, and zero accountability.“

He called it “gambling dressed up as trading or investment.”

Most importantly, with this whale back, the community is curious what he knows this time. Is Bitcoin at risk again?

Technical Analysis Points to Critical Resistance Test

Bitcoin currently trades around $115,000, recovering within an ascending channel that has guided price action since April lows around $86,000.

The asset held lower channel support at $110,000 to $112,000 during the selloff, with the upper boundary projecting toward $126,000 to $128,000.

The critical $116,100 resistance level represents the midpoint between the $102,000 low and $126,000 high, creating a battleground for future direction.

As it stands now, Bitcoin must reclaim $116,000 with conviction to potentially trigger momentum toward $120,000 to $126,000.

The most probable near-term scenario involves consolidation between $110,000 and $118,000 as markets digest the liquidation event.

Failure of support around $110,000 to $112,000 would likely accelerate decline toward $100,000 to $105,000, invalidating the bullish channel.

The post Derivatives Funding Rates Collapse to 2022 Lows as Billions Liquidated — Is Bitcoin Set to Rebound? appeared first on Cryptonews.

A crypto whale who recently pocketed $192 million from a perfectly timed short is back with another massive bearish bet against Bitcoin.

A crypto whale who recently pocketed $192 million from a perfectly timed short is back with another massive bearish bet against Bitcoin.