Solana (SOL) holders have watched their token rebound 10.59% in the past day, yet doubts linger over its sustainability above $200. Spot trading volume on Binance plunged 62% earlier, though it climbed 10.2% recently amid the rally.

Such volatility has prompted investors to seek more stable alternatives in the DeFi crypto space. Now, many pivot toward Mutuum Finance (MUTM), priced at $0.035 in its ongoing presale, drawn by promises of explosive gains through innovative lending tools. This shift reflects broader crypto prices today, where caution tempers hope. For readers weighing what crypto to invest in, that backdrop explains the renewed focus on early-stage DeFi.

On-chain metrics for Solana show accumulation since mid-July, but exchange balances dwindle unevenly. Meanwhile, Mutuum Finance (MUTM) has raised $17,600,000 since presale inception, boasting 17,300 holders who eye 420% returns post-launch at $0.06. Phase 6, 70% filled, underscores urgency in this DeFi crypto pursuit. At this stage, some investors rank MUTM among the best crypto to buy now as they position for the next cycle.

Solana’s Hidden Vulnerabilities Exposed

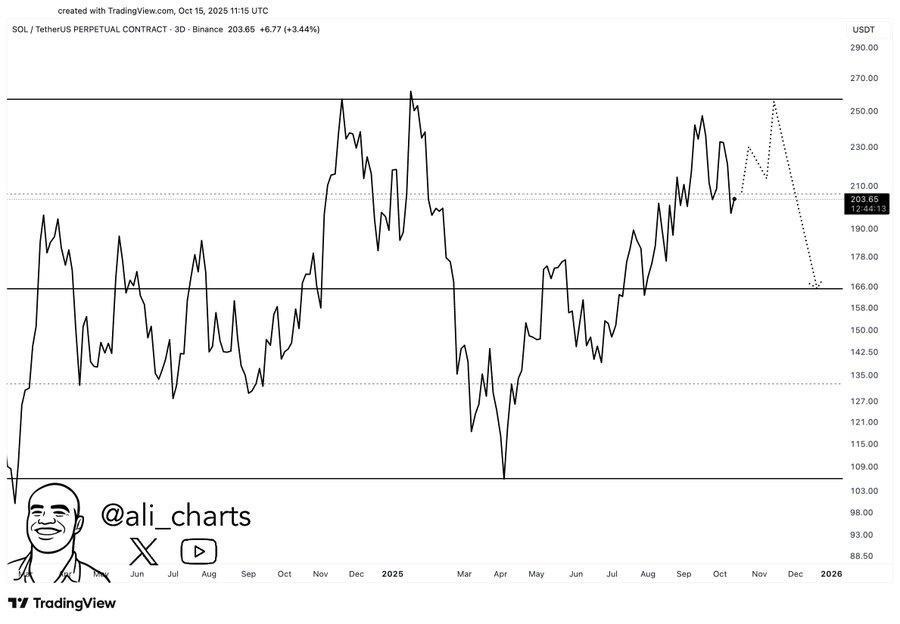

Analysts have highlighted embers of recovery in Solana’s chart, yet a red flag persists. Bulls tested $200 earlier, but the $200-$215 resistance looms large, blocking a true uptrend. Short-term holder NUPL dipped to June lows per Glassnode data, echoing past corrections without confirming bottoms.

Transaction counts fell since August but ticked upward lately. Exchange SOL balances have declined steadily, hinting at accumulation. Still, broader sentiment ties to Bitcoin’s push toward $117k resistance.

A break above $120k might aid Solana, yet crypto predictions warn of delays. Why is crypto down today? Liquidation cascades explain much, eroding confidence.

Solana holders, sensing fragility in these crypto prices, now explore DeFi crypto options for resilience. This unease fuels migrations, as investing in crypto demands vigilance amid such swings.

Mutuum Finance Presale Accelerates

Mutuum Finance (MUTM) has opened phase 6 of its 11-phase presale, with tokens selling at $0.035 each. Investors snapped up spots rapidly; this stage reached 70% capacity already. Early participants paid $0.01 in phase 1, securing 250% appreciation so far, or a 3.5x lift.

Phase 6 sells out fast, closing doors on this entry soon. Phase 7 follows, hiking prices 14.3% to $0.04. Launch targets $0.06, positioning current buyers for 420% gains thereafter. The team finalized its CertiK audit successfully, earning a 90/100 token score that bolsters trust. Holders total 17,300, up from initial waves, as crypto investment flows in steadily.

Moreover, Mutuum Finance (MUTM) launched a dashboard tracking the top 50 holders. Its 24-hour leaderboard resets daily at 00:00 UTC. The top user claims a $500 MUTM bonus, conditional on one transaction in that window. Past 24 hours crowned buyers at $1,704.60, $1,291.53, $1,000.00, $734.87, and $685.05.

Such features engage communities, mirroring why crypto is going up in select DeFi crypto niches.

Mutuum Finance Builds Robust Lending Core

Developers at Mutuum Finance (MUTM) announced its lending and borrowing protocol expansion. Version 1 deploys to Sepolia Testnet in Q4 2025. Core elements include liquidity pools, mtTokens, debt tokens, and liquidator bots. Initial assets cover ETH and USDT for lending, borrowing, or collateral.

Borrow interest rates derive from utilization, balancing supply dynamically. Abundant capital keeps rates low, spurring loans. Scarce funds raise them, drawing deposits via yields. Stable rates lock in predictability for borrowers, starting higher than variables to offset risks.

Rebalancing activates if variables surge beyond 90% of stables, ensuring fairness. Overcollateralization guards positions; liquidations trigger below thresholds, rewarding liquidators with bonuses. Deposit and borrow caps limit exposures, curbing manipulations. Restricted modes apply to illiquid tokens, tying collateral to the same-asset borrows.

Enhanced collateral efficiency boosts limits for correlated assets like stablecoins. Loan-to-value ratios cap borrowings at 75% max for stables, dropping to 35-40% for volatiles. Liquidation penalties fund treasuries partly, while reserve factors collect interest shares—10% for stables, up to 35% for riskier ones.

Chainlink oracles feed prices, with fallbacks for reliability. These mechanics fortify the DeFi crypto against volatility, appealing to cautious investors. Crypto fear and greed index readings aside, Mutuum Finance (MUTM) prioritizes solvency.

Gains Beckon in DeFi Crypto Shift

Solana’s rebound falters under liquidation scars, driving holders toward Mutuum Finance (MUTM) for tangible yields. Protocol safeguards and presale momentum position this DeFi crypto as a prudent bet amid crypto crash fears.

Crypto investing thrives on such calculated moves. Secure tokens now at $0.035 before phase 6 vanishes. For many, that makes MUTM a top crypto to buy during this window.

For more information about Mutuum Finance (MUTM), visit the links below:

Website: https://mutuum.com/

Linktree: https://linktr.ee/mutuumfinance

The post Why Solana (SOL) Holders Are Shifting to This DeFi Crypto Priced at $0.035 appeared first on Cryptonews.