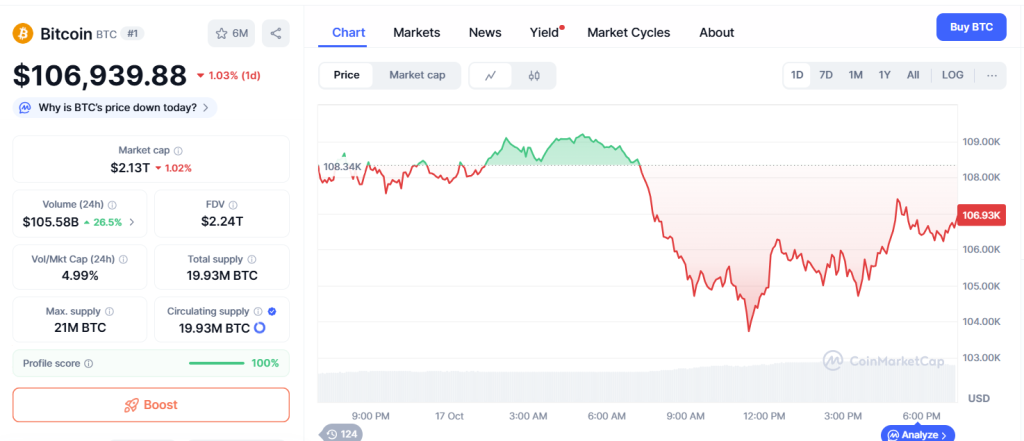

ChatGPT’s BTC analysis has revealed Bitcoin declining -2.78% to $105,191, testing the key 200-day EMA at $104,901 as President Trump cancels 100% China tariffs, stating “we’ll be fine with China.”

In comparison, $1.2B liquidations trigger market deleveraging, with Polymarket showing 52% odds of a sub-$100K move this month.

ChatGPT’s BTC analysis synthesizes 28+ technical indicators at the make-or-break support level.

Technical Analysis: Key 200-Day EMA Test

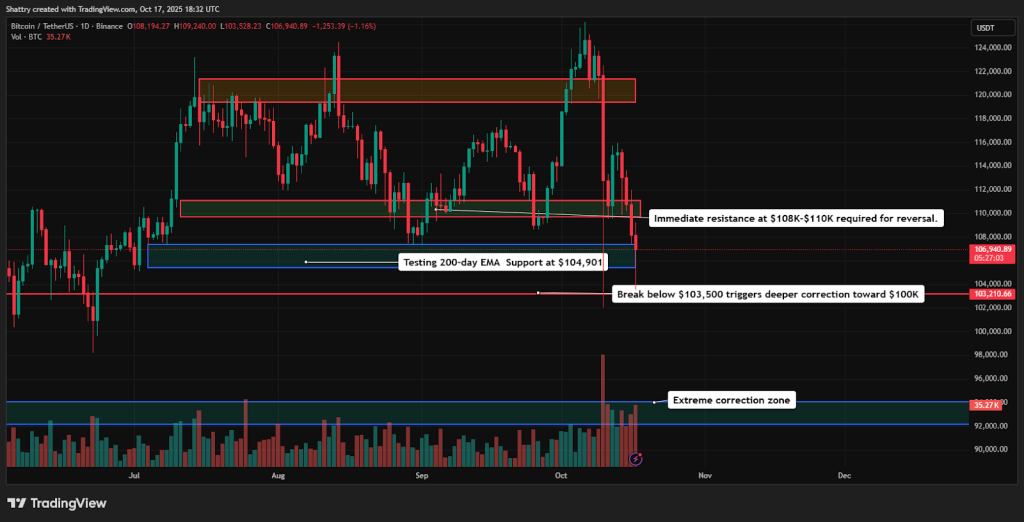

Bitcoin at $105,191 reflects a -2.78% decline from $108,194, down ~14% from October’s ATH at $126,198. Tests crucial 200-day EMA at $104,901, just -0.3% below current level, representing 50% Fibonacci retracement. Volume sits at 29.24K BTC during the correction.

RSI at 52.18 neutral. Moving averages bearish short-term: 20-day at $114,259 (+8.6%), 50-day at $114,672 (+9.0%), 100-day at $113,190 (+7.6%). All EMAs are overhead, while the 200-day provides a key support test.

