Federal Reserve (FED) Chair Jerome Powell spoke on Tuesday that the central bank’s three-year campaign to shrink its $6.6 trillion balance sheet could end within months, while keeping the door open for further interest rate cuts.

Speaking at the National Association for Business Economics conference in Philadelphia, Powell warned Congress against eliminating the Fed’s ability to pay interest on bank reserves, stating such action would cause the central bank to “lose control over rates.”

The announcement sent ripples through crypto markets. Arthur Hayes tweeted, “QT is over. Back up the f**king truck and buy everything,” while Joe Consorti noted Bitcoin rose from $18,000 to $126,000 during QT.

Gold hit a record high near $4,200, up 59% year-to-date, driven by rate cut expectations.

Powell acknowledged “downside risks to employment have risen” and suggested another quarter-point cut at the October 28-29 meeting remains likely.

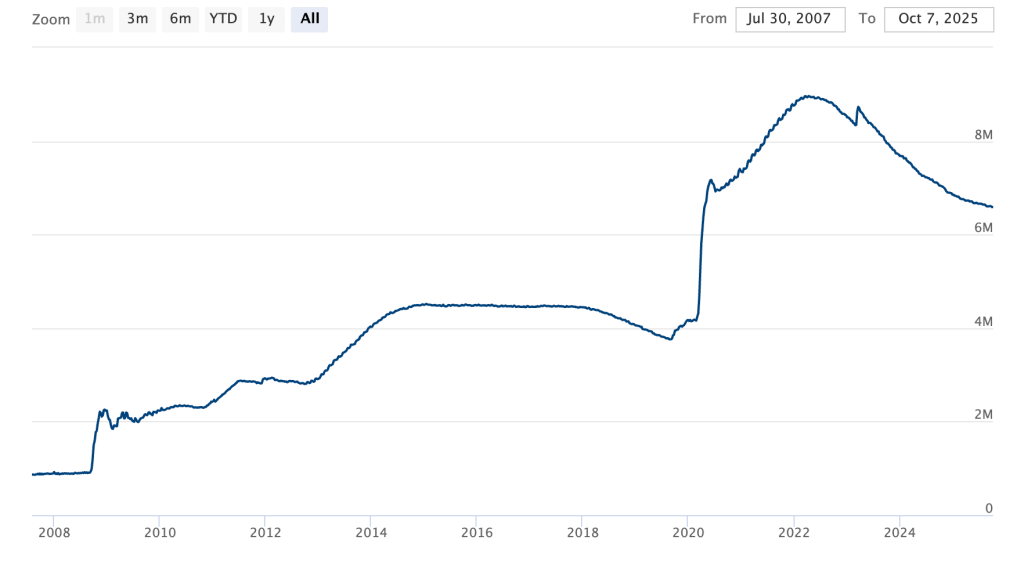

The Fed has been passively reducing its balance sheet since mid-2022, when its holdings peaked at nearly $9 trillion following pandemic-era stimulus.

