A heated debate has emerged in the crypto community after Binance founder Changpeng “CZ” Zhao claimed that tokenized gold, despite its rising popularity, isn’t truly “on-chain.”

His remarks came in response to gold advocate and longtime Bitcoin critic Peter Schiff, who recently announced plans to launch a blockchain-based tokenized gold platform.

Gold’s rally in traditional markets has further fueled the conversation; the metal’s recent renewed market activity has drawn renewed attention to its tokenized versions in the crypto space.

The Gold Debate Goes On-Chain: CZ and Peter Schiff Clash Over Blockchain’s “Real Value”

In a recent interview clip, Schiff described a system where users could buy gold through an app, store it in vaults, and transfer ownership digitally or redeem it for physical gold. “Ideally, the one thing that makes sense to put on a blockchain is gold,” Schiff said in the video.

“You can use tokenized gold as a medium of exchange, as a unit of account, and as a store of value.”

He added that the upcoming platform, built under his company Shift Gold, will allow instant transfers and redemption, promoting what he described as a “stable” digital asset tied to physical value.

However, CZ quickly weighed in on X (formerly Twitter), suggesting that tokenized gold only simulates blockchain integration. “Tokenizing gold is NOT ‘on-chain’ gold,” he wrote.

“It’s tokenizing that you trust some third party will give you gold at some later date — maybe decades later, during a war, after management changes, etc. It’s a ‘trust me bro’ token.”

He added that such trust-based mechanisms explain why “no gold coins have really taken off” in the digital asset space.

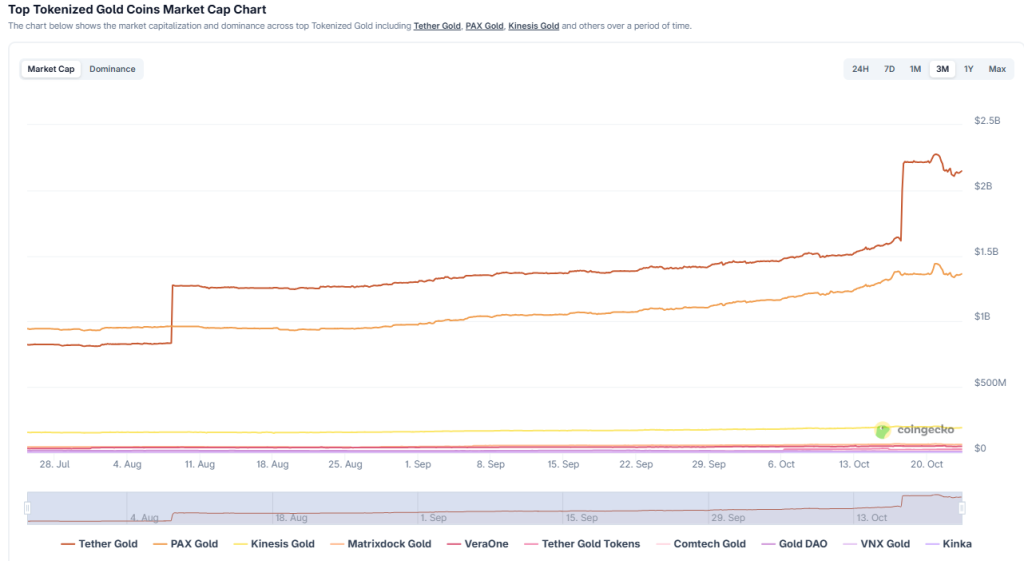

The exchange between the two figures comes as tokenized gold markets hit new highs. On October 7, the combined market capitalization of gold-backed digital assets crossed the $3 billion mark, according to CoinGecko. Now, it is currently at over $3.75 billion.

Tokens such as Tether Gold (XAUT), PAX Gold (PAXG), and Kinesis Gold (KAU) led the market, each closely tracking spot gold prices, which briefly surged past $4,000 per ounce, an all-time high.

Trading volume for the asset class jumped to $640 million within 24 hours as investors sought refuge amid the ongoing U.S. government shutdown and global economic uncertainty.

Data from rwa.xyz shows continued growth in real-world asset (RWA) tokenization, with total on-chain RWA value surpassing $34 billion.

Tokenized commodities, led by gold, now account for more than $3.5 billion of that total, a 36% increase in the last month. Tether Gold and PAX Gold remain dominant, with market capitalizations of roughly $2.1 billion and $1.3 billion, respectively.

Despite the rising interest, CZ’s comment highlights a deeper question about whether these assets can truly be considered “on-chain.”

Are Tokenized Gold Really Not Fully Decentralized?

While tokenized gold allows holders to own digital representations of physical gold, typically pegged to weights like a troy ounce or a gram, the underlying asset remains stored off-chain in centralized vaults.

Issuers such as Paxos and Tether use smart contracts to mint tokens corresponding to gold reserves, offering audits and redemption options. But as CZ pointed out, the system still depends on third-party custodians to verify and safeguard those reserves.

In essence, while ownership of the tokens is recorded on the blockchain, the gold itself remains off-chain.

Each transaction relies on trust that the issuer indeed holds and manages the corresponding physical gold, a structure some critics argue undermines the core principles of decentralization.

For tokenized gold to be fully on-chain, both the representation and the settlement of ownership would need to occur without intermediary custodians, a technical and logistical challenge given that gold, as a physical commodity, cannot exist natively on a blockchain.

Currently, even the most transparent issuers still operate within traditional financial frameworks involving regulated vaults and audit institutions.

Over 150,000 Holders Now Own Tokenized Gold as Sector Activity Hits Record Levels

The broader tokenized gold sector, however, continues to expand rapidly. Market data shows rising adoption, with more than 150,000 holders and over 20,000 active addresses interacting with gold-backed tokens in the past month.

Source: RWA.xyz

The monthly transfer volume for tokenized gold has surged above $8.6 billion, signaling increasing retail and institutional participation.

Recent developments suggest that major players are doubling down on the narrative. Earlier this month, Tether and crypto lender Antalpha, a firm connected to Bitcoin mining giant Bitmain, raised at least $200 million for a new digital asset treasury vehicle centered on XAUT.

The initiative would build a public treasury exclusively holding tokenized gold, potentially strengthening its liquidity and visibility in the RWA market.

Gold’s rally in traditional markets has further fueled the conversation. The metal recently surged to $4,035 per ounce amid fears of prolonged U.S. government gridlock and weakening fiscal confidence.

Although prices briefly corrected after a sharp $2 trillion drop in market cap, gold remains up roughly 30% since April.

Analysts attribute the rally to Trump’s trade policies, a weaker dollar, and investor demand for safety, conditions that have also helped tokenized gold gain traction as a digital bridge to traditional assets.

The post Binance Founder CZ Says Tokenized Gold Isn’t Truly ‘On-Chain’ — And It’s Stirring Debate appeared first on Cryptonews.

BNB (@cz_binance)

BNB (@cz_binance)