Additionally, the MACD remains bearish at -1,579.16, but is converging with the signal line at -1,580.73, and the histogram at -1.57, suggesting a momentum shift. Extremely high ATR at 102,898.05 confirms massive volatility potential.

Tariff Cancellation Meets $19B Leverage Purge

Trump canceled 100% China tariffs, stating “no” when asked if tariffs stand and “we’ll be fine with China.”

White House Advisor Hassett also clarified, “We’re not in a trade war with China,” while suggesting “three Fed rate cuts would be a good start.” Market shed $1.2B liquidations with investors fleeing to safe havens.

Speaking with Cryptonews, Farzam Ehsani, CEO of VALR, notes Bitcoin “stabilizing above $110,000 after historic $19 billion leverage purge reset traders’ positioning.“

He emphasizes “structural demand for BTC remained resilient” with “spot BTC ETFs recording more than $4.5 billion inflows in October” and stablecoin liquidity crossing “$300 billion, revealing capital flight remained minimal.“

Ehsani highlights “gold and Bitcoin increasingly viewed as alternatives to the US dollar’s reserve dominance” as “renewed demand for hard assets reflects investor unease with fiscal deficits, swelling sovereign debts, persistent inflation.“

Amid these unexpected market dips, Arthur Hayes observes, “$BTC on sale. If US regional banking wobble grows to a crisis, be ready for a 2023-like bailout.”

Grant Cardone is already buying more BTC during the crash.

Liquidation Tests Structure

Bitcoin maintains $2.13T market cap (-4.1%). Volume surged +26.51% to $105.58B, producing a 4.99% volume-to-market cap ratio. Market dominance rises to 58.42% (+0.77%) as altcoins underperform.

Historical 2025: $104,031 (January), $81,976 (February correction), $126,198 (October peak) before the current 14% retracement.

As it stands now, Polymarket odds show a 52% probability of a sub-$100K move this month.

Social Sentiment: Fear Dominance Amid Support Test

LunarCrush shows AltRank at 134 (+85) and Galaxy Score at 41. Engagements surge to 223.28M (+27.83M), mentions at 382.13K (+2.25K). Social dominance jumps to 36.2% (+6.4%), sentiment declines to 75% (-2%).

Most analysts emphasize that the “critical level for BTC is $100K” as the”final price support during bull cycle.”

Others also note that “breaking below $100,000 could trigger a significant sell-off,” while some observe that”Bitcoin down 18% from ATH – not a big decline for Bitcoin.”

Ehsani concludes, “Bitcoin testing boundaries between being risk asset and hedge against systemic uncertainty. If liquidity tailwinds materialize and institutional accumulation persists, market setup for Bitcoin strengthening toward $132,000 by year-end remains plausible.“

ChatGPT’s BTC Analysis: 200-EMA Defense Determines Fate

ChatGPT’s BTC analysis reveals that Bitcoin is at a key juncture, testing 200-day EMA at $104,901. Bulls must defend or face correction toward $100K–$102.5K. Immediate resistance at $108K–$110K required for reversal.

Break below $103,500 triggers deeper correction toward $100K with potential extension to $95K–$97.5K.

Three-Month BTC Forecast

Bullish Recovery (60% if $104,901 Holds)

200-EMA hold with tariff relief drives recovery toward $113K–$120K (7–14% upside). Requires $110K reclaim.

Deeper Correction (70% if $103,500 Breaks)

Break triggers selling toward $100K–$102.5K (2–5% downside) with potential $95K extension (10% downside).

Extended Consolidation (30%)

Range $103,500–$108,000 allows institutional accumulation before directional break.

ChatGPT’s BTC Analysis: Key Support Defense

Next Target: $100K-$102.5K if Break, $113K-$120K if Hold

Hold above $104,901 maintains uptrend with recovery toward $110K–$113K. Failure indicates correction toward $100K with $95K–$97.5K final defense.

Tariff cancellation and Fed rate cuts provide a bullish backdrop, but Ehsani warns “geopolitical environment may need to cool down further before sustained upside resumes.”

A critical decision point has arrived, where bulls must defend $104,901 or face an extended consolidation.

The post ChatGPT’s BTC Analysis: $105K Tests Key 200-Day EMA as Trump Cancels China Tariffs appeared first on Cryptonews.

President Trump says “no” when asked if China tariffs will stand.

President Trump says “no” when asked if China tariffs will stand.  The critical level for

The critical level for