Nigeria’s central bank has formed a new task force to explore the adoption of stablecoins, raising questions over the future of the country’s digital currency, the eNaira.

Central Bank of Nigeria (CBN) Governor Olayemi Cardoso announced the formation of the working group during a press briefing at the conclusion of the annual World Bank and International Monetary Fund (IMF) meetings in Washington, D.C.

Cardoso said the Central Bank, in collaboration with the Ministry of Finance and other financial regulators, has created dedicated teams to assess the broader implications and potential framework for introducing an official Nigerian stablecoin.

The move comes amid sluggish adoption of the eNaira and growing public skepticism toward its performance.

CBN’s eNaira Struggles to Survive Amid Widespread Inactivity and Public Disinterest

According to IMF data published in 2023, only 0.5% of Nigerians had adopted the eNaira a year after its rollout, with 98.5% of wallets remaining inactive.

The number of eNaira wallets reportedly reached 13 million by early 2024, but most of them have not been used.

Total transaction volume since the launch was around ₦29.3 billion, with just over 850,000 transactions recorded, far below expectations for a country of over 200 million people.

The mobile app, once available on both Google Play and Apple stores, has been removed from Google’s platform, and the USSD code (*997#) no longer functions.

The last post from the eNaira’s official social media accounts was in August 2023, while users attempting to access the platform have reported persistent login and one-time password issues.

In August, the CBN admitted that the eNaira had failed to gain widespread acceptance, citing low awareness and weak user education.

Efforts to revive the project included a partnership with blockchain firm Gluwa in March 2024 to upgrade technical infrastructure and an announcement in September to expand eNaira use for government payments.

Despite these efforts, the platform remains largely inactive. Public sentiment toward the digital currency has been lukewarm.

On social media, Nigerians have dubbed it “E-vanish” and “E-dead,” reflecting frustration over its poor usability and lack of tangible benefits compared to cash or private crypto assets.

CBN’s Olayemi Cardoso Says Stablecoins Key to Balancing Innovation and Stability

According to Cardoso, discussions around stablecoins featured prominently during the global financial meetings. “The message from there is that we must support innovation while managing the risks that come with it,” he said.

“No one wants to stifle innovation, but it’s equally important to balance that innovation with financial stability.”

The announcement follows a series of regulatory shifts in Nigeria’s digital finance sector.

In 2024, the Africa Stablecoin Consortium (ASC), a group comprising Nigerian banks and fintech firms, received approval from the CBN to launch the cNGN stablecoin within its regulatory sandbox.

The consortium described the cNGN as compliant with the standards set by the CBN, the Securities and Exchange Commission (SEC), and the Nigerian Financial Intelligence Unit.

It was designed to complement, not replace, the eNaira, the cNGN is interoperable with major blockchains, including BNB Smart Chain and Bantu, with plans to expand to other networks.

Cardoso said the move toward stablecoin exploration was consistent with the CBN’s drive to support innovation while preserving monetary stability.

He also revealed that the bank has been holding strategy sessions with fintech leaders under the theme “Shaping the Future of FinTech in Nigeria: Innovation, Inclusion, and Integrity.”

However, the new stablecoin initiative comes at a time when the eNaira project appears to have lost momentum.

Nearly four years after its October 2021 launch, the eNaira has seen declining user activity, limited wallet engagement, and diminishing public interest. Meanwhile, stablecoins have become deeply embedded in Nigeria’s crypto economy.

Nigeria Ranked 6th Globally in Crypto Adoption as Stablecoin Use Soars

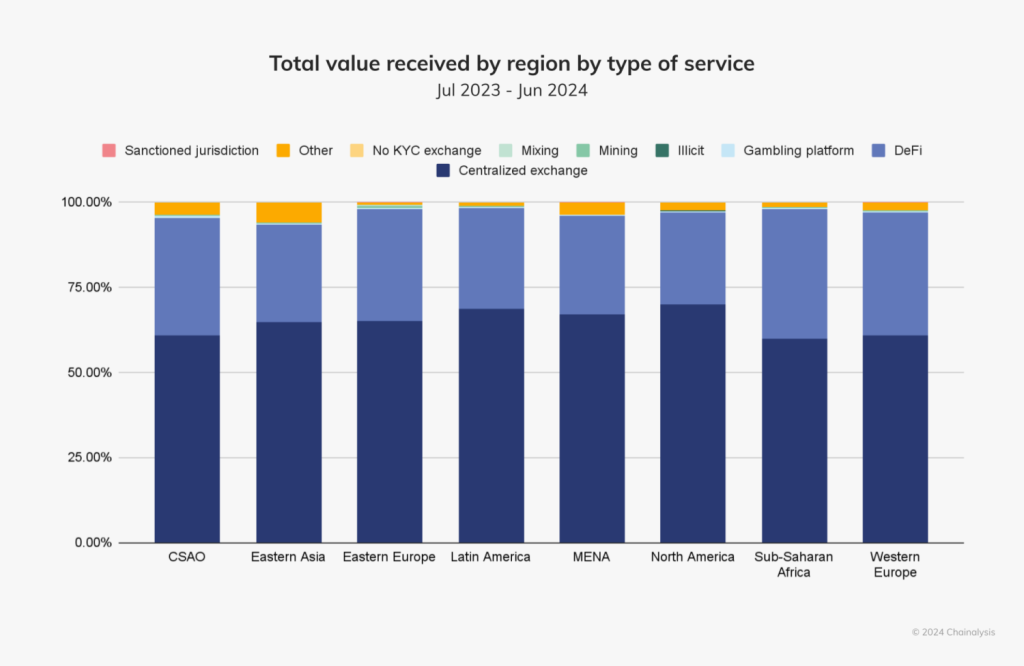

Between July 2023 and June 2024, stablecoin transactions in Nigeria reached nearly $22 billion, the highest in sub-Saharan Africa, according to data from Yellow Card.

Stablecoins accounted for 43% of total crypto transactions in the region, with USDT leading at over 88% of usage. The growing appeal of stablecoins mirrors the broader surge in crypto activity across the country.

Between 2024 and 2025, Nigeria processed roughly $59 billion in crypto transactions, ranking second globally behind India, according to Chainalysis.

According to Chainalysis data, Nigeria is ranked 6th in the Global Crypto Adoption Index 2025.

Stablecoins, used primarily for remittances and as a hedge against naira volatility, now dominate retail-level trades.

At the same time, the IMF’s latest assessment has reflected renewed optimism about Nigeria’s broader economic outlook.

The Fund upgraded Nigeria’s growth forecast to 3.9% for 2025 and 4.2% for 2026, citing rising oil output, stronger investor confidence, and improved fiscal conditions.

IMF Economic Counsellor Pierre-Olivier Gourinchas credited reforms such as fuel subsidy removal and foreign exchange unification for stabilizing inflation and strengthening the naira.

Cardoso echoed this sentiment during the briefing, saying inflation has started to ease due to “disciplined monetary tightening” and “enhanced transparency” in the forex market.

He noted that Nigeria’s foreign reserves now exceed $43 billion, providing over eleven months of import cover.

The post Is Nigeria’s eNaira Dead? CBN Forms New Task Force for Official Stablecoin appeared first on Cryptonews.

Central Bank of Nigeria Approves Africa Stablecoin Consortium to Pilot cNGN Stablecoin in Regulatory Sandbox

Central Bank of Nigeria Approves Africa Stablecoin Consortium to Pilot cNGN Stablecoin in Regulatory Sandbox