Bitcoin is trading near $111,580, down 2.25% in the past 24 hours, as renewed accumulation from large investors hints at a potential reversal after weeks of heavy liquidations. Market sentiment is stabilizing amid signs of renewed institutional interest.

BitMine Immersion Technologies (NYSE: BMNR) reported that its total crypto and cash reserves have climbed to $13.4 billion, including 3.03 million ETH and 192 BTC.

Led by Tom Lee of Fundstrat, BitMine now holds over 2.5% of Ethereum’s total supply and aims to expand that share to 5%, a target analysts call the “Alchemy of 5%.” The company remains the world’s largest Ethereum treasury and the second-largest corporate crypto holder, behind Strategy Inc. (MSTR), which owns 640,031 BTC worth about $73 billion.

The accumulation surge follows a period of forced liquidations that cleared excess leverage, creating opportunities for long-term investors. “Volatility causes deleveraging, often pushing assets below fair value and opening strategic entry points,” Lee said.

Bitcoin Price Outlook – Can BTC’s Triple Bottom Ignite the Next Rally?

Bitcoin (BTC/USD) is establishing a triple-bottom pattern around $109,600, a classic reversal signal pointing to fading selling pressure. The price remains capped below the 100-period SMMA at $116,200, which aligns with the 0.5 Fibonacci retracement level ($116,108), forming a crucial resistance zone.

A decisive close above the $114,500–$116,000 area would confirm a bullish reversal. Momentum indicators support a potential shift in trend. The RSI sits at 36, indicating oversold conditions and early bullish divergence.

Recent spinning tops and narrow-bodied candles show temporary consolidation before possible upward movement.

If Bitcoin sustains support above $109,600, a recovery toward $114,600 is likely, with a breakout above $119,800 strengthening bullish conviction. A close beyond $120,000 would confirm trend reversal potential, opening targets between $125,000 and $130,000.

Institutions Fuel the Next Supercycle

BitMine’s aggressive accumulation underscores a broader institutional resurgence in crypto. Supported by prominent investors including Cathie Wood’s ARK Invest, Pantera Capital, Galaxy Digital, and DCG, the company now ranks among the 25 most actively traded U.S. stocks, with an average daily volume of $3.5 billion.

Tom Lee describes Ethereum’s current rally as part of a “Supercycle,” driven by artificial intelligence integration and growing participation from traditional finance. The shift has revived optimism across digital assets as Bitcoin steadies above $111,000 and major holders return to the market.

If the triple-bottom structure confirms, Bitcoin could spearhead the next leg of the bull cycle, restoring the institutional momentum and confidence that had faded during recent volatility.

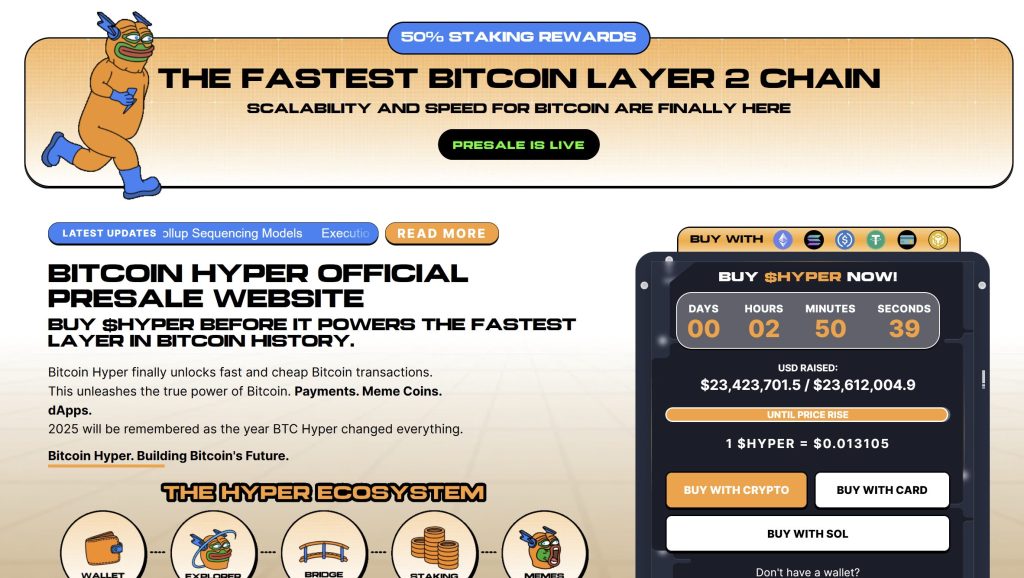

Bitcoin Hyper: The Next Evolution of Bitcoin on Solana?

Bitcoin Hyper ($HYPER) is bringing a new phase to the Bitcoin ecosystem. While BTC remains the gold standard for security, Bitcoin Hyper adds what it always lacked: Solana-level speed.

Built as the first Bitcoin-native Layer 2 powered by the Solana Virtual Machine (SVM), it merges Bitcoin’s stability with Solana’s high-performance framework. The result: lightning-fast, low-cost smart contracts, decentralized apps, and even meme coin creation, all secured by Bitcoin.

Audited by Consult, the project emphasizes trust and scalability as adoption builds. And momentum is already strong. The presale has surpassed $23.4 million, with tokens priced at just $0.013105 before the next increase.

As Bitcoin activity climbs and demand for efficient BTC-based apps rises, Bitcoin Hyper stands out as the bridge uniting two of crypto’s biggest ecosystems.

If Bitcoin built the foundation, Bitcoin Hyper could make it fast, flexible, and fun again.

Click Here to Participate in the Presale

The post Bitcoin Price Prediction: Big Buyers Are Back After the Crash – Explosive Rally is Starting Now appeared first on Cryptonews.