QT Program Nears Completion as Labor Market Weakens

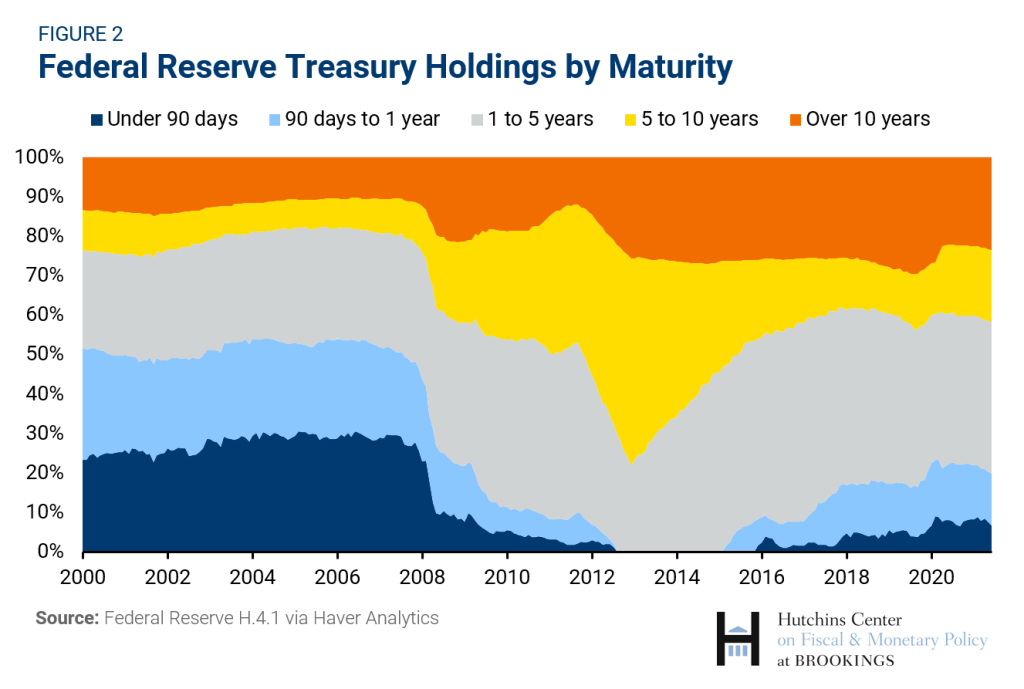

The Fed purchased enormous quantities of Treasury and mortgage-backed securities in 2020-2021 to lower long-term rates after slashing its benchmark interest rate to near zero.

Since mid-2022, the central bank has allowed securities to mature without replacement, resulting in a reduction of roughly $2.4 trillion in holdings.

Powell said “some signs have begun to emerge that liquidity conditions are gradually tightening,” indicating further reserve reduction could hinder growth.

However, the Fed has no plans to return to its pre-COVID balance sheet size of $4 trillion, noting non-reserve liabilities stand about $1.1 trillion higher than before the pandemic.

The Fed chair defended against critiques from Treasury Secretary Scott Bessent, who described quantitative easing as “effectively a gain-of-function monetary policy experiment.”

Powell acknowledged that “with the clarity of hindsight, we could have—and perhaps should have—stopped” pandemic-era QE sooner.

On employment, Powell noted “both lay-offs and hiring remain low” while “households’ perceptions of job availability and firms’ perceptions of hiring difficulty continue their downward trajectories.”

ADP data showed companies shed 32,000 jobs in September.

Congressional Threat to Fed’s Primary Policy Tool

Powell issued stark warnings about lawmakers’ efforts to revoke the Fed’s ability to pay interest on bank reserves, its primary monetary policy tool since 2008.

The Senate voted down such a proposal last week, championed by Senator Ted Cruz.

“If our ability to pay interest on reserves and other liabilities were eliminated, the Fed would lose control over rates,” Powell stated.

He warned that controlling rates without this tool might require “large sales of Treasury or mortgage securities over short periods, straining market functioning and risking financial turmoil.“

The Fed currently operates at a loss due to rapidly rising interest rates.

Powell emphasized these losses are “highly unusual” and “our net income will soon turn positive again, as it typically has been throughout our history.“

The government shutdown, which began on October 1, has limited the Fed’s access to key statistics.

Powell noted that evaluating economic performance “could become more challenging” if the shutdown persists, although data available before indicated that activity “may be on a somewhat firmer trajectory than expected.”

Crypto Community Sees Bullish Catalyst

The crypto community interpreted Powell’s comments as validation for risk assets.

Lark Davis called the potential QT end “super mega bullish for Bitcoin and alts,” while Chamath Palihapitiya suggested rate cuts would follow, criticizing Powell for being “behind the 8-ball.”

In September, J.P. Morgan had already projected two additional rate cuts for 2025 and one for 2026.

Chief U.S. economist Michael Feroli noted “a major shift in labor market momentum would be needed to prevent another cut in October.”

The firm outlined scenarios for Fed easing cycles.

In non-recessionary environments, the S&P 500 and high-yield bonds typically lead returns. In recessionary scenarios, Treasuries and gold outperform.

Gold’s rally to $4,185 is driven by geopolitical uncertainties, central bank buying, and ETF inflows.

StoneX analyst Matt Simpson noted the rally “has also become a momentum trade, where traders pile in simply to chase prices getting away from them.”

Bitcoin Faces Correction Risk Despite QT Optimism

Bitcoin trades at $115,321, positioned between the MVRV Mean band at $96,526 and the +0.5σ resistance at $119,018.

The MVRV framework compares Bitcoin’s market cap to its realized cap, providing valuation insight relative to holder cost basis.

Current positioning indicates that Bitcoin is approximately 19.4% above fair value, having retreated from extreme overvaluation near $141,510.

According to Analyst Ali Martinez, Bitcoin must reclaim $119,000 to maintain its bullish momentum; a failure would indicate a potential correction toward the $96,500 Mean band.

As it stands now, Bitcoin faces an unfavorable risk-reward scenario, with a 16.3% downside potential to its $96,500 fair value, versus limited upside, while trading below the $119,000 resistance level.

Failure to reclaim the +0.5 band suggests consolidation between $110,000 and $120,000 before a probable correction toward the MVRV Mean.

The $119,000 level is a critical test to determine whether bull momentum continues or a correction toward $96,500-$100,000 materializes.

The post Fed’s QT to End Soon, But Powell Warns Congress Threatens Rate Control Stability – Crypto at Risk? appeared first on Cryptonews.